AI and Accountability: The Future of Automated Corporate Compliance

In today’s digital enterprise, the most significant compliance risks are no longer found in a file cabinet but hidden in plain sight within terabytes of data. While many organizations view artificial intelligence (AI) as a reactive tool for sifting through this data, its true power lies in preventing crises before they begin. To fully invest in and utilize AI in legal settings, it’s crucial for companies to deepen their understanding and use of AI and treat it as a driver of proactive compliance rather than a backward-looking review mechanism. By building a framework that leverages AI and machine learning (ML) to proactively analyze communication patterns and operational data before issues escalate, businesses can identify compliance risks in real time and use AI triggers to automate the lifecycle of legal matters. End-to-end automation creates a new paradigm of engineered accountability, ensuring a company’s response to risk is consistent, defensible, and intelligent from start to finish.

Why is demand for AI compliance on the rise?

Compliance is a cornerstone of organizational stability. Yet, as technology rapidly evolves, businesses face new and complex compliance challenges that demand modern solutions.

For instance, the internal communication environment has shifted dramatically. From team chats to emails and online activity, employees’ digital footprints are expanding quickly, generating an overwhelming volume of data for organizations to manage. When legal issues arise, combing through that data can strain company resources, creating a potential inroad for the use of AI. By integrating automation into processes and reducing reliance on manual, error-prone work, companies are better prepared to navigate the complexities of legal and compliancematters.

AI’s proactive potential

AI’s role in compliance is not about reacting to events after the fact. Instead, business leaders can leverage technical innovation to create forward-thinking, proactive compliance strategies that protect the business, its bottom line, and its future. A recent report from EY captures the landscape. “The financial services industry—a field predicated upon speed, margin and precision, but that still frequently operates using dated technology and labor-intensive processes—presents some of the ripest opportunities for disruption, specifically in the compliance department,” researchers wrote.

Across industries, companies recognize the value of leveraging AI-driven compliance systems to evaluate risk. Thomas Fox, founder of The Compliance Podcast Network, noted that leading employers are using generative AI to “analyze employee emails, chat logs, and phone transcripts to identify risk-related language and patterns of unethical behavior.” Organizations harness these tools to power end-to-end legal processes, generate investigative reports, summarize key findings, and prompt next steps following whistleblower incidents.

Companies already on this path include General Electric, which employs AI to predict equipment risks that could put the company in a precarious position with regulators, and Lockheed Martin, which uses predictive analytics to identify potential cybersecurity risks. “The bottom line,” Fox wrote, “is that regulators worldwide now expect companies to leverage advanced analytics and AI-driven tools to proactively identify misconduct rather than relying solely on traditional audit-based detection methods.”

An engineering blueprint for accountable AI

A proactive, AI-focused approach to compliance requires accountability built into the design of the solution and its processes. AI-powered compliance solutions deliver an accountability-by-design framework through three core foundations:

1. Automated triggers and preservation: Leaders can define the conditions under which the technology will flag potential instances of risk. These triggers will vary by industry and company, depending on the regulatory landscape and respective organizational requirements. A financial firm, for example, requires significantly more triggers than a company in the packaged goods industry. Once activated, triggers launch a cascade of actions, including automatically generating a report and notifying specific employees. Importantly, AI can create an error-proof audit trail, heightening efficiency and accuracy. This ensures an immediate, defensible response, minimizing the risk of spoliation from the onset.

2. Intelligence scoping and collection. When AI supports compliance, systems are more malleable than when workflows are entirely human-driven. For instance, after automated triggers are defined and the system performs intelligence data scoping and collection, essentially, drawing boundaries around what is flagged and preserved, humans can continuously learn from and update processes. Scoping boundaries are refined as AI advances, alongside the evolution in the regulatory environment. This intelligent scoping dramatically reduces the volume of data sent for review, directly translating to significant cost savings in legal expenditures.

3. Automated disposition. Instead of time-consuming and potentially risky manual compliance checks, AI provides business leaders with a continuous view of compliance. From ongoing monitoring to risk evaluations and real-time reporting, AI enables businesses to observe compliance through a proactive lens. When automated rules drive

processes, compliance teams remain confident in the entire lifecycle of their data. This capability also solves the massive legal and financial risk of “over-preservation” by ensuring data is not retained beyond legal requirements.

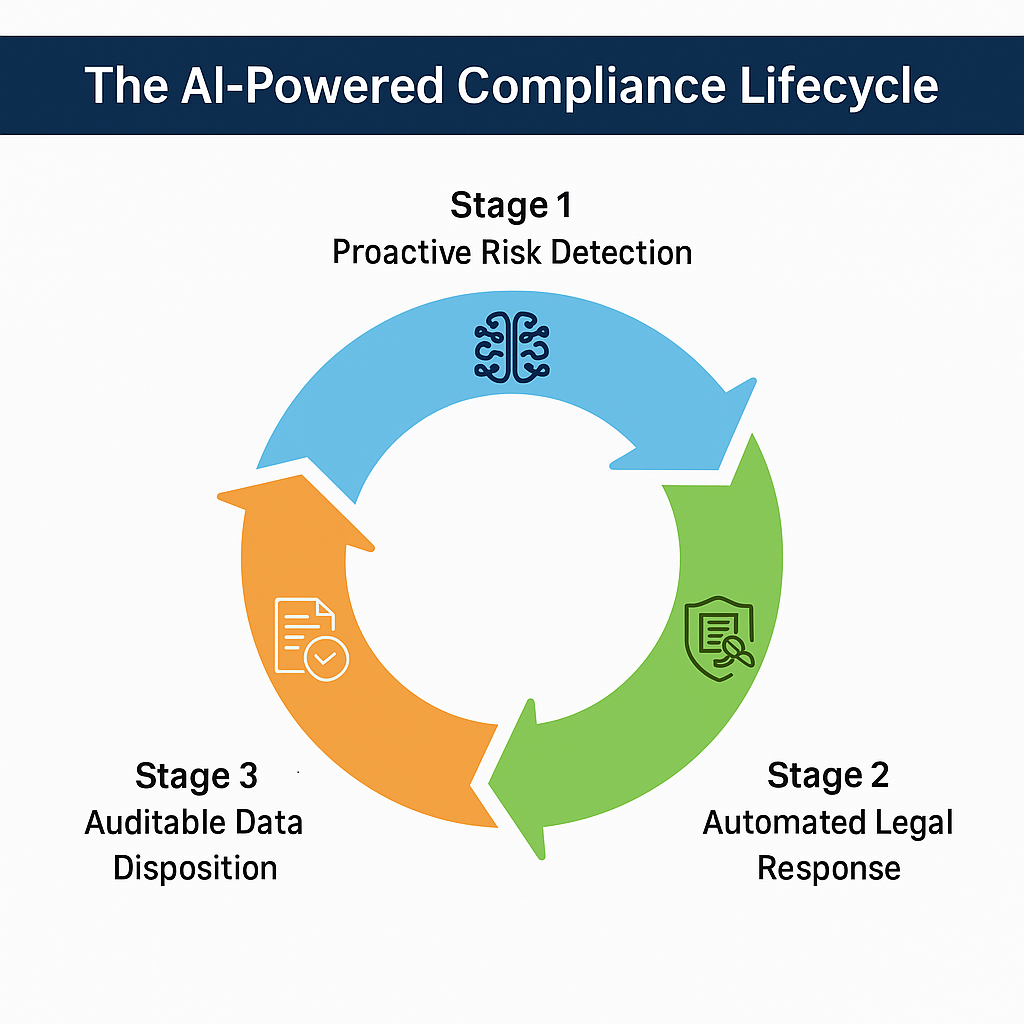

This framework represents a continuous cycle of proactive detection, automated response, and auditable data management (Figure 1).

Figure 1: The AI-Powered Compliance Lifecycle shows how proactive risk detection, automated legal response, and auditable data disposition form a continuous cycle that aligns with accountability-by-design principles. (Graphic courtesy of Amar Joshi)

AI in compliance is new and already changing the game

AI has only recently exploded into the mainstream, so its use in the compliance space is still in its developmental stages. Organizations progressing in their AI journeys are transforming

how compliance teams operate and what they deliver. Wolters Kluwer assembled a panel of leaders from the financial industry, a sector rife with compliance complexities, to explore how AI is redefining their approaches to compliance. The panelists cited the use of AI compliance systems to evaluate lending patterns for disparities, perform loan-to-cost analyses, and detect fraud. Even in firms with limited AI deployment, panelists reported that the tech simplifies processes, drives efficiencies, and improves risk identification and management.

The business case for AI-enabled compliance is compelling. A report published in Emerging Science Research found that monitoring systems powered by AI can issue alerts 50% faster than manual systems. Financial institutions, in particular, are cutting operating costs by as much as 30% with the use of AI compliance. One firm that deployed AI for fraud detection reduced its regulatory fines by 40% within two years.

“By automating compliance processes,” the report stated, “AI significantly reduces costs, enhances resource allocation, and mitigates risks of non-compliance.” In a landscape where costs are paramount, but the outcomes of cutting corners in the compliance space are also significant, an AI-supported strategy is the next logical progression for compliance.

Where AI-driven compliance is headed A Moody’s survey of 550 risk and compliance professionals revealed that 80% expect “widespread adoption” of AI in their functions within five years. Yet, many remain cautious, especially about ethics and fairness.

To drive sustainable progress, respondents stated that organizations should prioritize “transparency and explainability” with their tech deployments. Federal Home Loan Bank of Chicago researcher Hariharan Pappil Kothandapani emphasizes the criticality of “robust AI frameworks” in organizations that incorporate AI into their compliance efforts. Leaders will need to strike “a delicate balance between innovation, ethical responsibility, and regulatory collaboration.” In a rapidly changing landscape, accountability by design can enable business leaders to harness the potential of AI fairly and consistently, propelling them to the leading edge of compliance. Now is the time to adapt as AI-driven compliance evolves.

Compliance of the future

AI transforms all facets of business, and compliance is one area primed for innovation. AI-powered compliance systems help leaders approach risk proactively through structured, strategic systems that identify business-specific risks, with stated governance and outcomes. With clear expectations in place, organizations strengthen confidence in their compliance efforts and gain the operational advantage needed today.

About the Author:

Amar Joshi is a tech lead and a senior software engineer specializing in the field of legal engineering at a leading global technology company. He leads the design and implementation of complex, large-scale technology solutions essential for eDiscovery, litigation support, and regulatory compliance. His work has been central to navigating high-stakes government investigations and has saved millions of dollars in operational costs. Joshi earned his master’s degree in computer science from New York University and has been a leader in the legal tech space for over a decade. Connect with him on LinkedIn.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the official policy or position of the author’s employer.