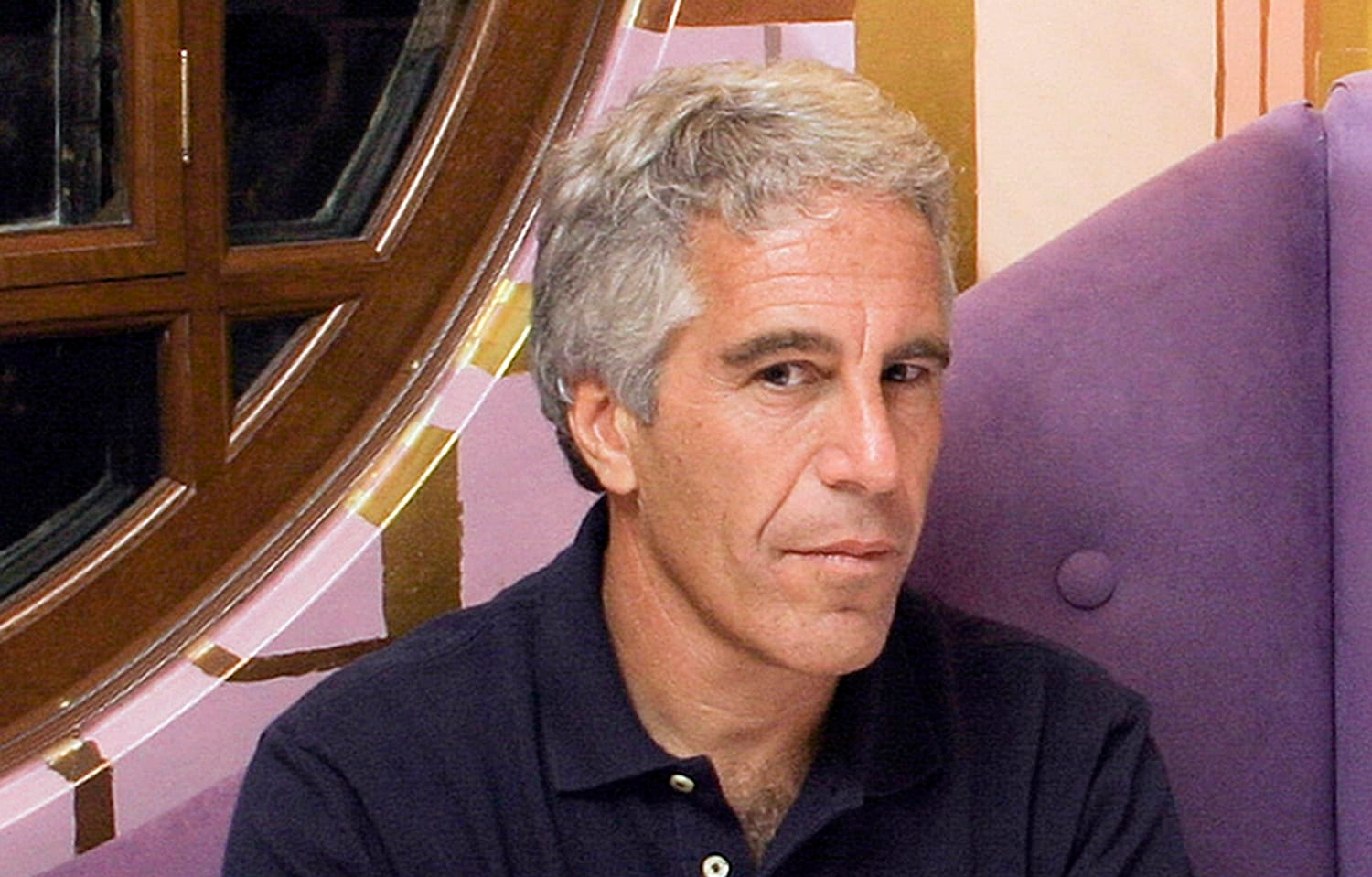

Epstein Lawsuits Put Bank of America and BNY Mellon’s Brand, Compliance, and Billions at Risk

New Epstein-linked lawsuits expose Bank of America and BNY Mellon to major legal, reputational, and financial risks that could weigh on earnings.

A woman identified as Jane Doe filed lawsuits in Manhattan federal court on October 15, 2025, accusing Bank of America and BNY Mellon of knowingly enabling Jeffrey Epstein’s sex-trafficking network by providing financial services that kept his operation afloat for years. Both banks declined to comment, according to Reuters and the Financial Times.

The twin filings—arriving two years after multimillion-dollar settlements with JPMorgan Chase and Deutsche Bank—carry heavy financial and reputational implications. They raise new questions about how some of Wall Street’s biggest institutions handled accounts linked to one of the most notorious figures in modern finance.

Allegations and Financial Exposure

Jane Doe’s complaint says she met Epstein in 2011 and became financially dependent on him. By 2013, she had opened a Bank of America account at the direction of Epstein’s accountant, Richard Kahn, through which she received rent and later payroll transfers connected to a “sham company.” Her lawyers argue these transactions should have triggered Suspicious Activity Reports (SARs) under U.S. anti-money-laundering laws.

A separate lawsuit claims BNY Mellon extended a line of credit to MC2 Model Management, described as part of Epstein’s trafficking infrastructure, and processed roughly $378 million in payments tied to women exploited by Epstein.

If proven, those failures could expose the banks to hundreds of millions in damages, regulatory fines, and increased compliance costs—directly affecting profitability and investor confidence.

Legal Precedent and Risk Benchmark

Doe is represented by Boies Schiller Flexner and Edwards Henderson, the same firms that won $290 million from JPMorgan Chase and $75 million from Deutsche Bank in 2023 settlements—neither institution admitting wrongdoing.

Those outcomes offer a benchmark for potential exposure: even a mid-range settlement could materially impact quarterly earnings or compel the banks to increase legal-reserve allocations. Analysts note that such overhangs often pressure valuations until cases are resolved.

The Compliance and Brand Dimension

Banking depends on trust and perception. Allegations of complicity in a high-profile trafficking network cut directly at that foundation. Corporate clients, wealth-management customers, and pension trustees may delay new mandates or move funds elsewhere to avoid reputational spillover.

For investors, the litigation adds a risk premium to both stocks. Credit-rating agencies could reassess the banks’ outlooks, while institutional investors might demand higher yields on debt placements. Meanwhile, internal remediation—staffing AML teams, upgrading transaction-monitoring technology, and commissioning third-party audits—will raise expenses and compress margins until confidence stabilizes.

Political and Regulatory Backdrop

The lawsuits land amid renewed Congressional scrutiny of Epstein-related financial flows. Lawmakers have cited more than $1.5 billion in flagged transactions across multiple institutions and pressed the U.S. Treasury Department for broader disclosure of suspicious transfers.

That political momentum could prompt tighter compliance expectations and additional document requests from regulators, effectively extending the fallout beyond the courtroom. For the wider industry, it signals that legacy account reviews and enhanced due-diligence procedures will likely become the norm.

Q&A — People Also Ask

Q: How do Jeffrey Epstein-related lawsuits affect a bank’s financial outlook?

A: They raise legal-reserve requirements, elevate compliance and audit costs, and can erode investor confidence. A large settlement or fine reduces near-term earnings and may delay share-buyback or dividend programs until risk levels normalize.

What Investors Should Watch Next

-

Motions to Dismiss: Initial hearings will reveal how courts view the sufficiency of evidence.

-

Discovery Phase: Internal AML records could surface, influencing both legal exposure and public trust.

-

Earnings Guidance: Any mention of expanded legal reserves or compliance investments will indicate potential financial impact.

-

Settlement Signals: As seen with JPMorgan and Deutsche Bank, negotiated resolutions may emerge even without admissions of wrongdoing.

Whether these cases proceed or settle quietly, they remind investors that Epstein’s financial shadow still hangs over Wall Street. For major banks, protecting reputation has become as valuable—and as costly—as managing risk.

FAQs — Financial and Business Implications

1. Could these Epstein lawsuits affect Bank of America or BNY Mellon’s credit ratings?

Yes. Rating agencies treat significant litigation as a contingent liability that can trigger negative outlooks or downgrades until resolved.

2. What additional costs follow beyond settlements?

Legal fees, consultant audits, and compliance-system upgrades can reach tens of millions annually, reducing short-term profits even if the banks ultimately prevail.

3. How can banks rebuild brand reputation after scandals like this?

Transparent reporting, independent oversight, visible leadership accountability, and consistent engagement with regulators and clients are critical to restoring confidence.

RELATED:

JP Morgan's Jamie Dimon’s “Cockroach” Warning

America’s Debt Time Bomb: J.P. Morgan Warns the U.S. Is ‘Going Broke Slowly’