Top 10 Richest Living Hedge Fund Managers in 2025

Behind the suits, spreadsheets, and Bloomberg terminals, hedge fund titans are still human beings—albeit ones with billions in the bank. Some got here by spotting patterns no one else saw. Others took big bets when the rest of the market panicked. All ten of these living legends have shaped the way global finance works today. Let’s meet the richest of them, one by one.

Note on Net Worth Figures: The net worth estimates provided are as of June 2025 and are subject to daily fluctuations based on market performance, asset valuations, and public disclosures. Figures are primarily sourced from reputable financial publications and indices.

1. Ken Griffin – $45.9 Billion

Ken Griffin, founder and CEO of Citadel, remains the world’s richest hedge fund manager in 2025. His firm continues to outperform, managing over $60 billion in assets.

If there’s a single person who defines modern hedge fund power, it’s Ken Griffin. The Citadel founder started trading from his dorm room at Harvard and never looked back. Today, his firm manages over $60 billion, and his fortune includes mega-mansions, rare artwork, and deep political influence. But Griffin’s not just spending—he’s also giving. From Chicago to Harvard, his philanthropic fingerprint is everywhere. Even with markets on edge in 2025, Griffin is still in the lead—quietly pulling strings across Wall Street, Washington, and beyond.

2. David Tepper – $21.3 Billion

:max_bytes(150000):strip_icc()/GettyImages-472161290-499991e362c64a19b0df8faef09c5ab6.jpg)

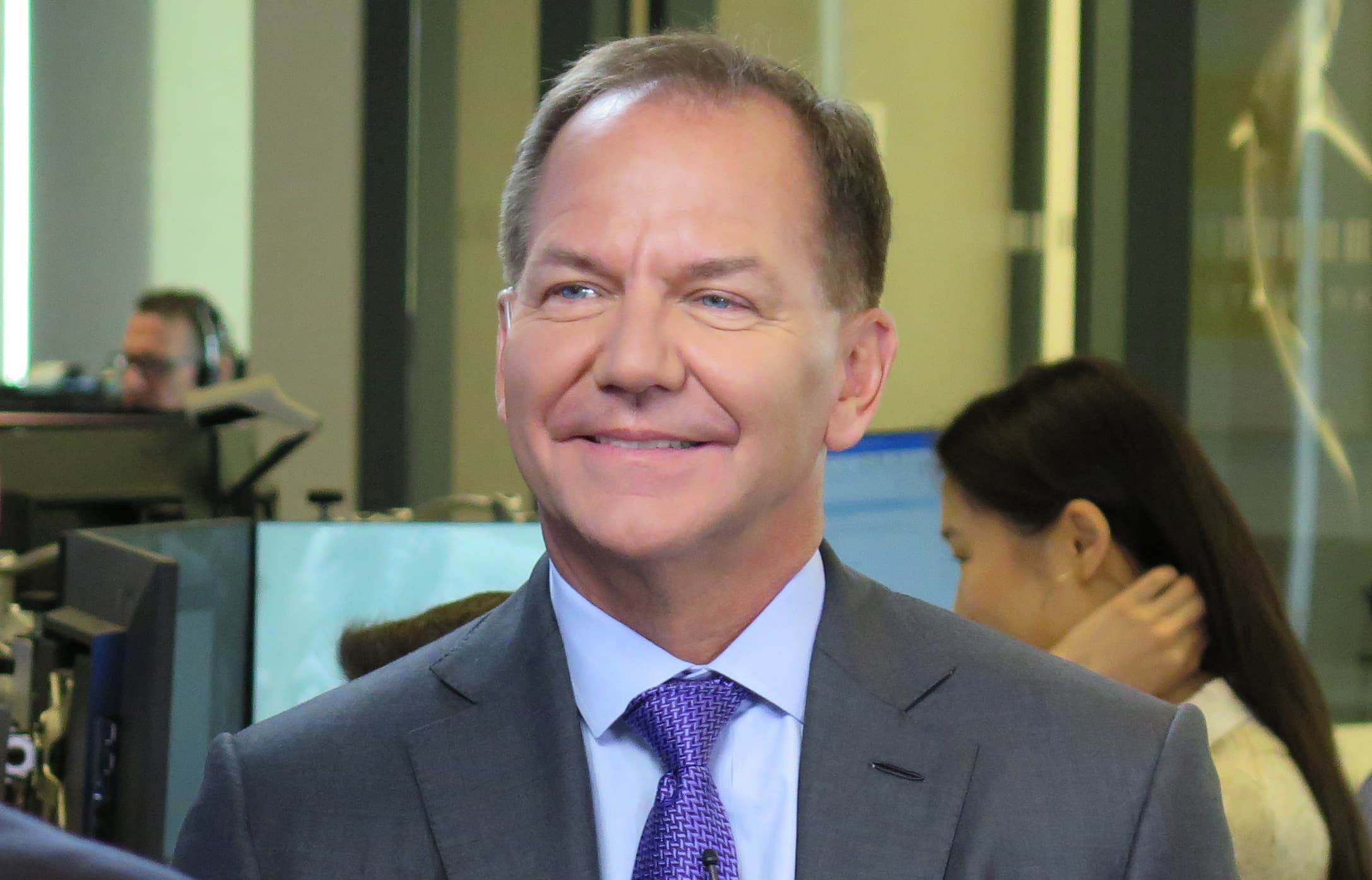

David Tepper, founder of Appaloosa Management, made his fortune betting on distressed assets. In 2025, he ranks among the world’s wealthiest hedge fund managers.

David Tepper has always been a bit different. A blue-collar kid from Pittsburgh, he didn’t come from money—but he sure figured out how to make it. Tepper’s hedge fund, Appaloosa, built its empire buying distressed assets when others ran scared. His secret? A steel stomach and an eye for opportunity. He now owns the Carolina Panthers and gives generously to education and urban development. Blunt, smart, and fearless, Tepper’s success story still feels gritty, even with a billion-dollar scoreboard behind him.

3. Steve Cohen – $21.3 Billion

Steve Cohen, founder of Point72 and owner of the New York Mets, remains one of the most influential figures in hedge fund history and sports ownership in 2025.

Few hedge fund managers have lived through more reinvention than Steve Cohen. After his original firm, SAC Capital, became the focus of an insider trading probe, Cohen came roaring back with Point72—and now runs it alongside owning the New York Mets. With a trading style that’s instinctive and high-octane, Cohen’s known for backing what he believes in, fast. Off the field, he’s a major player in the art world and a generous donor to causes like autism research. In 2025, his edge hasn’t dulled—it’s just evolved.

Related: The Enigma of Wall Street: How Steve Cohen Forged a Fortune

4. Michael Platt – $18.8 Billion

Michael Platt, co-founder of BlueCrest Capital, has quietly amassed a fortune by turning his hedge fund into one of the most profitable proprietary trading firms in the world.

Michael Platt might be the most successful hedge fund manager you’ve never heard speak. The ultra-private co-founder of BlueCrest gave back his clients’ money in 2015 so he could just trade for himself—and it paid off in spades. His firm, now a proprietary trading beast, delivers monster returns with little fanfare. No TV interviews. No Twitter drama. Just numbers, results, and a growing net worth that now rivals anyone in the game. If stealth wealth were a sport, Platt would be its MVP.

5. Ray Dalio – $14.0 Billion

Ray Dalio, founder of Bridgewater Associates, remains a towering voice in global finance, known for his macro strategies and principles-based investing philosophy.

Ray Dalio built Bridgewater Associates into a hedge fund juggernaut by studying history, writing down principles, and betting big on macro trends. He’s retired from day-to-day leadership now, but his legacy is still very much alive—from the firm’s All Weather portfolio to his bestselling books. Dalio has shifted his focus to philanthropy and global policy, but when he speaks, people still listen. Markets may be volatile, but Ray’s influence remains steady, shaped by decades of data, meditation, and deep thinking about how the world works.

Related: Ray Dalio's $319 Million Gold Bet and Warnings on U.S. Debt Risk

6. Israel “Izzy” Englander – $14.2 Billion

Izzy Englander, founder of Millennium Management, built one of the most diversified and disciplined hedge fund platforms in the world, with over 300 trading teams and $58 billion in AUM.

Izzy Englander doesn’t do splashy interviews or grandstanding. Instead, he built Millennium Management into a fortress—one powered by over 300 independent teams that manage billions with surgical precision. Englander’s style is quiet, methodical, and relentlessly focused on risk. That’s made his fund one of the most consistent in the game, even when everything else is breaking. Born in Brooklyn and grounded in his Jewish heritage, he’s quietly donated millions to medical research and education. He’s not chasing headlines—just performance.

7. Chris Hohn – $9.2 Billion

Chris Hohn, founder of TCI Fund Management, is known for his activist investing style and one of the most generous charitable foundations in global finance.

Chris Hohn isn’t your typical hedge fund billionaire. The British fund manager runs TCI, an activist firm that goes after underperforming companies—and then demands they change. But what really sets him apart is what he does with his money. Hohn channels a massive chunk of his wealth into the Children’s Investment Fund Foundation, which tackles child poverty and climate change. In fact, he’s one of the only hedge fund managers who took a huge pay cut to give more to charity. Fierce in business, soft-hearted in impact.

8. Bill Ackman – $9.3 Billion

Bill Ackman, founder of Pershing Square Capital, is known for bold activist bets, public campaigns, and one of the most recognizable voices in hedge fund investing.

Bill Ackman loves a good fight. Whether it’s shorting Herbalife or wading into the debate on COVID lockdowns, the Pershing Square founder rarely holds back. He’s made billions from concentrated bets that sometimes defy the crowd—and occasionally backfire. But when they work, they really work. Case in point: his $2.6 billion gain from a single hedge in early 2020. In recent years, he’s softened slightly, turning more toward philanthropy and education. Still, his tweets alone can move markets. In 2025, he’s still a headline machine with a sharp eye for value.

9. David Shaw – $9.15 Billion

David Shaw, founder of D. E. Shaw & Co., pioneered algorithmic trading and later shifted his focus to groundbreaking research in computational biomedicine and neuroscience.

David Shaw is what happens when a computer scientist walks into Wall Street and rewrites the rules. He founded D. E. Shaw & Co. in the late ’80s and pioneered quant investing long before it was cool. These days, Shaw is more focused on brain science and biomedicine than on stock tickers, but his firm continues to thrive using algorithms, data, and machine learning. His fortune reflects both financial genius and a lifelong love of science. In a world of fast talkers, Shaw lets the math speak for itself.

10. Paul Tudor Jones – $8.1 Billion

Paul Tudor Jones, legendary macro trader and founder of Tudor Investment Corporation, remains a prominent voice in markets and philanthropy through his Robin Hood Foundation.

A legend since the ’80s, Paul Tudor Jones made his first billion predicting the 1987 crash. Today, his firm, Tudor Investment Corp., still plays the macro game—riding waves in currencies, commodities, and global trends. Jones has also carved out a reputation as one of Wall Street’s most philanthropic voices, founding the Robin Hood Foundation to fight poverty in New York. In an industry that changes fast, Jones remains timeless: smart, principled, and always just a little ahead of the next big move.

Final Thoughts These hedge fund giants didn't just make money—they built machines that print it. Whether they’re taking activist stances, using high-frequency algorithms, or placing long-term macro bets, each of these billionaires has left a mark on the financial world. And while their strategies differ wildly, one thing’s clear: they're not just surviving in 2025—they're thriving.

📚 Further Reading

David Thomson Net Worth

Inside the elusive world of Thomson Reuters' heir and Canada’s richest man.

Andy Jassy Net Worth

How Amazon’s low-key CEO built his tech-driven fortune and navigates post-Bezos power.

CZ (Changpeng Zhao) Net Worth

From crypto billionaire to convicted felon—inside the spectacular fall of Binance’s founder.

Jim Irsay Net Worth

A look at the life, legacy, and fortune of the late Indianapolis Colts owner.