A Danish Giant Under Pressure

Novo Nordisk has long stood as a pillar of Denmark’s economy, renowned worldwide for its diabetes and weight-loss medicines particularly Ozempic and Wegovy. But in 2025, the company is navigating a storm. With rising competition, shifting pricing strategies, and a major leadership change, Novo’s latest moves are not just about healthcare they reflect deep economic ripples across the Danish pharmaceutical landscape.

Denmark’s Growth Story Meets a Reality Check

Novo Nordisk’s meteoric success once fueled Denmark’s national economic growth. However, recent downward revisions in the country’s GDP forecast highlight how intertwined the company is with wider economic health. In August 2025, Denmark cut its annual growth projection to 1.4%, citing weaker-than-expected pharmaceutical exports from Novo as a key factor.

The slowdown is intensified by rising global competition in the GLP-1 obesity market, particularly from U.S. rival Eli Lilly, and increasing pressure on pricing in key markets.

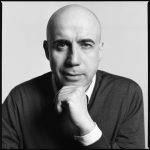

Meet the New CEO: Maziar “Mike” Doustdar

In a bold leadership transition, Maziar “Mike” Doustdar officially became Novo Nordisk’s President and CEO on 7 August 2025, taking over from longtime leader Lars Fruergaard Jørgensen. Doustdar, a veteran of the company since 1992, previously ran its international operations, where he oversaw DKK 112 billion in sales in 2024.

His appointment comes at a volatile moment, placing him at the helm amid shrinking profit forecasts, increased competition, and a need for operational reinvention.

What the CEO Earns: The Numbers Behind the Title

According to Novo Nordisk’s 2024 remuneration report, CEO Mike Doustdar’s total compensation for the year came to DKK 57.1 million. Around 36% of that is fixed salary, while the remaining 64% is performance-based, tied to the company’s long-term incentive plan.

Price Cuts, Bold Moves — and a Gamble on Hope

In late 2025, Novo announced steep price cuts for its blockbuster weight-loss drug Wegovy, bringing the cost for cash-paying U.S. patients down significantly. The move came as part of a broader strategy under Doustdar’s leadership to remain competitive in a crowded GLP-1 market.

Beyond pricing, Novo is streamlining its operations. The company plans to cut 9,000 jobs globally, including 5,000 roles in Denmark, to free up funds for R&D and make the organization more agile.

Navigating a New Competitive Landscape

Novo’s aggressive restructuring reflects a broader strategic pivot. The company has lowered its 2025 outlook for sales and profits, citing fierce competition and slower-than-expected growth in critical drug markets.

Doustdar has been clear: Novo needs to become leaner and faster. He argues that in an increasingly consumer-driven obesity market, agility and efficiency are now just as important as scientific breakthroughs.

Why Denmark Is Watching Closely

For Denmark, Novo is more than a global pharmaceutical company — it’s an economic heavyweight. Its performance affects not just healthcare but national exports, investor sentiment, and even political debate.

If Novo successfully executes its turnaround plan under Doustdar, it could resecure its position as a growth engine for Denmark. If not, the wider implications for the country’s economy could be serious.