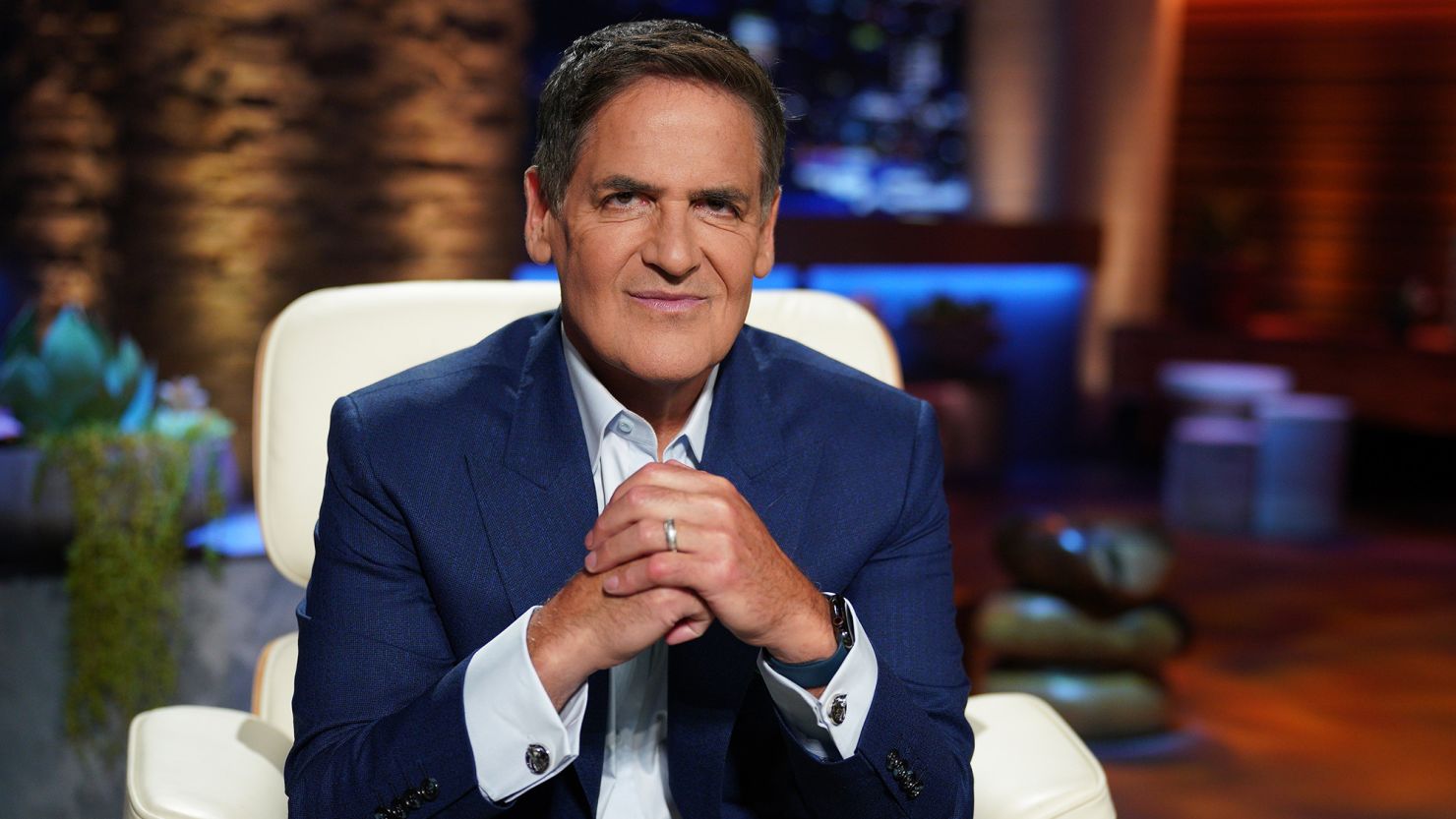

Mark Cuban Warns “Corporate Greed Has Gone Too Far” as Billionaire Wealth Soars $33 Trillion

Mark Cuban is sounding the alarm on billionaire excess. After a new Oxfam report revealed global billionaire wealth has surged by $33 trillion since 2015, the Shark Tank star says it’s time for workers to get a cut — not through bonuses or slogans, but through real stock ownership.

“You know who is funding the increase, particularly lately? Retail investors. 401(k)s,” Cuban wrote on X. “The better question is, why are we not giving incentives to companies to require them to give shares in their companies to all employees, at the same percentage of cash earnings as the CEO?”

His comments have reignited debate over corporate greed, stock market inequality, and whether American capitalism can survive if workers remain locked out of ownership.

Why Mark Cuban Is Taking Aim at Billionaire Wealth

Cuban’s remarks came in response to the Oxfam study that documented how global billionaire fortunes ballooned by $33 trillion in just a decade — a rise fueled largely by soaring stock markets.

While many executives have reaped the rewards, Cuban says the real question isn’t why billionaires are rich, but why the workers who fuel those profits aren’t getting equity too.

“Wealth isn’t the problem,” he told Fortune. “It’s how companies use it.”

Cuban argues that capitalism itself isn’t broken — it’s just become too concentrated at the top. His solution is both moral and practical: require corporations to give every employee stock at the same proportional rate as the CEO.

What Is Employee Stock Ownership?

Employee stock ownership means workers hold a stake in the company through shares or stock options. In plain English, it’s when employees become partial owners — allowing them to earn money when the business performs well instead of relying solely on wages.

It’s a model proven to increase motivation, retention, and wealth equality. Studies show that companies with broad-based employee ownership often report higher productivity and longer employee tenure.

Corporate Programs Are Too Small to Matter, Says Cuban

Some major tech companies, like Intel and Adobe, already offer discounted stock purchase programs. Intel lets employees buy stock at a 15% discount up to $21,250 per year, while Adobe allows up to 25% of salary contributions, also capped at $21,250.

But Cuban believes these programs are cosmetic — “window dressing,” he says — because they limit what ordinary workers can earn while executives collect millions in shares and bonuses.

The billionaire insists the solution is simple: equity for everyone, not just the boardroom.

“The Game Is Rigged — Unless We Change the Rules”

Cuban, whose own net worth is around $6 billion, has practiced what he preaches. When he sold Broadcast.com to Yahoo in 1999 for $5.7 billion, 300 out of 330 employees became millionaires.

At MicroSolutions, his first company, he distributed 20% of the sale proceeds to staff. And even though he never sold the Dallas Mavericks outright, he still paid out more than $35 million in bonuses to employees.

“In every business I’ve sold, I’ve paid out bonuses to every employee who’d been there for more than a year,” he wrote on X.

For Cuban, wealth creation only means something if everyone benefits:

“You’ll get more from your employees, and they’ll be more committed if you share equity immediately in a meaningful way, so that everybody rises.”

Cost Plus Drugs: Capitalism with Compassion

Cuban’s philosophy isn’t just talk. His company Cost Plus Drugs, founded in 2022, has already saved millions for employers and patients by cutting out pharmacy middlemen and selling medicine at near-wholesale prices.

That same ethos — capitalism that serves rather than exploits — drives his latest challenge to America’s corporate giants.

“The value of those dollars becomes much greater—to you, and to so many others—when you use your business or expertise to help others,” he said.

Cuban calls this “compassionate capitalism” — a system that rewards innovation and effort while making sure everyone has skin in the game.

Can Capitalism Be Saved by Sharing Ownership?

As billionaire wealth hits record highs, many economists say Cuban’s argument is hard to ignore. Broadening stock ownership could narrow the wealth gap, improve corporate culture, and stabilize the economy long term.

Critics warn it might expose workers to risk if company shares fall, but Cuban sees that as a small price for empowerment. “If we don’t change how wealth is distributed,” he’s warned privately, “we’ll end up with capitalism that eats itself.”

For now, his message is spreading fast — and it’s clear that Cuban isn’t just talking to CEOs. He’s calling on policymakers, shareholders, and everyday workers to demand a system where the people who build companies finally share in the billions they create.

Mark Cuban People Also Ask (PAA)

Why is Mark Cuban calling for employee stock ownership?

Cuban says the stock market boom has made billionaires richer while leaving workers behind. He wants companies to share equity with all employees, not just top executives, to make capitalism more fair and sustainable.

What is employee stock ownership in simple terms?

Employee stock ownership means employees get a real stake in their company through shares or stock options. It lets them benefit when the company performs well, giving workers both income and investment value.

How much has billionaire wealth grown since 2015?

According to Oxfam, global billionaire wealth has increased by over $33 trillion since 2015, driven largely by stock market gains and executive equity payouts.

What is Mark Cuban’s net worth in 2025?

Cuban’s net worth is estimated at around $6 billion, built from ventures like Broadcast.com, the Dallas Mavericks, and Cost Plus Drugs.