Why Jensen Huang Is Heading to South Korea: Big Tech, Bigger Stakes

What it means for the business of chips, geopolitics and strategy

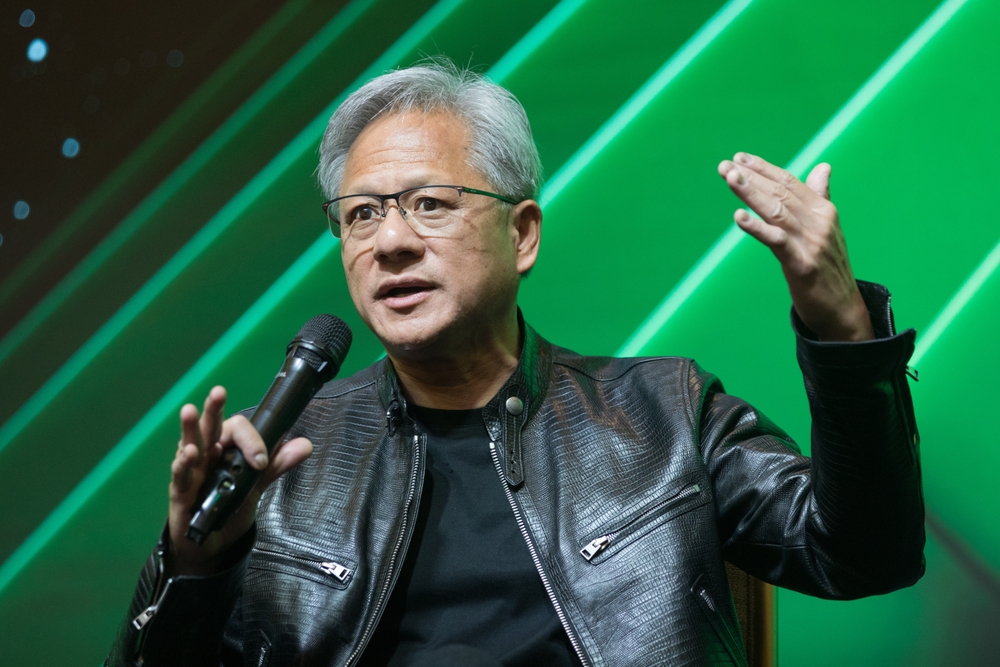

Jensen Huang, CEO of NVIDIA, is making a high-profile visit to South Korea this week—one that showcases how semiconductor power meets global strategy. According to Reuters, Huang will participate in the APEC CEO Summit in Gyeongju from 28 to 31 October 2025. Reuters+1

His agenda is packed: key meetings with executives at Samsung Electronics, SK Hynix and other South Korean technology firms that supply crucial memory chips—essential components in NVIDIA’s AI and data-centre stack. Reuters+1

But there’s another layer: his trip overlaps with a planned meeting between U.S. President Donald Trump and China’s President Xi Jinping—positioning Huang and NVIDIA at the intersection of tech, diplomacy and market access. Reuters+1

Why South Korea?

South Korea isn’t just a regional stop-over for Huang—it’s a strategic node. Samsung and SK Hynix supply the high-bandwidth memory (HBM) that powers NVIDIA’s AI-accelerator units. Huang himself told reporters:

“Samsung, SK, Hyundai, LG, Naver… every one of the companies are deep friends of mine and very good partners.” Reuters

By strengthening these ties, NVIDIA hedges against global supply-chain disruption, boosts manufacturing resilience and deepens its role in accelerating AI infrastructure.

The Financial and Strategic Angle

From a financial viewpoint, this trip sends several bold signals:

-

Supply‐chain security is central. With memory-chip supplies under pressure globally, Korea holds strategic leverage.

-

AI infrastructure is the new battlefield. NVIDIA’s lead in AI processors (like the Blackwell series) depends not just on its own chips but on partnerships with foundries and memory-makers.

-

Diversification amid China-exclusion. Huang recently disclosed that NVIDIA’s share of China’s advanced-AI-accelerator market has plunged from about 95 % to zero after export restrictions. Yahoo Finance+1 With China largely off the table, deepening Korean and other alliances becomes ever more important.

-

US-ROK alignment. By aligning with South Korea—an ally of the U.S.—NVIDIA positions itself favourably in both tech and geopolitical arenas, increasing investor confidence in its global strategy.

Legal & Governance Risks in the Mix

Huang’s trip also highlights legal and governance issues:

-

Export controls: The U.S. continues to limit certain advanced chips to China, meaning NVIDIA must navigate complex licensing, compliance and risk mitigation.

-

Market access: Tools like the H20 chip were designed for China, but Beijing has blocked purchases and regulatory scrutiny remains intense. TechRadar+1

-

Supplier contracts & IP exposure: As partnerships deepen, NVIDIA must ensure memory- and fabrication-partners comply with export laws and don’t create back-door vulnerabilities—especially in regions under tighter regulation.

What’s Next—and What to Watch

-

Announcements expected. Huang has indicated he will unveil strategic partnerships and investments in AI factories with Samsung and Hyundai during his visit. Reuters

-

Deal flow in Korea. Reports suggest negotiations are underway for NVIDIA to supply AI-chips and systems tied to Korean data-centres and manufacturing hubs.

-

China implications. With China actively excluding NVIDIA’s advanced compute products and pushing domestic alternatives, the Korean component of NVIDIA’s supply-chain becomes even more critical. TechRadar

-

Investor sentiment. With global tech competition, NVIDIA’s ability to secure manufacturing and memory-feeds via Korea may become a differentiator for its valuation and market leadership.

FAQ – Jensen Huang & the Korean Mission

What is Jensen Huang doing in South Korea?

He is attending the APEC CEO Summit and meeting with senior executives from Samsung, SK Hynix and other Korean firms to strengthen NVIDIA’s AI supply-chain partnerships.

Why are partnerships with Samsung and SK Hynix important for NVIDIA?

These firms supply high-performance memory (HBM) and chip-components that are central to NVIDIA’s AI accelerators—ensuring production capability and market competitiveness.

How does China factor into the visit?

NVIDIA’s market access in China has collapsed due to export bans and regulatory barriers—down from approximately 95 % share to zero in its advanced accelerator segment. China’s exclusion creates urgency for alternative partnerships.