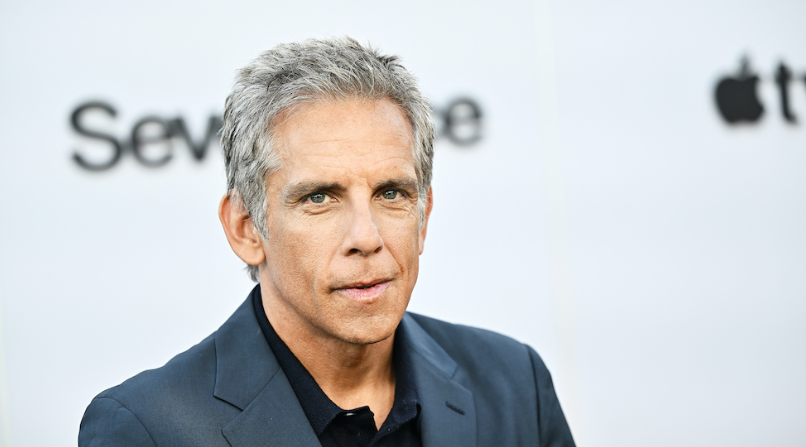

Risk Aversion and the Decline of Billion-Dollar Comedy: Ben Stiller’s CEO Case Study

As of 2025, Ben Stiller, whose films have generated over $6 billion in box-office revenue, warns that Hollywood’s focus on reputational risk is stifling mid-budget comedies. By shifting from theatrical comedy to producing prestige streaming dramas like Severance, Stiller protects his $200 million net worth and brand. His move highlights how financial risk, legal liabilities, and viral backlash now shape studio investment strategies and influence creative decision-making in the entertainment industry.

Hollywood’s Creative Freeze and the Financial Stakes

Ben Stiller, whose comedic projects have earned more than $6 billion globally, has highlighted a growing problem: studios are increasingly avoiding risk due to potential reputational fallout. In today’s social media-driven climate, any misstep can trigger viral outrage, making executives hesitant to greenlight ambitious comedic projects. This caution has given rise to what industry insiders call the Morality Clause Premium, a cost that directly impacts the financial and operational viability of films.

High-budget comedies now carry the risk of losing global distribution deals, advertising partnerships, and lucrative licensing agreements if any element offends the public, turning a $50 million to $100 million investment into a potentially precarious gamble.

The Morality Clause Premium: When Legal Liability Shapes Business

The Morality Clause Premium represents a financial and legal safeguard embedded in modern contracts. It allows studios to mitigate losses if an actor, joke, or scene sparks controversy that could undermine a film’s profitability.

Ted Hope, veteran film producer and former CEO of streaming service Fandor, explained:

“Studios now evaluate every project for its upside and downside. A million-dollar return isn’t sufficient—you have to account for billion-dollar risks if controversy erupts.”

This framework has contributed to the disappearance of mid-budget, original comedies, forcing studios to either invest in billion-dollar franchises or tightly controlled, low-risk projects.

Ben Stiller’s Strategic Pivot: Protecting Wealth and Brand

Stiller’s transition from starring in theatrical comedies to executive-producing high-end streaming dramas, including Apple TV+’s Severance, demonstrates a strategic approach to mitigating risk.

Financial Security Through Streaming

High-quality streaming content operates under fixed-fee contracts, offering predictable revenue and shielding Stiller from the volatility of theatrical box-office performance. This strategy safeguards his $200 million net worth and ensures his career remains financially stable, even as traditional comedy faces declining investment.

Reputation Management

By aligning himself with critically acclaimed dramas, Stiller reduces exposure to contractual liabilities and positions his brand in a safer, prestige-driven market segment. Dan Feldstein, an entertainment attorney specializing in talent contracts, said:

“Morality clauses and reputational risk management are now embedded in every deal. Stiller’s pivot is a smart hedge against legal exposure while maintaining creative influence.”

Lessons for CEOs: Risk Management Trumps Creativity

The decline of mid-budget comedies offers a broader lesson for corporate leaders. When the perceived cost of reputational damage exceeds potential returns, companies naturally gravitate toward low-risk investments. Stiller’s approach shows that financial, legal, and brand considerations are inseparable. Leaders across industries must weigh the impact of public perception and contractual liability when making high-stakes decisions, balancing innovation with strategic risk management.

CEO Takeaway

Ben Stiller’s pivot provides several key lessons for executives:

-

Predictable revenue and portfolio diversification are essential for wealth preservation.

-

Legal diligence and contractual foresight are increasingly critical.

-

Brand reputation has become a measurable asset that often drives investment strategy.

According to analysis reviewed by CEO Today, Stiller’s strategy illustrates how modern leaders can navigate a reputation-driven environment, protecting assets while still pursuing innovation.

FAQ: Ben Stiller, Hollywood Risk, and the Morality Clause Premium

1. Why is Hollywood avoiding mid-budget comedies?

Studios are wary of reputational risk and viral backlash, which can trigger contractual breaches and financial losses. Mid-budget comedies are considered too risky in a climate where public outrage can instantly spread online.

2. What is the Morality Clause Premium?

It is a contractual provision calculated into production budgets to cover potential legal and financial damages if a film or talent behavior sparks controversy, protecting studios from revenue and licensing losses.

3. How is Ben Stiller protecting his wealth?

Stiller has shifted to producing streaming dramas like Severance, which offer fixed-fee contracts and predictable revenue, safeguarding his $200 million net worth from the unpredictability of theatrical comedy.

4. What can CEOs learn from Stiller’s pivot?

The main lesson is that financial, legal, and reputational risks are interconnected. Effective leaders diversify revenue streams, assess potential liabilities, and protect brand value when pursuing high-stakes initiatives.