In 2025, the global billionaire landscape is more concentrated than ever. While more than 3,000 individuals worldwide qualify as billionaires, a handful of nations host the lion’s share. The number of billionaires in a country reveals not just its wealth, but its economic structures, capital access, and regulatory climate. It also highlights where self-made billionaires—those who built empires from innovation and grit rather than inheritance—continue to thrive. Below, we explore the top 10 countries with the most billionaires in 2025 — who they are, how many there are, and what it says about global inequality and opportunity.

United States – ~902 Billionaires

The United States leads the world by a wide margin, boasting approximately 902 billionaires in 2025. (According to Forbes via Investopedia, the U.S. number jumped from 813 in 2024 to 902.) Investopedia+2mint+2 Many of these fortunes stem from tech, finance, entertainment, and consumer brands. The American system of venture capital, big public markets, and relatively permissive regulation enables scale. The richest U.S. billionaire in 2025 is Elon Musk, whose net worth overshadows many national totals. Because so many of the world’s top innovators are American, the U.S. serves as the global hub for wealth creation and accumulation.

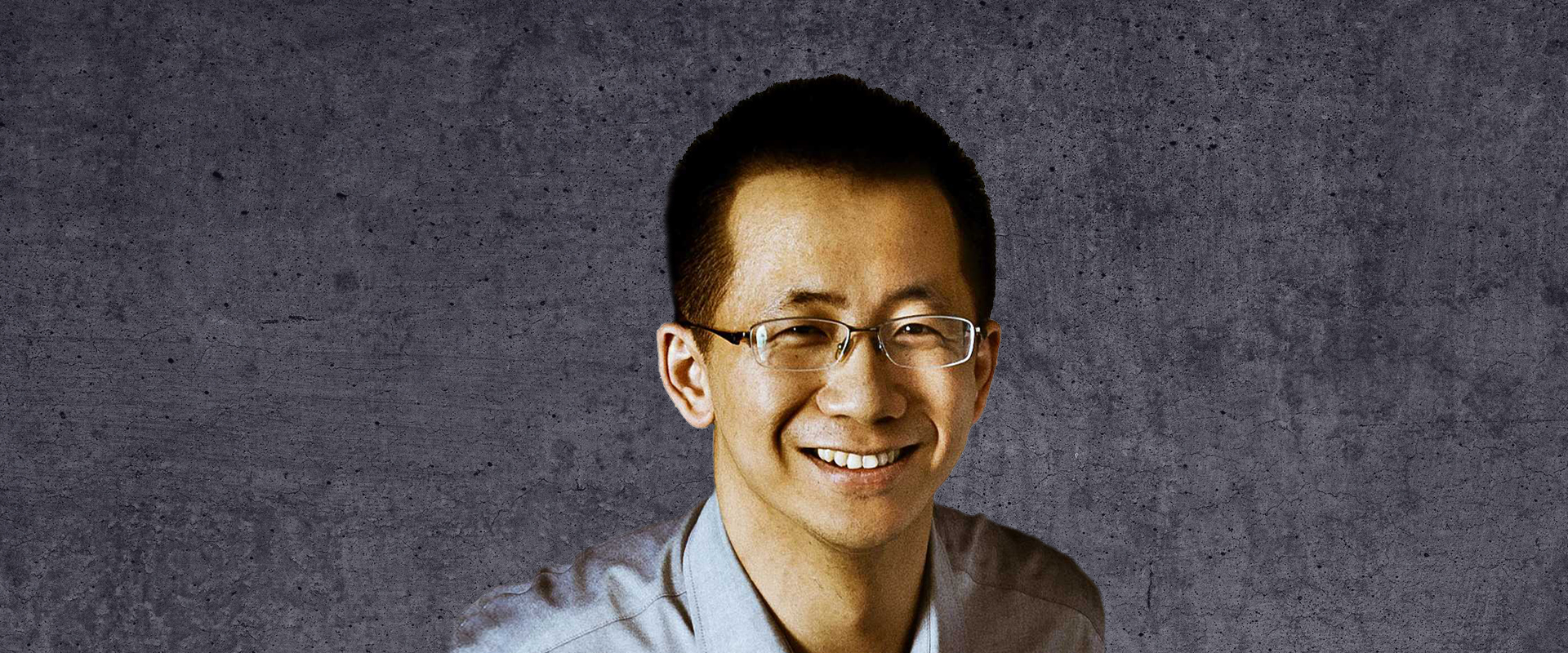

China (Including Hong Kong & Macau) – ~516 Billionaires

In second place is China (counting Hong Kong and Macau), with about 516 billionaires as of 2025. This figure reflects China’s enormous manufacturing base, explosive tech growth, and property development boom. However, wealth there is subject to regulatory flux and political risk. One standout figure is Zhang Yiming, co-founder of ByteDance, who remains among the country’s richest. The Indian Express+2mint+2 The Chinese billionaire ecosystem is one built on scale, speed, and heavy state involvement.

India – ~205 Billionaires

India ranks third in 2025 with around 205 billionaires. Forbes+2mint+2 India’s wealth creation increasingly comes from IT, telecommunications, renewable energy, and consumer markets. Giants like Mukesh Ambani of Reliance Industries are emblematic of how traditional sectors morph in modern economies. (Ambani has long been India’s richest.) India’s combination of demographic scale and digital adoption is powering a new generation of ultra-wealthy.

(Image: World Economic Forum - wikicommons | CC-BY-SA 2.0)

Germany – ~171 Billionaires

Germany holds the fourth spot with about 171 billionaires. This European heavyweight’s fortunes are heavily rooted in industrial manufacturing, automotive, chemicals, and family-owned global brands. Figures such as Dieter Schwarz (behind Lidl/Kaufland) often top the German list. Visual Capitalist+1 The German model emphasizes steady growth, craftsmanship, and strong export orientation.

Dieter Schwarz

Russia – ~140 Billionaires

Rounding out the top five is Russia, with roughly 140 billionaires in 2025. Much of Russian billionaire wealth is tied to energy, natural resources, and raw materials. Because the state often intersects with industry here, fortunes can be politically sensitive and subject to sanctions or asset seizures. Vagit Alekperov, longtime figure in oil and energy sectors, is often cited among Russia’s richest. 360 Mozambique+2mint+2 Russian wealth thus reflects both resource leverage and geopolitical vulnerability.

Vagit Alekperov

Canada – ~76 Billionaires

Canada lands in sixth place, with about 76 billionaires in 2025. Though fewer in number, Canadian billionaires tend to enjoy stability, good infrastructure, and moderate regulation. Wealth in Canada often comes from natural resources, mining, technology, and finance. A notable name is Changpeng Zhao, the co-founder of Binance, who has had global influence. World Population Review+1 Canada’s position shows that you don’t need scale like the U.S. or China to produce significant wealth — but you do need systemic stability.

Changpeng Zhao

Italy – ~74 Billionaires

Italy has around 74 billionaires in 2025. Many Italian fortunes arise from long legacy family businesses in fashion, food, industrial manufacturing, and luxury goods. One such name often cited is Giovanni Ferrero, heir of Ferrero Group (Nutella, etc.). 360 Mozambique+1 Italy’s wealthy tend to blend entrepreneurial dynamism with generational legacy.

Giovanni Ferrero

Brazil – ~56 Billionaires

Brazil also appears in the top ten, with approximately 56 billionaires. In Brazil, billionaire wealth is often tied to agriculture, mining, banking, and commodities. Figures like (cofounder of Facebook, who moved to Brazil) illustrate how local markets can connect to global networks. Brazil’s billionaire class is exposed to macro volatility — but it retains power in Latin America.

Eduardo Saverin

United Kingdom – ~55 Billionaires

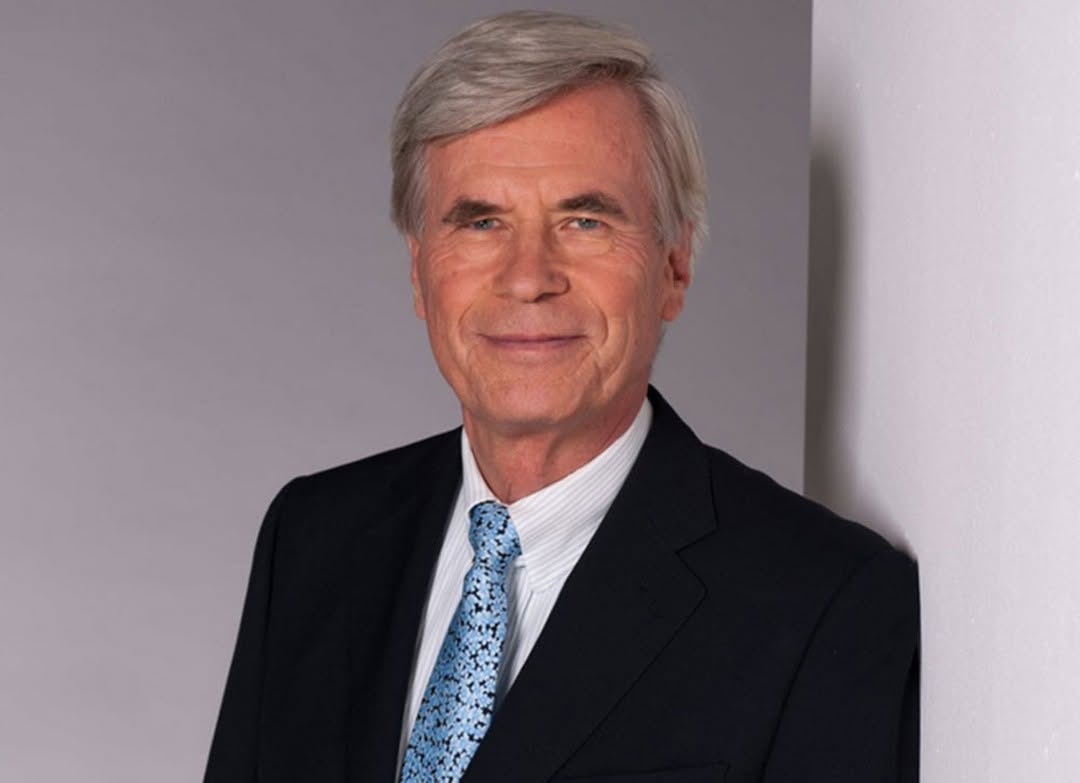

Rounding out the top 10, the United Kingdom has around 55 billionaires, spanning industries from finance and real estate to tech and media. While London attracts global wealth, the UK still produces homegrown tycoons like Sir Jim Ratcliffe, founder of INEOS, whose fortune—estimated at £30 billion—was built from the ground up in the chemical and energy sectors. His rise from Manchester engineer to global industrialist captures the UK’s blend of traditional enterprise and modern ambition.

Sir Jim Ratcliffe

Conclusion

The top 10 countries by billionaire count—led by the U.S., China, and India—map a world where wealth accumulates where infrastructure, markets, regulation, and scale align. The dominance of a few nations underscores inequality, but also shows where the engines of capital run strongest.

Still, these rankings are shifting. Currency fluctuations, taxation changes, regulatory crackdowns, and innovation waves can reorder them quickly. And while raw billionaire count is dramatic, the stories beneath the numbers — who they are, how they hold power, and whether their wealth contributes positively or reinforces inequality — are even more critical to watch.