Meta's $100 Million Talent War: Inside Zuckerberg's Aggressive AI Hiring Spree

The Stunning Revelation That Shook Silicon Valley

In a moment that reverberated across the tech industry, OpenAI CEO Sam Altman disclosed on the Uncapped podcast that Meta has offered individual AI researchers signing bonuses of up to $100 million. The revelation, though casually dropped, ignited a firestorm in Silicon Valley. For perspective, this is not a total team package or equity-laden long-term incentive—it's a flat upfront offer, nearly equivalent to the GDP of a small nation.

“None of our best people have decided to take them up on that,” Altman said.

Yet the very existence of such offers makes one thing clear: the competition for elite AI talent has entered a new, uncharted phase. Meta, once focused heavily on its metaverse ambitions, is now seemingly willing to spend whatever it takes to close its AI gap—and it’s targeting the industry's best and brightest to do so.

Why Meta Is Willing to Pay $100 Million Per Engineer

Meta’s position in the AI race has been precarious. While its open-source language model family, LLaMA, earned early respect in academic and open-source communities, the latest version—LLaMA 3—has struggled to match the capabilities of commercial leaders like OpenAI’s GPT-5 and Google’s Gemini Ultra. At the same time, Meta has sunk over $42 billion into Reality Labs in pursuit of a metaverse future that has yet to materialize in any meaningful commercial form.

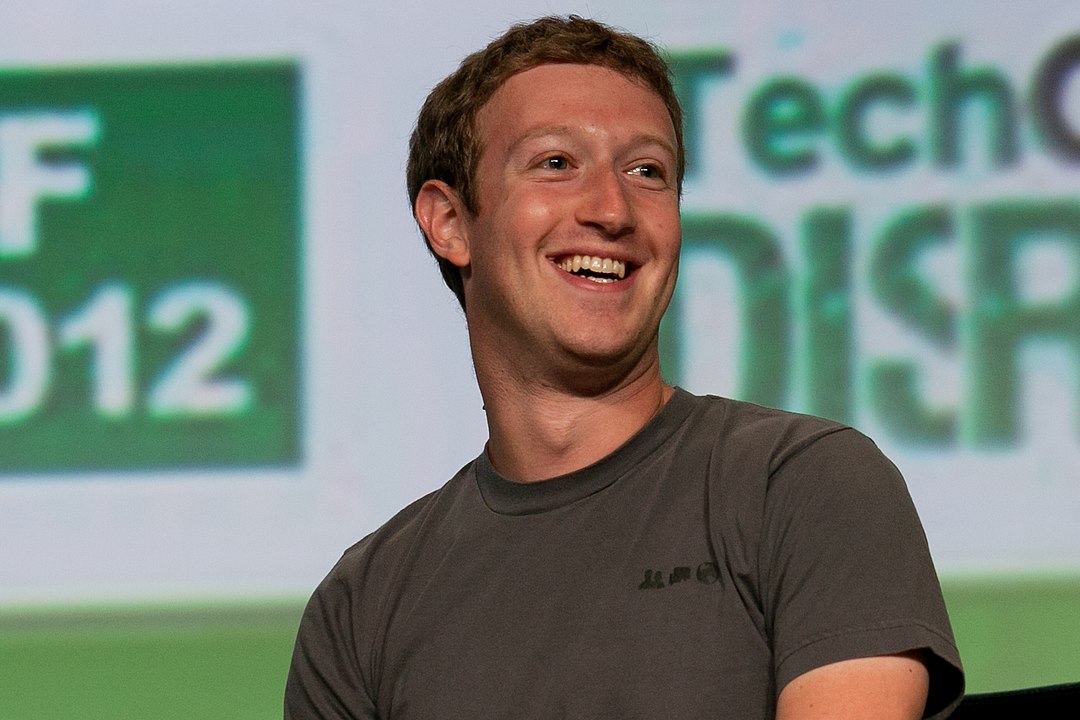

As Meta's internal AI efforts reportedly stalled, CEO Mark Zuckerberg has taken a more hands-on approach, even directly recruiting top researchers himself. The company’s recent $14.3 billion acquisition of data-labeling powerhouse Scale AI signals a new approach: if innovation isn't flourishing organically within Meta, it will be imported—at any cost. In this context, nine-figure signing bonuses are not just incentives; they’re symbolic weapons in a larger war for dominance in generative AI.

The Surreal Economics of AI Recruitment

The repercussions of this arms race are being felt throughout the tech labor market. Entry-level PhD graduates in machine learning are now commanding compensation packages north of $1 million annually, while entire research teams have started defecting from one company to another as cohesive units. Non-compete clauses, long considered boilerplate, are now being tested in courtrooms as companies push back against losing IP and institutional knowledge to well-funded rivals.

One DeepMind researcher, speaking anonymously, described the current landscape as “NFL free agency meets the Manhattan Project.” AI researchers are no longer just engineers—they are franchise players, with personal brands, multi-million-dollar leverage, and influence over the technological direction of trillion-dollar companies.

Related: Inside Zuckerberg’s Superintelligent AI Gamble: The Team, the Costs, and the Controversy

Related: Meta’s $14.3B Power Play: Why Alexandr Wang Is the Real Prize in the Scale AI Deal

Does Buying Talent Actually Work?

While Meta’s aggressive hiring strategy may seem logical on the surface, the historical precedent is more sobering. Massive acquisitions and compensation packages don't always translate into meaningful innovation. Microsoft’s $68.7 billion acquisition of Activision hasn't reversed Xbox’s declining influence in the gaming market. Google has spent over $400 million retaining top AI talent, only to watch some of its key researchers leave to found Anthropic and other emerging competitors.

Even Sam Altman hinted at this limitation, saying, “I don’t think they’re a company that’s great at innovation.” It’s a pointed critique, and one shared by many in the AI field. Talent alone isn't enough; without the right culture, infrastructure, and long-term vision, even the most brilliant hires can become lost in organizational inertia.

Meta’s Silence and Industry Fallout

As of now, Meta has declined to comment publicly on Altman’s claim or the specifics of its recruitment strategy. However, the company’s recent moves suggest a clear pivot toward AI dominance—whether through open-source releases, GPU infrastructure scaling, or high-profile acqui-hires. Industry insiders believe Meta is betting not just on building the best models, but on owning the talent ecosystem that underpins them.

At the same time, regulators are beginning to pay attention. There’s increasing concern about "market distortions" caused by outsized compensation in AI. Lawmakers in both the U.S. and Europe have started discussing whether runaway pay packages and concentrated talent flows could create monopolistic dynamics in what is rapidly becoming the defining tech sector of the decade.

What’s Next in the AI Arms Race

As Meta pushes forward, several trends appear imminent. More startups may be absorbed by tech giants before they can fully develop independent platforms. Governments could begin scrutinizing not just acquisitions, but individual hiring practices and compensation structures. Meanwhile, new employment models—like equity-for-life or revenue-sharing agreements—are beginning to emerge to retain elite talent without relying solely on cash.

What’s certain is this: the AI industry is now as much about recruiting as it is about research. When the CEO of Meta is personally offering engineers nine-figure packages, we are witnessing a fundamental shift—not just in how technology is built, but in who gets to build it, and at what cost.

Related: How Zuckerberg’s AI Missteps Gave His Rivals the Upper Hand