Bruce Springsteen: From “Nebraska” to Billion-Dollar Brand

Bruce Springsteen is universally recognized as “The Boss” of rock, but behind the music lies a masterclass in strategic brand and financial management. His 1982 album Nebraska, with its raw, stripped-back acoustic storytelling, is more than a landmark in music—it is a cornerstone of a carefully cultivated empire that spans intellectual property, licensing, and long-term wealth planning.

Springsteen’s recent documentary, Deliver Me From Nowhere, revisiting the making of Nebraska, highlights how nostalgia and media rights continue to fuel his financial ecosystem. This resurgence of interest demonstrates how artistic legacy can drive tangible business outcomes in today’s media-driven economy.

“If you get the art right, the music right, and the band right, you go out and play every night like it’s your last night on Earth,” Springsteen told Business Insider, emphasizing that creative authenticity and brand value are inseparable (Business Insider, 2021).

Turning Creative Work Into Financial Power

Springsteen’s career provides a blueprint for transforming artistic output into financial leverage. In 2021, he sold his entire music catalog—including masters and publishing rights—to Sony Music Entertainment for $500–550 million. Analysts note that such a transaction demonstrates not only market timing and brand leverage but also strategic tax planning and portfolio diversification, turning intangible cultural capital into a liquid, investable asset according to The Guardian.

Executives can learn from this approach: high-value intellectual property, when managed strategically, functions as a robust financial instrument. Revenue streams from streaming royalties to licensing for commercials, films, and media projects create a diversified and resilient portfolio.

Legal and Governance Considerations

Managing a catalog of Springsteen’s magnitude requires meticulous legal oversight. Key areas include:

-

Royalty rights: Ensuring co-writers, producers, and collaborators are fairly compensated.

-

Brand licensing: Protecting the use of Springsteen’s name, image, and likeness across merchandise, digital media, and commercial ventures.

-

Tax strategy: Structuring sales to optimize capital gains treatment while remaining compliant with U.S. tax regulations.

Erin Jacobson, an entertainment attorney specializing in high-profile estates, explains:

“A catalog like Springsteen’s isn’t just music—it’s a living asset. Proper legal and financial structuring preserves wealth across generations while safeguarding the artist’s legacy.”

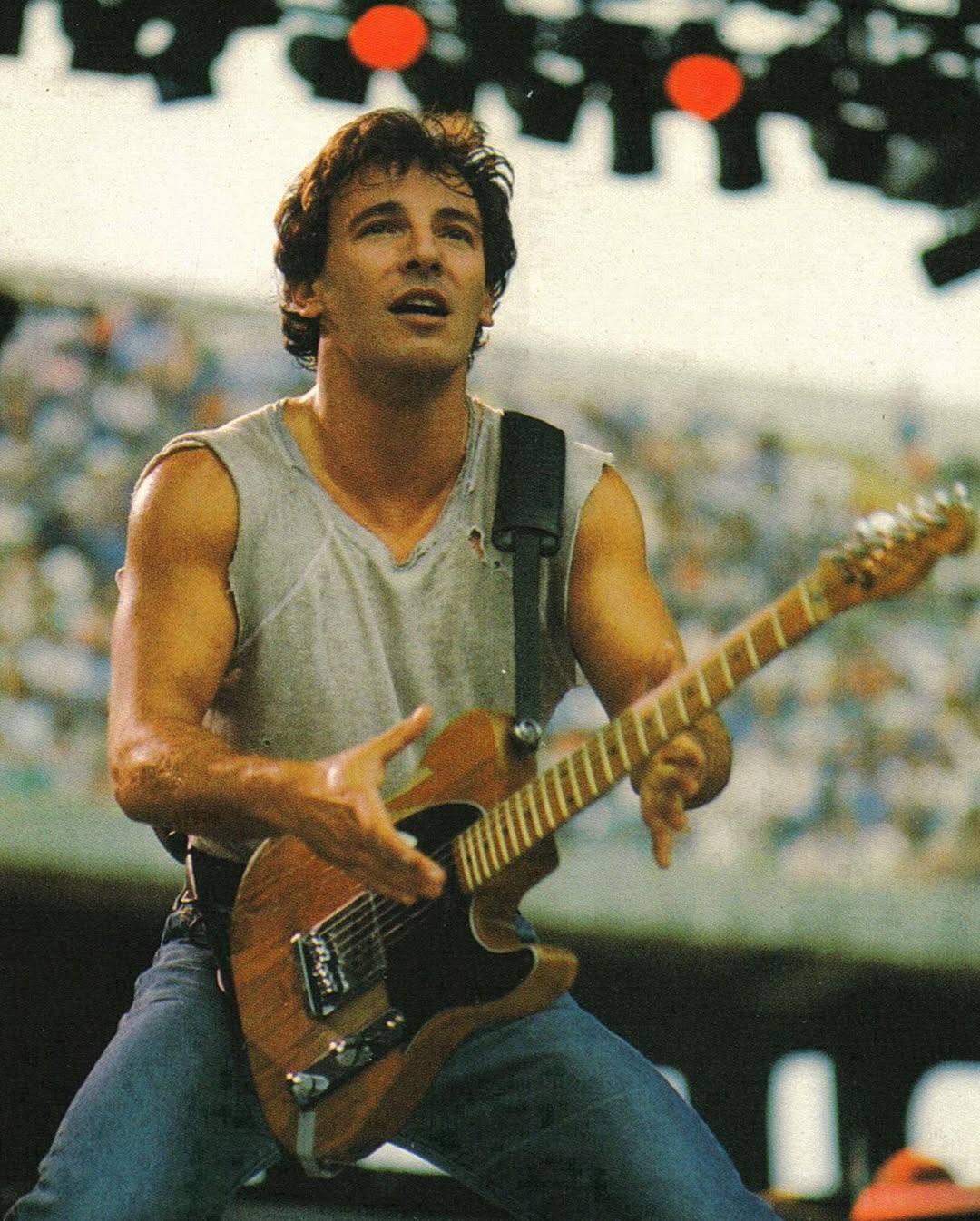

Bruce Springsteen

Why Nebraska Still Matters to Business Leaders

Though minimalistic, Nebraska strengthened brand authenticity, laying the foundation for long-term fan loyalty and revenue growth. In business terms, it exemplifies value-added differentiation: unconventional choices can enhance brand equity, creating monetization opportunities years later.

Corporate executives can apply the same principle: sometimes bold, non-obvious strategic decisions enhance brand valuation, ultimately translating into financial returns.

Current and Future Revenue Streams

Springsteen’s diversified portfolio continues to expand:

-

Film and media rights: Deliver Me From Nowhere boosts streaming interest and media licensing revenue (Pitchfork, 2023).

-

Touring: Live performances remain major revenue drivers, generating tens of millions per tour cycle.

-

Merchandising and licensing: From branded apparel to documentaries, every touchpoint leverages the Springsteen brand.

By combining live performance, digital rights, and licensing, Springsteen exemplifies strategic asset diversification in celebrity wealth management.

Financial Takeaways for Executives

-

Intellectual property is a long-term asset: Treat creative or intangible outputs with the same rigor as core business assets.

-

Diversify revenue channels: Multiple streams reduce risk and strengthen brand resilience.

-

Strategic timing matters: Selling assets at peak value requires market awareness and patience.

-

Legal oversight is essential: Protecting brand and royalty rights safeguards wealth and reduces future disputes.

FAQ – Bruce Springsteen & His Financial Legacy

-

What is Springsteen’s net worth? Estimated at $1.1 billion, primarily from catalog sales, touring revenue, and licensing (The Guardian, 2021).

-

How much did he sell his catalog for? $500–550 million to Sony Music Entertainment.

-

Why is Nebraska significant financially? Its authenticity reinforced brand equity, generating long-term monetization across tours, licensing, and media.

-

What upcoming projects impact his earnings? Deliver Me From Nowhere renews attention to his catalog and drives streaming and licensing revenue (Pitchfork, 2023).

Springsteen’s trajectory demonstrates the intersection of creativity, authenticity, and business strategy. For CEOs and executives, the lesson is clear: treat intangible assets with the same diligence as financial instruments, and the results can be transformative.