The Billion-Dollar Baseline: Where the Richest Tennis Players Are Investing Their Fortunes

Tennis titans aren’t just serving aces—they’re building business empires. From venture capital to real estate, food tech to football clubs, the wealthiest names in tennis have parlayed their prize-money earnings and endorsement deals into serious investments. Here’s a look at how some of the richest tennis players are putting their money to work off-court, and what their strategies teach business leaders about legacy, diversification, and long-term value.

1. Roger Federer: Running Shoes, Food Tech & Strategic Partnerships

Roger Federer’s off-court portfolio is perhaps the most emblematic of a modern athlete-turned-investor. His 3% stake in On, the Swiss running-shoe and athletic apparel company, is now worth hundreds of millions.

Beyond footwear, Federer co-founded Team8, a management and investment business, and helped launch the Laver Cup, a high-profile tennis event, with consistent sponsorship and ticket revenue.

He’s also backed NotCo, a Chilean food-tech company developing plant-based products. These investments show how star power and strategic capital can combine to create lasting business value.

Roger Federer

2. Serena Williams: From Grand Slams to Boardrooms

Serena Williams has built a genuine business ecosystem. Through Serena Ventures, she’s backed over 85 companies—including more than a dozen “unicorns” (startups valued at $1B+).

Her portfolio spans sectors: she’s invested in MasterClass (edtech), Impossible Foods (food tech), Daily Harvest (healthy food), and even blockchain/NFT ventures via Sorare.

Williams also holds equity in sports teams: she was a minority owner of the Miami Dolphins and is part of Angel City FC, a women’s football club.

Her strategy demonstrates how modern athletes are leveraging capital, brand, and influence to shape industries beyond sport.

3. Novak Djokovic: Real Estate, Biotech & Wellness

Novak Djokovic has quietly built a diversified business empire. He’s invested in wellness through Waterdrop, supporting their launch of SILA, a line of supplement-infused hydration products.

He’s also put money into vertical-farming startup OnePointOne and previously supported CLMBR, a fitness startup offering a vertical climbing machine.

In more ambitious plays, Djokovic owns 80% of QuantBioRes, a Danish biotech firm focusing on novel treatments.

He has real estate holdings in Belgrade, Monte Carlo, and New York, underpinned by a family business entity called Family Sport that organizes sporting events and hospitality.

In 2025, he expanded into sport ownership: Djokovic became a part-owner of French football club Le Mans FC. Reuters

His portfolio is a strong example of long-term thinking—businesses that align with his personal brand and values.

Novak Djokovic

4. Rafael Nadal: Tennis Academy & Real Estate Growth

Rafael Nadal’s wealth isn’t just locked up in trophies—it’s in his infrastructure. A major piece of his business is the Rafa Nadal Academy in Mallorca. In a recent deal, Nadal sold almost 45% of the Academy to GPF Capital, generating a windfall in the process.

His holding company, Aspemir, covers ventures spanning hotel operations, real estate, and the academy itself. Nadal’s model shows how athletes can monetize legacy through education and property.

RAFAEL NADAL

5. Maria Sharapova: Sugarpova, Beauty & Lifestyle

Even in retirement, Maria Sharapova remains a business force. She founded Sugarpova, a premium candy brand, and has long-standing stakes in beauty and wellness companies.

Her business insight extends beyond branding—Sharapova has positioned Sugarpova in premium retail, leveraging her global profile to create a consumer lifestyle business that outlasts her tennis career.

Maria Sharapova

6. Ion Țiriac: From Tennis to Billion-Dollar Banking & Beyond

Former Romanian tennis pro Ion Țiriac is often at the top of richest-tennis-player lists.

He’s built a financial empire: investments include banking, insurance, real estate, and automotive dealerships. Though his tennis was only the starting point, his business legacy defines his wealth.

Ion Tiriac

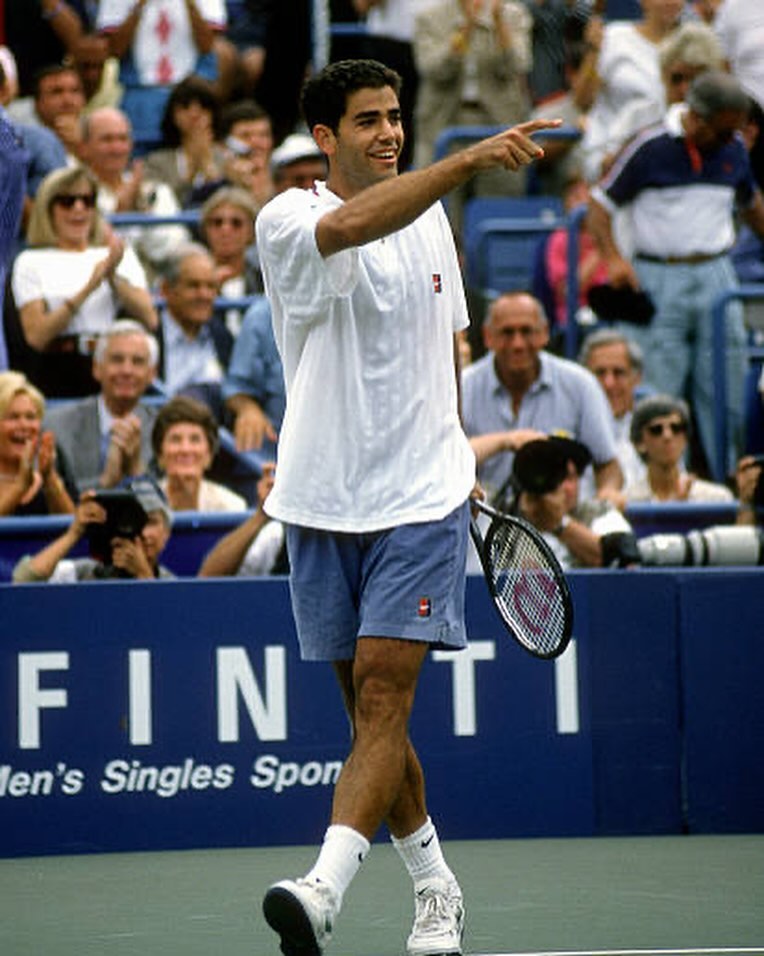

7. Pete Sampras: Legacy Brand & Real Estate

While not as publicly visible as his former rivals, Pete Sampras has maintained a strong financial presence post-retirement. According to wealth‑tracking sources, his net worth is bolstered by legacy endorsements, real estate, and ongoing brand-related income.

This model highlights how once-elite athletes can convert historic success into steady, long-term cash flow by preserving their legacy.

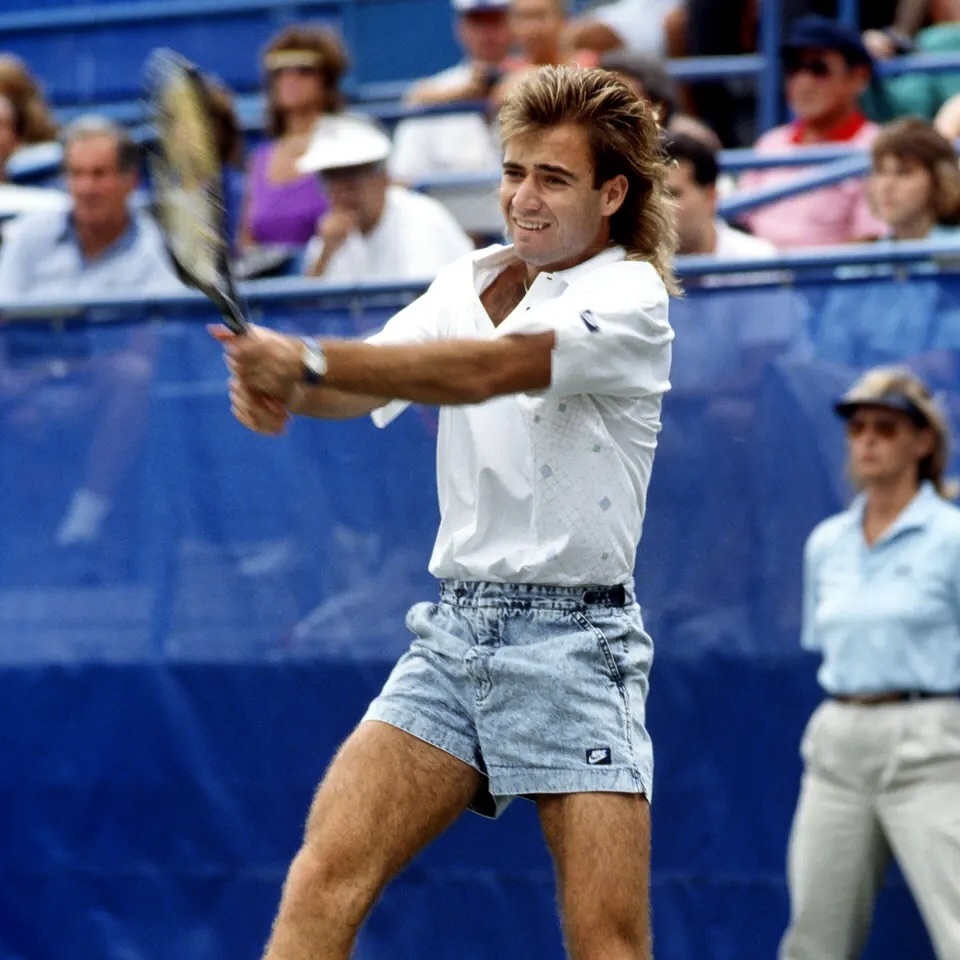

8. Andre Agassi: Philanthropy Meets Private Equity

Andre Agassi has threaded together philanthropy, mentorship, and investment. While detailed public investments are more discrete than his peers, he is known for working through his foundation’s endowment and staying connected to ventures in education and youth development.

Agassi’s approach shows that not all wealth is reinvested for growth—sometimes it’s reinvested to give back, blending financial returns with social impact.

Andre Agassi

9. Andy Murray: Sports Tech & Athlete Services

Andy Murray has turned his brand into a venture platform. According to wealth profiles, he holds a stake in Castore, a sportswear company, and co-founded 77 Sports Management, which helps athletes with training, brand deals, and career development.

He’s leveraged experience on tour to invest in athlete-focused business models—understanding both competition and commerce.

Andy Murray

10. John McEnroe: Galleries, Media & Real Estate

Tennis legend John McEnroe has diversified into art, media, and property. While his playing days earned him fame, his long-term net worth is fortified through real estate, endorsements, and his presence in sports commentary. Nichesss

McEnroe’s off-court work illustrates how cultural icons can transition into lifestyle entrepreneurs, balancing legacy and reinvention.

John McEnroe

What Business Leaders Can Learn from These Players’ Portfolios

-

Diversification isn’t just for finance firms. Top tennis players don’t rely solely on one industry; they invest across food tech, real estate, sport, and wellness.

-

Brand + equity = exponential leverage. Their public profile isn’t just for endorsement deals — it's fuel for meaningful equity plays.

-

Legacy-building requires long-term thinking. Investments like academies, charities, and consumer brands extend influence well beyond athletic careers.

-

Strategic risk works. Whether backing startups or buying into teams, these players take calculated bets aligned with their values and expertise.