How The Golden Bachelor and The Bachelor Franchise Became One of Television’s Most Reliable Financial Engines

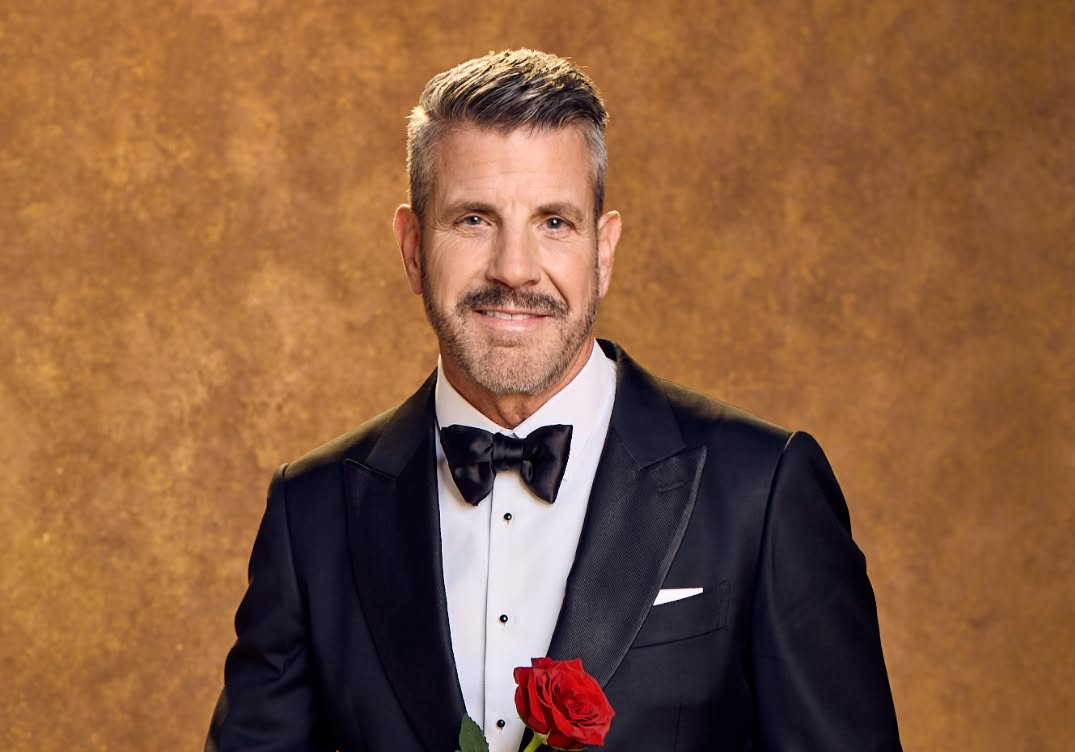

When Australia’s 2025 Golden Bachelor season pushed Bear into the spotlight, the headlines were understandably emotional. But beneath all the champagne toasts and romantic crescendos sits a far larger story—one about resilience, reinvention, and the quiet maturity of a global franchise that refuses to age.

What’s most remarkable isn’t that audiences still care about The Bachelor after more than two decades. It’s that the franchise has become one of the most consistent profit generators in unscripted television, even as the broader entertainment economy convulses under streaming disruption, advertising fragmentation and rising production costs.

The Bachelor isn’t built on romance. It’s built on strategy.

A Format That Refuses to Expire

In an industry where almost nothing has a long shelf life anymore, the durability of The Bachelor is a small economic marvel. The format remains structurally inexpensive to produce compared with scripted drama. Casting is the engine, not sets or CGI. And the storytelling architecture hope, rivalry, vulnerability—renews itself every generation.

Spinoffs like The Golden Bachelor show that the franchise’s adaptability isn’t an accident; it’s a studied response to shifting demographics and market realities. The senior dating format taps into a powerful advertising segment: the over-55 demographic, which Nielsen and Deloitte regularly identify as having the highest spending power in categories like insurance, travel, financial planning, and wellness.

This is where the Bear-led 2025 Australian season becomes particularly instructive. The emotional appeal is obvious, but the commercial logic is far more interesting: mature viewers watch live television more than any other age group, and live viewers are precisely what advertisers will pay a premium for.

Why Mature-Age Romance Became a Marketing Sweet Spot

The “golden” audience segment is a gift to broadcasters and streamers because it solves several commercial challenges at once.

They stay tuned. They watch in real time. And they buy.

Travel brands lean in because empty-nester couples take more and higher-value trips. Wealth managers understand the stakes of the retirement-planning market. Luxury brands know aspirational content doesn’t diminish with age; if anything, it becomes more vivid.

The Golden Bachelor sits right at that intersection.

It’s aspirational but grounded. Emotional without being chaotic. Warm rather than cynical.

For advertisers, that credibility is money.

Industry analysts have also noted that the “active aging” economy covering everything from wellness to longevity technology—is set to surpass USD $1.5 trillion globally by 2030 (source: World Economic Forum). Reality TV has struggled to find a natural way into that market. The Golden Bachelor does it effortlessly.

The Multi-Platform Revenue Engine Behind the Roses

What keeps the franchise financially relevant isn't the weekly episodes; it’s the surrounding ecosystem.

Brand Integration With Unusual Efficiency

Few shows can weave product placement into narrative arcs without viewer fatigue. The Bachelor does it with geographic travel, wardrobe partnerships, sponsored experiences, and hospitality relationships that double as destination marketing.

A romantic getaway becomes an ad. A date card is a commercial. A suite upgrade is a tourism strategy.

Streaming Extensions

As legacy broadcasters fight for relevance, reality formats with deep archives have become incredibly valuable. Hundreds of episodes of The Bachelor function like emotional comfort food—perfect for binge watching. Streaming platforms pay for content that keeps viewers climbing through back catalogues, and The Bachelor’s structure—predictable tension, cliffhangers, personal storytelling—naturally drives multi-episode viewing.

International Scalability

The Bachelor template is extraordinarily easy to export. Love is universal. Jealousy is universal. Final choices are universal.

The operational model—light scripting, flexible filming locations, and globally recognisable tropes—means the format scales into nearly any culture with minimal adaptation.

The Influence Economy

Contestants often become micro-celebrities, which sustains the franchise’s relevance beyond the screen. Their podcasts, clothing partnerships, and social presences function like an unpaid PR pipeline for the entire franchise.

Because audiences feel they “know” these people, the brand never fully disappears between seasons.

The Hidden Economics: Why Viewers Keep Coming Back

Emotion may be the currency The Bachelor trades in, but behavioural economics is the system that underpins the entire format.

Scarcity (one rose). Social proof (crowds, confessionals). Parasocial attachment (the viewer’s invisible relationship with contestants). Narrative cycles engineered for anticipation.

These patterns create one of television’s most powerful retention engines. Not through gimmicks, but through the psychology of expectation and reward.

What feels intuitive to viewers is highly intentional for producers.

The Golden Bachelor and the Future of Reality Entertainment

The viral power of mature-age romance is telling the industry something it has been slow to recognise: cultural relevance doesn’t only come from youth. Older demographics are hungry for representation, eager to see their own lives reflected in mainstream storytelling, and increasingly comfortable engaging with digital platforms.

Bear’s season in Australia became a cultural moment not because it was young, but because it wasn’t. The tenderness and vulnerability of later-life romance cut through the noise of algorithm-driven content overload.

As networks hunt for formats that feel both warm and commercially robust, more reality franchises will likely follow the path The Golden Bachelor has cleared stories of reinvention, resilience, and second acts that resonate across generations.

Conclusion: The Bachelor Isn’t Just Entertainment—It’s Strategy

The longevity of The Bachelor isn’t an accident. It’s an exercise in business discipline: low production risk, high emotional payoff, and unparalleled adaptability.

The Golden Bachelor simply sharpened the formula, expanding the franchise into an increasingly powerful demographic and proving that reinvention can come from maturity, not youth.

In a television economy dominated by volatility, The Bachelor stands out as something rare: a format with a commercial blueprint that ages as gracefully as it evolves.

Key Questions on the Economics and Strategy Behind The Bachelor Franchise

Why is The Bachelor franchise still financially successful after more than two decades?

Its low production costs, predictable viewer engagement, and global scalability create unusually stable returns. The franchise also monetises across advertising, streaming, licensing, and destination partnerships, giving it multiple revenue streams beyond weekly ratings.

How does The Golden Bachelor attract premium advertisers?

The show targets older viewers who statistically have higher spending power, watch more live television, and engage more deeply with lifestyle content. This combination gives advertisers a high-value demographic that many entertainment formats fail to reach.

Are reality dating shows still profitable in the streaming era?

Yes. Reality formats perform well on streaming platforms because they encourage binge-watching, have low licensing risks, and create large back catalogues with long-term engagement potential.