The Top 10 Richest Luxury Brand Owners in 2025: Fortunes Behind Fashion's Biggest Names

These billionaires navigate complex succession planning and family wealth preservation strategies

The world's wealthiest luxury brand owners represent more than just extraordinary personal fortunes. They've built global empires that shape how billions of people dress, accessorize, and express their identity through fashion. In 2025, these ten individuals and families control over $300 billion in combined wealth—but maintaining these fortunes across generations requires sophisticated estate planning, tax strategies, and succession frameworks that rival the complexity of their business operations.

The luxury fashion industry presents unique wealth preservation challenges. Unlike diversified investment portfolios, these fortunes remain concentrated in single brands or family businesses, creating both opportunity and risk. As several founding billionaires enter their eighties, the question of generational wealth transfer has become as critical as quarterly earnings.

1. Amancio Ortega: The $71.3 Billion Zara Empire Builder

Amancio Ortega

Amancio Ortega, founder of Inditex and the mastermind behind Zara, sits atop the luxury fashion wealth rankings with a staggering net worth of $71.3 billion. The 88-year-old Spanish billionaire built his fortune through a revolutionary "fast fashion" model that transformed how clothing reaches consumers.

Ortega's Inditex portfolio extends far beyond Zara, encompassing brands like Massimo Dutti, Pull&Bear, Bershka, and Stradivarius. His business philosophy centers on rapid inventory turnover—designs move from concept to store shelves in as little as two weeks. This agility allows Inditex to respond instantly to fashion trends while minimizing excess inventory.

Despite his immense wealth, Ortega maintains a notoriously private lifestyle. He rarely gives interviews and reportedly still eats lunch with Inditex employees in the company cafeteria in A Coruña, Spain. His reclusive nature stands in sharp contrast to the public-facing luxury brand owners who cultivate celebrity status.

Ortega's fortune has shown remarkable resilience even as fast fashion faces growing criticism over environmental sustainability and labor practices. Inditex has invested heavily in sustainable materials and supply chain transparency, attempting to address concerns while maintaining profitability. The company operates over 7,000 stores across 96 countries, generating annual revenues exceeding €35 billion.

What distinguishes Ortega financially is his strategic dividend policy. Inditex has paid substantial annual dividends since 2011, providing Ortega with billions in liquid cash that he's reinvested primarily in real estate. He owns prime properties in Madrid, London, Paris, and New York, creating a diversified wealth base beyond his Inditex shareholdings. This real estate portfolio reportedly exceeds €15 billion in value, providing income stability independent of retail volatility.

2. Bernard Arnault: The $41.5 Billion LVMH Luxury Titan

The Arnault family

Bernard Arnault commands a $41.5 billion fortune as chairman and CEO of LVMH (Moët Hennessy Louis Vuitton), the world's largest luxury goods conglomerate. The 75-year-old French businessman oversees a portfolio of 75 prestigious brands including Louis Vuitton, Christian Dior, Fendi, Givenchy, and Tiffany & Co.

Arnault's business acumen has earned him the nickname "the wolf in cashmere" for his aggressive acquisition strategy. He systematically built LVMH through strategic purchases, hostile takeovers, and savvy brand management. His 2021 acquisition of Tiffany & Co. for $15.8 billion represented the largest luxury goods deal in history, though the path to completion was fraught with legal battles and renegotiation.

The French tycoon's approach emphasizes brand heritage combined with contemporary relevance. Under his leadership, LVMH brands maintain exclusivity while expanding global reach, particularly in Asian markets where luxury consumption continues accelerating. China represents roughly one-third of global luxury sales, and LVMH has strategically positioned itself to capture this demand.

Arnault's wealth fluctuates dramatically with LVMH's stock performance. In 2022 and 2023, his net worth briefly exceeded $200 billion, making him the world's richest person. However, softening Chinese luxury demand and broader economic headwinds caused LVMH shares to decline, reducing his fortune by approximately $54 billion from its peak. Despite this substantial loss, Arnault remains one of the world's wealthiest individuals and the undisputed king of European luxury.

Arnault has carefully positioned his five children throughout LVMH's brand portfolio, creating a succession structure that keeps wealth and control within the family. His eldest daughter Delphine leads Christian Dior, while his sons hold key positions at Louis Vuitton, Tiffany, and TAG Heuer. This strategic placement prepares the next generation while maintaining family dominance over the conglomerate.

3. The Brenninkmeijer Family: The $30 Billion C&A Dynasty

The Brenninkmeijer family controls an estimated $30 billion fortune built on C&A, the European retail chain they founded in 1841. This Dutch-German family represents one of Europe's oldest and most successful retail dynasties, spanning six generations of business leadership.

Unlike flashier luxury competitors, C&A focuses on affordable fashion for middle-class consumers across Europe, Latin America, and Asia. The company operates over 1,300 stores in 17 countries, generating billions in annual revenue through high-volume, value-oriented retail. The Brenninkmeijers' strategy emphasizes consistency and long-term thinking over trend-chasing.

The family's wealth extends far beyond C&A through Cofra Holding, their private investment vehicle. Cofra holds stakes in real estate, renewable energy, and various retail ventures worldwide. This diversification has protected the family fortune through multiple economic cycles and retail industry disruptions.

Remarkably private, the Brenninkmeijer family rarely appears on public rich lists and maintains strict confidentiality about their financial affairs. Family members sign agreements restricting public discussion of their wealth, contributing to their mysterious reputation among European business circles. Despite their low profile, they remain one of the continent's most influential retail families.

The Brenninkmeijers employ a sophisticated family governance structure that balances individual autonomy with collective stewardship. Family members can access capital for ventures outside C&A, but major decisions require consensus among family council members. This framework has prevented the wealth fragmentation that often plagues multi-generational family fortunes.

4. Bertrand Puech & Family: The $28.6 Billion Hermès Heritage

Bertrand Puech and the extended Hermès family control a $28.6 billion fortune anchored by Hermès International, arguably the world's most exclusive luxury brand. The sixth-generation family business remains largely family-owned, an extreme rarity among major luxury houses.

Hermès epitomizes luxury through scarcity and craftsmanship. The company's iconic Birkin and Kelly handbags command waiting lists stretching years, with prices ranging from $10,000 to over $500,000 for exotic leather versions. This deliberate scarcity creates insatiable demand—Hermès intentionally limits production to maintain exclusivity and pricing power.

The family successfully fought off a hostile takeover attempt by LVMH's Bernard Arnault in 2010-2014, demonstrating their commitment to independence. They restructured ownership into a holding company controlled by family members, effectively preventing any external acquisition. This fierce protection of family control distinguishes Hermès from competitors who've sold to conglomerates.

Bertrand Puech, a descendant of founder Thierry Hermès, represents the family's commitment to traditional craftsmanship. Hermès artisans undergo years of training, and each handbag is crafted by a single artisan from start to finish. This dedication to quality over quantity has proven extraordinarily profitable—Hermès consistently delivers industry-leading profit margins exceeding 30%.

The Hermès family structure includes approximately 100 family shareholders organized through H51, a holding company that controls 66% of Hermès International. This arrangement ensures no single family member can unilaterally sell or make major strategic decisions. The structure has preserved family unity and prevented the hostile takeover attempts that plague publicly traded luxury brands.

5. Phil Knight: The $26.2 Billion Nike Sportswear Legend

Phil Knight built a $26.2 billion fortune by transforming Nike from a small Oregon shoe distributor into the world's dominant athletic brand. The 87-year-old entrepreneur co-founded Nike in 1964, initially operating as Blue Ribbon Sports before rebranding as Nike in 1971.

Knight's genius lay in recognizing that athletic shoes could transcend sports to become fashion statements and cultural symbols. His strategy of signing celebrity athletes—starting with runner Steve Prefontaine and exploding with basketball legend Michael Jordan—revolutionized sports marketing. The Air Jordan line alone generates over $5 billion in annual revenue.

Though Knight stepped down as Nike chairman in 2016, he retains substantial ownership in the company he built. Nike's global reach extends to over 170 countries, with annual revenues exceeding $50 billion. The swoosh logo ranks among the world's most recognized symbols, appearing everywhere from professional sports to street fashion.

Knight's wealth has enabled massive philanthropy, particularly toward his alma mater, the University of Oregon. He's donated over $1 billion to the university, funding athletics facilities, academic programs, and research initiatives. His autobiography, "Shoe Dog," became a bestseller by chronicling Nike's scrappy early days and near-bankruptcy experiences.

Knight has structured his wealth to minimize estate taxes while maintaining family control over his Nike shares. He established the Knight Foundation and various trusts that will distribute his wealth according to predetermined plans. Unlike some billionaires who die with complex succession battles, Knight has publicly outlined his philanthropic intentions and family arrangements.

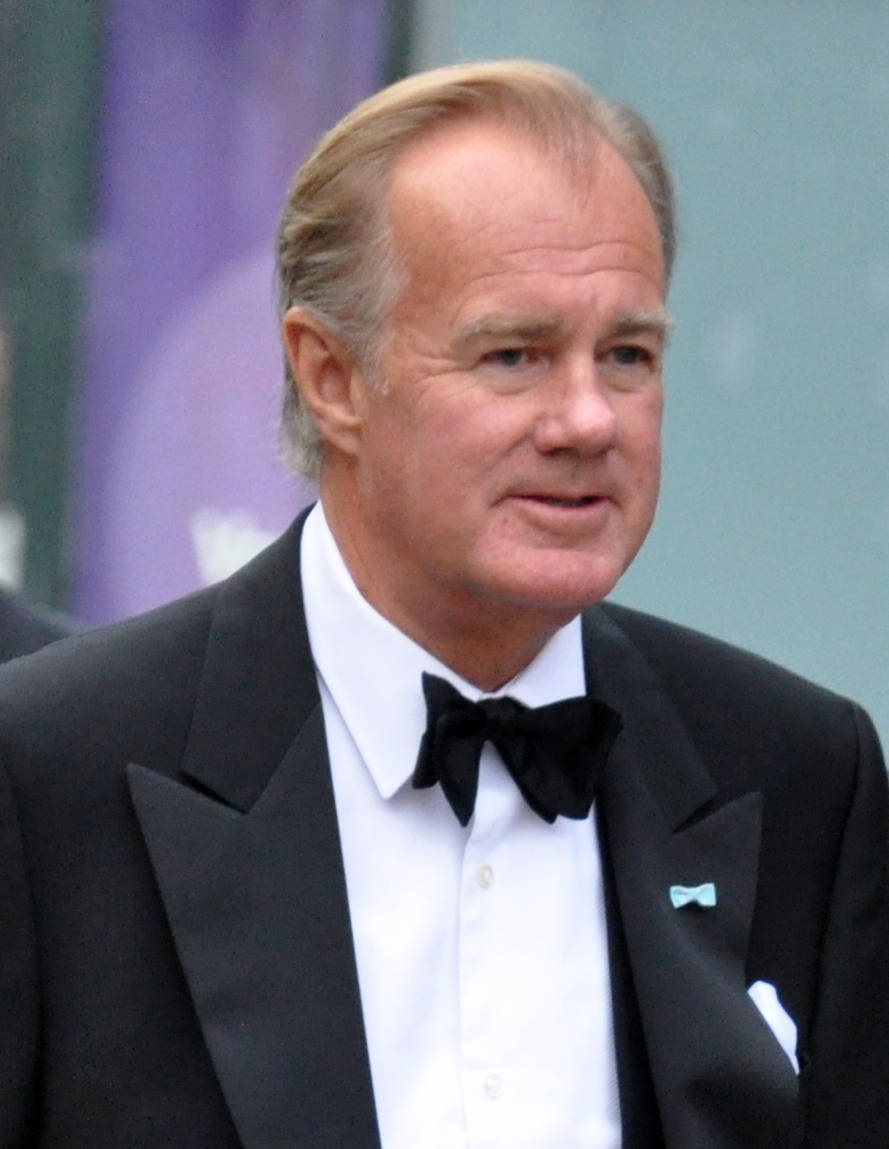

6. Alain & Gérard Wertheimer: The $23.6 Billion Chanel Brothers

ALAIN & GÉRARD WERTHEIMER

Brothers Alain and Gérard Wertheimer control a combined $23.6 billion fortune as the secretive owners of Chanel, the iconic French fashion house. The grandsons of Pierre Wertheimer, who partnered with Coco Chanel in 1924, they represent the third generation leading this intensely private luxury empire.

Chanel remains one of the few major luxury brands still privately held, allowing the Wertheimers complete control over strategy without shareholder pressure. This independence enables long-term thinking and protects Chanel's exclusive positioning. The company reportedly generates over $15 billion in annual revenue, though precise figures remain confidential.

The brothers split their time between New York, Paris, and Geneva, maintaining remarkably low profiles for billionaires controlling such a famous brand. They rarely grant interviews and avoid photography, preferring to let Chanel's products and creative directors occupy the spotlight. This reclusiveness extends throughout their business empire, which includes vineyards and thoroughbred horse racing operations.

Chanel's business model emphasizes timeless design over fleeting trends. The classic Chanel suit, the quilted handbag with chain strap, and Chanel No. 5 perfume remain bestsellers decades after introduction. This consistency generates predictable revenue streams while maintaining the brand's prestigious positioning. The Wertheimers have successfully balanced tradition with contemporary relevance, ensuring Chanel remains aspirational for new generations.

The Wertheimer brothers have no clear succession plan publicly disclosed, raising questions about Chanel's future ownership. Both are in their seventies, and neither has children prominently positioned within the business. Speculation suggests they may eventually sell to a luxury conglomerate like LVMH or Kering, though such a transaction would likely value Chanel at over $50 billion, making it the largest luxury acquisition in history.

7. Stefan Persson: The $19.6 Billion H&M Fast Fashion Heir

Stefan Persson

Stefan Persson controls a $19.6 billion fortune as the largest shareholder in Hennes & Mauritz (H&M), the Swedish fast fashion giant his father founded in 1947. Though he stepped down as chairman in 2020, Persson and his family maintain substantial ownership and influence over the company.

H&M operates over 4,700 stores worldwide, competing directly with Zara for fast fashion dominance. The company popularized designer collaborations, partnering with high-fashion brands like Balmain, Versace, and Stella McCartney to offer limited-edition collections at accessible prices. These partnerships generate enormous consumer excitement and reinforce H&M's fashion credibility.

Persson's wealth has declined from its peak as H&M struggles against online competitors and changing consumer preferences. The company has invested heavily in digital transformation and sustainable fashion initiatives, responding to criticism about fast fashion's environmental impact. H&M now sources significant portions of materials from recycled or sustainable sources, though skeptics question whether fast fashion can ever be truly sustainable.

Beyond retail, Persson has invested heavily in real estate, particularly in Stockholm and London. His property portfolio includes prime commercial and residential buildings, diversifying his wealth beyond H&M's retail volatility. He maintains a relatively low profile in Sweden despite his immense wealth, avoiding the flashy lifestyle associated with many billionaires.

Persson has transferred significant shareholdings to his three children—Karl-Johan, Tom, and Charlotte—preparing the next generation while reducing his personal estate tax exposure. Karl-Johan served as H&M's CEO from 2009 to 2020, though his tenure coincided with the company's struggles against Zara and online retailers. The family's continued control ensures H&M remains aligned with long-term Persson family interests rather than short-term shareholder demands.

8. Leonardo Del Vecchio: The $17.9 Billion Eyewear Empire (Legacy)

Leonardo Del Vecchio

Leonardo Del Vecchio built a $17.9 billion fortune before his death in 2022 through Luxottica, the eyewear conglomerate controlling brands like Ray-Ban, Oakley, and Oliver Peoples. His legacy continues through his children and EssilorLuxottica, the merged entity formed with French lens maker Essilor.

Del Vecchio's rise from orphanage poverty to billionaire status represents one of history's most remarkable entrepreneurial journeys. He started as an apprentice making eyeglass frames before founding Luxottica in 1961. His strategy of vertical integration—controlling design, manufacturing, and retail—revolutionized the eyewear industry.

Luxottica's dominance extends beyond brand ownership to retail control. The company operates LensCrafters, Sunglass Hut, Pearle Vision, and other chains, while also manufacturing frames for fashion brands like Chanel, Prada, and Versace under license. This comprehensive control allows Luxottica to influence pricing and distribution throughout the industry.

Del Vecchio's estate and family continue managing his business interests, with his six children inheriting his fortune and leadership responsibilities. However, succession has proven contentious—Del Vecchio's complex family structure involving three marriages and six children from different relationships created competing interests. Italian media has reported disputes over control of Delfin, the holding company that owns the family's 32% stake in EssilorLuxottica.

Del Vecchio's will reportedly established a structure requiring family members to maintain unified control over Delfin for at least five years after his death. This cooling-off period aims to prevent immediate asset sales or family fractures. However, wealth advisors note that second-generation family businesses with multiple heirs from different marriages face statistically higher chances of wealth fragmentation and control disputes.

9. Michael Otto: The $17.9 Billion German Retail Magnate

Michael Otto

Michael Otto controls a $17.9 billion fortune as head of Otto Group, Germany's largest online retailer and one of Europe's biggest e-commerce companies. The 81-year-old businessman transformed his father's mail-order catalog company into a digital retail powerhouse spanning multiple brands and countries.

Otto Group operates over 120 companies across 30 countries, including well-known brands like Crate and Barrel, About You, and Otto.de. The conglomerate generates approximately €16 billion in annual revenue, with e-commerce representing the vast majority of sales. Otto's early recognition of online retail's potential positioned the company advantageously against traditional competitors.

Unlike luxury-focused competitors on this list, Otto Group emphasizes accessible fashion and home goods for middle-class consumers. The company's strategy prioritizes volume and logistics efficiency over exclusivity and high margins. This mass-market approach has proven remarkably profitable, generating consistent returns across economic cycles.

Otto has also distinguished himself through environmental commitment and sustainable business practices. Otto Group was among the first major retailers to publish detailed sustainability reports and set ambitious carbon reduction targets. The company has invested substantially in renewable energy, sustainable packaging, and ethical supply chain management. Otto personally views environmental stewardship as essential to long-term business success.

Otto has transferred significant operational control to his son Benjamin Otto, who serves as managing partner focused on strategic development. However, Michael Otto retains ultimate authority over major decisions, maintaining the careful succession approach that preserves family wealth. The Otto family has established governance structures ensuring professional management while keeping strategic control within the family across generations.

10. : The $17.4 Billion Uniqlo Visionary

Tadashi Yanai built a $17.4 billion fortune by transforming Uniqlo into Asia's largest clothing retailer and a global fast fashion powerhouse. The 76-year-old Japanese entrepreneur leads Fast Retailing, Uniqlo's parent company, which also owns brands like Theory, Helmut Lang, and J Brand.

Yanai's business philosophy blends Japanese efficiency with global ambition. Uniqlo emphasizes high-quality basics—innovative fabrics and timeless designs rather than trend-driven fashion. The company's proprietary materials like Heattech (thermal wear) and AIRism (moisture-wicking fabric) demonstrate Yanai's focus on technological innovation in clothing.

Fast Retailing operates over 3,500 stores worldwide, with particularly strong presence across Asia. Yanai has set aggressive expansion targets for Europe and North America, where Uniqlo faces stronger competition from established retailers. The company's clean, minimalist store design and organized presentation distinguish it from cluttered fast fashion competitors.

Yanai's management style combines demanding standards with long-term thinking. He's known for setting ambitious goals and holding executives accountable for results. Despite Uniqlo's global success, Yanai has expressed frustration with slower international expansion than initially envisioned. His net worth fluctuates with Fast Retailing's stock performance, which responds to quarterly sales results and expansion progress.

Yanai has been publicly contemplating succession for over a decade, initially targeting retirement by age 70. However, he's repeatedly extended his tenure, citing difficulty finding suitable successors who share his vision and drive. He's appointed and dismissed several potential successors, creating uncertainty about Fast Retailing's post-Yanai future. This succession challenge highlights a common problem among founder-led companies—finding leaders who can match the founder's unique combination of vision, risk tolerance, and operational expertise.

The Complex World of Luxury Brand Succession Planning

The concentration of wealth among luxury brand owners creates unique succession challenges that require sophisticated legal and financial strategies. Unlike diversified investment portfolios that can be easily divided among heirs, family businesses present complex questions about control, management, and long-term vision.

Estate planning experts note that family-owned luxury brands face what they call the "three-generation curse"—the statistical tendency for family wealth to dissipate by the third generation. The founder builds the business, the second generation maintains it, and the third generation often lacks the hunger and vision to sustain growth. Approximately 70% of family businesses fail to successfully transition to the second generation, and 90% don't survive to the third.

The Hermès family represents a notable exception. Through careful governance structures and family agreements, they've maintained unified control through six generations. Their success stems from formal family councils, clear voting structures, and mechanisms that prevent any individual family member from unilaterally selling shares or forcing asset liquidation.

Barbara Hauser, an international estate planning attorney specializing in ultra-high-net-worth families, explained in a Forbes interview: "The families that preserve wealth across generations share common characteristics—they establish clear governance structures early, they educate younger generations about stewardship responsibilities, and they create legal frameworks that balance individual autonomy with collective family interests."

Future Challenges: Sustainability, Digital Disruption, and Generational Values

Beyond succession planning, luxury brand owners face mounting challenges that could reshape their industries and threaten established fortunes. Sustainability concerns are particularly acute, as younger consumers increasingly reject fast fashion's environmental impact and demand transparent, ethical supply chains.

Amancio Ortega's Zara and Stefan Persson's H&M both face criticism over their fast fashion business models. Environmental activists argue that producing vast quantities of trend-driven clothing, regardless of recycled material usage, fundamentally contradicts sustainability. These brands must balance profitability with evolving consumer values or risk becoming obsolete among younger demographics.

Digital disruption continues reshaping retail in unpredictable ways. Social media has created new marketing channels and influencer-driven purchasing patterns that bypass traditional retail. Direct-to-consumer brands launched by internet-native entrepreneurs are capturing market share from established players. Luxury brand owners must invest billions in digital capabilities while protecting the exclusivity and craftsmanship that justify premium pricing.

Generational wealth transfer also means transferring decision-making to heirs who may hold different values than their parents. Second and third-generation family members increasingly prioritize environmental sustainability, social responsibility, and employee welfare over pure profit maximization. This shift could fundamentally alter how luxury brands operate, potentially sacrificing growth for stakeholder interests.

FAQ: Luxury Brand Billionaires and Fashion Fortunes

Who is the richest luxury brand owner?

Amancio Ortega, founder of Inditex (parent company of Zara), is the richest luxury brand owner with a net worth of $71.3 billion in 2025. The Spanish billionaire built his fortune through fast fashion, revolutionizing how clothing moves from design to retail. His wealth substantially exceeds the second-richest luxury brand owner, Bernard Arnault of LVMH, who controls $41.5 billion. Ortega's fortune places him among the world's top ten wealthiest individuals, remarkable for someone who started as a textile shop worker in rural Spain. He has diversified his wealth through extensive real estate holdings exceeding €15 billion.

Which is the richest luxury brand?

LVMH (Moët Hennessy Louis Vuitton) is the world's richest and most valuable luxury brand conglomerate, with a market capitalization exceeding $380 billion. Controlled by Bernard Arnault, LVMH owns 75 prestigious brands including Louis Vuitton, Christian Dior, Fendi, and Tiffany & Co. The Louis Vuitton brand alone is valued at approximately $130 billion, making it the single most valuable luxury brand globally. LVMH generates over €80 billion in annual revenue, dwarfing individual brands and establishing it as the undisputed luxury industry leader. The conglomerate's diversification across fashion, spirits, cosmetics, and jewelry provides resilience against sector-specific downturns.

How did Bernard Arnault lose $54 billion?

Bernard Arnault lost approximately $54 billion from his peak net worth due to declining LVMH stock prices driven by weakening Chinese luxury demand and broader economic concerns. In 2022-2023, Arnault's fortune briefly exceeded $200 billion, making him the world's richest person. However, China's economic slowdown significantly reduced luxury purchases, and LVMH shares declined accordingly since luxury goods are discretionary purchases particularly vulnerable to economic uncertainty. Despite this substantial loss, Arnault remains one of the world's wealthiest individuals with $41.5 billion. His experience demonstrates how billionaire fortunes tied to publicly traded companies can fluctuate dramatically with market conditions, unlike privately held luxury brands that avoid public market volatility.

Who is the no. 1 trillionaire?

As of 2025, no trillionaire exists—no individual has achieved a net worth of $1 trillion. The world's richest person varies between Elon Musk, Bernard Arnault, and Jeff Bezos, with fortunes ranging between $180-250 billion depending on stock market fluctuations. Wealth analysts project that the first trillionaire may emerge within the next 10-15 years, likely from technology sector wealth rather than luxury brands. Some speculation focuses on Elon Musk potentially reaching this milestone first if Tesla and SpaceX valuations continue growing. However, achieving trillionaire status would require unprecedented wealth accumulation, roughly quadrupling current record fortunes. Estate taxes, philanthropy, and wealth distribution among heirs make sustained wealth accumulation at this scale extremely difficult.