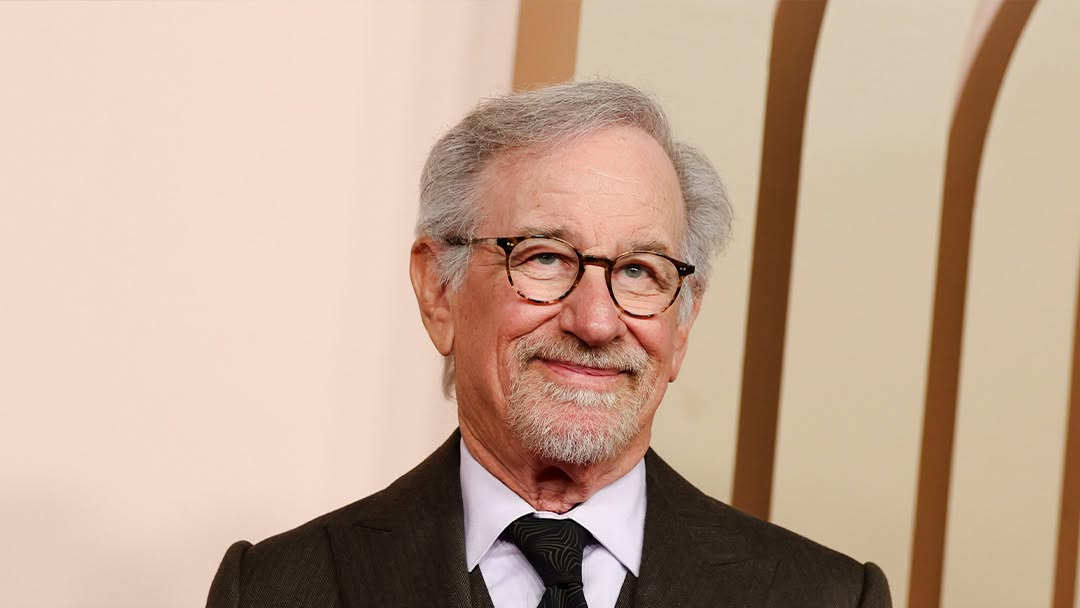

Steven Spielberg’s Billion-Dollar Empire: How He Turns Creative Vision Into Financial Power

Steven Spielberg is widely acknowledged not just as one of cinema’s greatest storytellers, but as a savvy business architect whose strategic moves in production, intellectual property and distribution have delivered a personal fortune estimated at around US$8 billion. Behind the creative magic lies robust financial and legal infrastructure—making Spielberg a case study in how artistry and enterprise converge.

From Blockbusters to Executive Engine – The Rise of a Media Mogul

Spielberg burst onto the mainstream scene in the 1970s with iconic films such as Jaws and Close Encounters of the Third Kind. But rather than only directing, he recognised early the value of ownership. He co-founded Amblin Entertainment (later evolving into Amblin Partners) to produce films and TV under his creative banner—turning production credits into strategic assets.

Through Amblin, he backed E.T., Jurassic Park, Schindler’s List and a host of hit titles, aligning with studios for long-term partnerships that allowed the company to retain backend revenue streams. These deals often include rights, merchandising, theme-park revenue and global licensing—elements that transform film into durable business.

The Financial Machinery: How Spielberg’s Fortune Was Built

Spielberg’s reported net worth places him among the wealthiest individuals in entertainment. His wealth isn’t simply from directing fees but from strategic financial positioning:

-

IP & Franchise Ownership – He secured long-term participation in franchises such as Jurassic Park and Indiana Jones, keeping equity stakes rather than taking a one-off fee.

-

Distribution & Platform Deals – Amblin’s 2021 multi-year deal to produce films for Netflix, and its enduring relationship with Universal Pictures, keep the business model at the cutting edge of the streaming and theatrical era.

-

Back-End Revenue and Theme-Parks – For instance, Spielberg’s earlier agreement with Universal included a share of theme-park revenue, showing how creative output feeds high-margin ancillary business.

In a 2025 interview he declared:

“I’m making a lot of movies and I have no plans… ever… to retire.” The Guardian+1

That quote showcases not only enduring passion but financial foresight—each project fuels the machine, rather than marking a slowdown.

Legal & Strategic Infrastructure: Rights, Ownership and Legacy

The cornerstone of Spielberg’s enterprise isn’t just what gets made—it’s how it’s structured. Legal and financial architecture plays a critical role:

-

Amblin Partnership Agreements: Amblin Partners’ joint ventures with major studios and streaming platforms include shared upside and protective clauses that give Spielberg and his partners creative and financial latitude.

-

Rights Retention & Licensing: By maintaining rights for sequels, spin-offs and global merchandise, Spielberg’s deals turn each film into a long-tail asset rather than a one-time success.

-

Tax & Trust Structures: High-net-worth entertainment professionals often employ trusts and holding entities to manage IP income, residuals and future back-end compensation—Spielberg’s enterprise is no exception.

Legally, this positioning creates barriers to erosion of value: once rights are secured, the engine continues regardless of a single film’s box-office performance.

What Sets Spielberg Apart: Lessons for CEOs and Entrepreneurs

Spielberg’s trajectory offers more than celebrity fascination—it yields valuable business insights for C-suite leaders:

-

Own the Asset, Don’t Just Create It – Winning films are one thing; owning the platform, the ecosystem and the revenue streams make them transformative.

-

Diversify Across Formats, Platforms and Revenue Streams – Spielberg didn’t restrict himself to theatre; he embraced TV, streaming, theme parks and global licensing.

-

Structure for Longevity, Not Just the Sprint – His legal and business deals are built for decades. As he said, retirement isn’t part of the plan.

-

Marry Creative Credibility with Commercial Strategy – Spielberg still sits in the director’s chair, but his role as executive and producer ensures he shapes deals—not just narratives.

From CEO Today’s perspective, Spielberg’s model is one in which creative excellence serves a strategic, monetised enterprise—not the reverse.

The Next Chapter: What to Watch in 2025 and Beyond

In mid-2025, Spielberg launched new projects as both producer and director. His appetite for genres he hasn’t yet conquered—like the Western—signals continued ambition. He remains active in the boardroom, production pipeline and global franchises. Long-term, his aim appears not to ease off but to scale up.

Legally and financially, that means the underlying structures—rights agreements, distribution pacts, IP ownership—will keep generating value well after individual releases hit theatres or platforms.

As the industry shifts rapidly amidst streaming wars, AI tools and changing consumption patterns, Spielberg’s method—own, partner, produce—remains resilient.

Fast Facts: Steven Spielberg’s Empire and Business Strategy

Q1: What is Steven Spielberg’s current net worth?

A1: As of 2025, Spielberg’s estimated net worth is around $8.3 billion, making him one of the richest figures in global entertainment. (Source: Bloomberg, The National News)

Q2: What is Amblin Partners, and how does it generate wealth?

A2: Amblin Partners is Spielberg’s production company, producing films and TV for major studios and platforms like Netflix. It earns through backend rights, distribution, and equity participation.

Q3: How does Spielberg’s legal and financial strategy differ from others in Hollywood?

A3: Spielberg retains rights to his franchises, negotiates profit participation, and structures deals to generate long-term residuals — a model emphasizing ownership over salary.