Changpeng Zhao Net Worth: A Multi-Billion Dollar Cryptocurrency Empire and Enduring Influence.

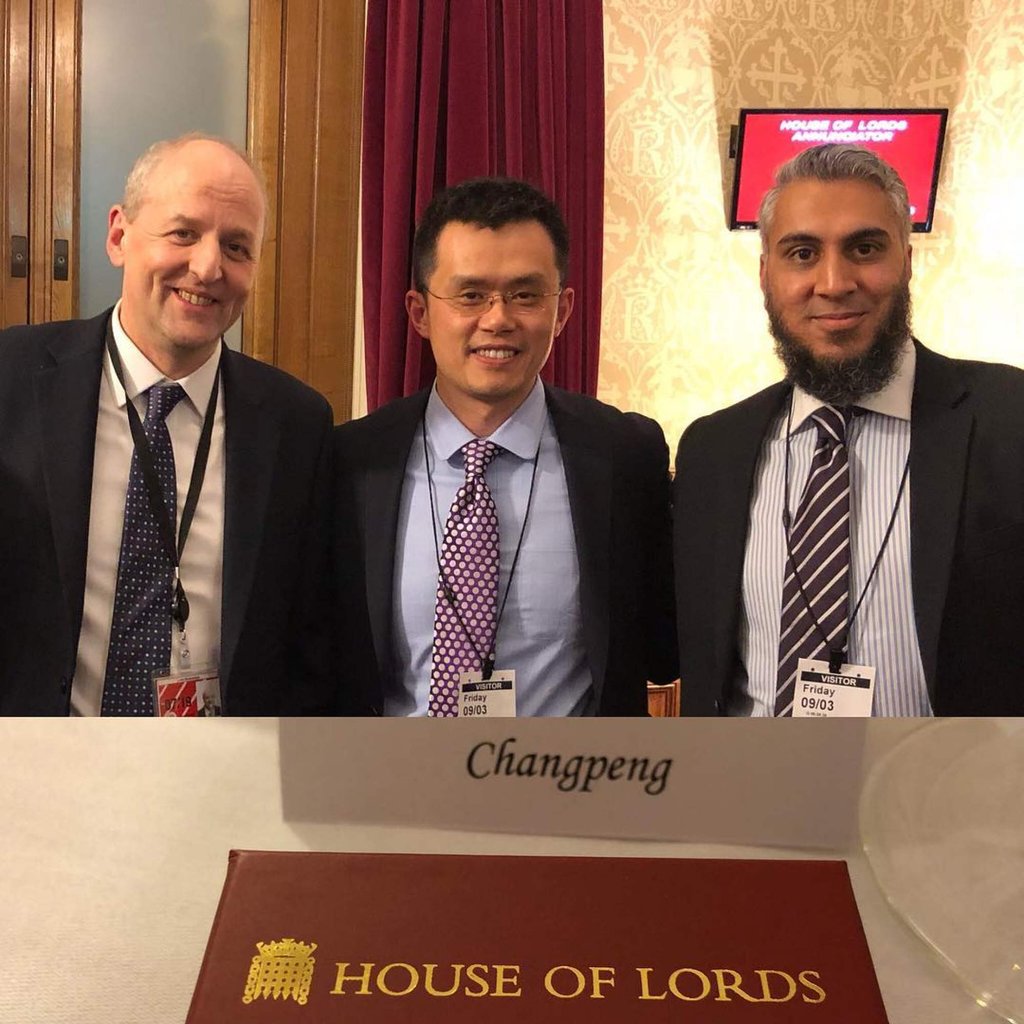

Changpeng Zhao, universally recognized simply as "CZ," stands as a veritable titan in the global cryptocurrency landscape. His colossal estimated net worth of $64.8 billion as of May 2025, according to Forbes, isn't just a number; it positions him as the 24th richest person globally and, indeed, the wealthiest individual of Chinese descent.

💼 Top 10 Richest Living Hedge Fund Managers in 2025 — Meet the billionaires shaping global finance. Read the full list

This puts him in a rare echelon, alongside figures like David Thomson, the Canadian media magnate whose family's vast fortune, built through Thomson Reuters, represents a more traditional lineage of wealth accumulation. While Thomson's billions derive from established media and information services, CZ's fortune, forged in the nascent and volatile world of digital assets, tells a distinctly modern tale of financial innovation.

This article isn't merely a chronicle of his financial holdings; rather, it aims to deeply explore the intricate financial tapestry that forms CZ's immense wealth, meticulously tracing its origins, dramatic growth, and the pivotal moments—including significant legal challenges—that have so profoundly shaped his financial destiny.

Early Life and Formative Financial Footings

Born in 1977 in Jiangsu, China, CZ's early experiences were indelibly marked by significant political and economic shifts. His father, a university professor, endured being labeled a "pro-bourgeois intellectual" during the tumultuous Cultural Revolution, leading to the family's harsh exile to rural areas and considerable financial hardship.

Then, in 1989, amidst the aftermath of the Tiananmen Square protests, the family bravely emigrated to Canada, where his father pursued a doctoral program, seeking new horizons.

In Canada, the Zhao family lived modestly, often frugally, and a young CZ took on various demanding service jobs—including stints at McDonald's and a gas station—to help make ends meet and support his family. These early experiences weren't just about earning; they unequivocally instilled in him a tenacious work ethic and a keen, practical understanding of money's ebb and flow.

His innate talent for mathematics, combined with a burgeoning, almost intuitive, interest in computers, naturally guided him towards pursuing a Bachelor of Science degree in computer science at McGill University in Montreal.

Career Trajectory: The Engine of Wealth Accumulation

The very core of CZ's staggering net worth is, undeniably, inextricably linked to his groundbreaking career, first in traditional software development and then, most notably, in the burgeoning cryptocurrency industry. This section dissects the key financial milestones and strategic decisions that have so powerfully fueled his unprecedented accumulation of wealth.

Earnings and Foundational Capital

After graduating from McGill, CZ immediately plunged into finance, developing sophisticated trading systems for major institutions. He honed his skills as a programmer for the Tokyo Stock Exchange and spent four pivotal years at Bloomberg Tradebook, building cutting-edge futures trading software. These high-pressure roles provided him with a deep understanding of high-frequency trading and financial markets, accumulating substantial initial capital.

In 2005, CZ moved to Shanghai, founding Fusion Systems, a startup lauded for its ultra-fast trading systems. This venture cemented his fintech expertise and significantly contributed to his early wealth. He later founded Bijie Tech, a cloud-based exchange, before fully immersing himself in crypto.

A pivotal moment occurred in 2013 when, introduced to Bitcoin, CZ famously went "all in." Acting on advice, he liquidated his entire real estate portfolio, including his Shanghai apartment, pouring all capital into Bitcoin when its price was around $600. This exceptionally bold, unconventional bet laid the undeniable foundation for his astonishing future success.

Binance: The Genesis and Explosive Growth

CZ's professional journey in crypto rapidly, indeed almost volcanically, accelerated. He served first as Head of Development at Blockchain.com and then as Chief Technology Officer (CTO) at OKCoin, where his contributions were instrumental in establishing critical futures trading capabilities. These experiences proved to be the perfect crucible, positioning him ideally to launch Binance in July 2017.

Binance initially secured funding through an Initial Coin Offering (ICO) for its indigenous token, Binance Coin (BNB), successfully raising a respectable $15 million. The exchange almost immediately rocketed in popularity, largely owing to its remarkably user-friendly interface, competitively low trading fees, and an impressively wide array of supported cryptocurrencies.

Within less than eight months of its nascent launch, by January 2018, Binance had astonishingly surged to become the world's largest cryptocurrency exchange by daily trading volume. This explosive, indeed unprecedented, growth directly translated into a rapid and dramatic appreciation of CZ's net worth, given his substantial estimated 90% equity stake in the company.

Mergers, Acquisitions, and Strategic Investments

While Binance's phenomenal growth is largely organic, CZ's shrewd leadership has also driven strategic investments and acquisitions, meticulously expanding its ecosystem and indirectly boosting his monumental net worth. Binance Labs, its venture capital arm, has raised substantial funds (e.g., $500 million in 2022) to accelerate blockchain and Web3 adoption, pouring capital into diverse innovative projects across DeFi, NFTs, Metaverse, and gaming. These strategic plays have undeniably solidified Binance's dominant market position, underpinning CZ's vast and evolving wealth.

Initial Public Offerings (IPOs) and Market Valuation

Though Binance notably eschewed a traditional IPO, its sheer market valuation remains the foremost determinant of CZ's net worth. Driven by massive trading volume, an extensive global user base, and BNB's increasing value, Binance's unofficial valuation, often in the tens of billions, directly correlates with CZ's significant, often controlling, ownership stake. The performance of BNB, despite fluctuations, has shown remarkable appreciation, profoundly impacting his reported holdings. As of May 2025, CZ's public portfolio is heavily concentrated in BNB (98.48%), with smaller holdings in Bitcoin (1.32%), Eurite (0.17%), and Tether (0.03%).

Family Life: Wealth, Legacy, and Succession

CZ, famously, generally maintains a remarkably private personal life, deliberately directing public attention primarily towards his business endeavors and the expansive crypto industry itself. He has been married previously and is known to have children. His current "life partner" is He Yi, a prominent co-founder of Binance, with whom he shares three children.

The intersection of his family life and immense wealth has, quite recently, become more pronounced and strategically significant. In January 2025, reports surfaced indicating a profound strategic shift: CZ was actively transforming the former venture capital arm of Binance, Binance Labs, into a dedicated family office, fittingly renamed YZi Labs.

This newly formed entity is now reportedly set to meticulously manage the substantial wealth of both CZ and He Yi. This strategic pivot towards a sophisticated family office model strongly suggests a long-term, comprehensive approach to wealth management, aiming for diversification beyond solely crypto assets, and a clear, forward-looking focus on legacy planning for his family's enduring financial future.

Legal Issues and Financial Repercussions

CZ and Binance faced a torrent of regulatory scrutiny and complex legal challenges globally, incurring substantial financial and professional repercussions. The most prominent issue culminated in November 2023, when CZ pleaded guilty to failing to maintain an effective anti-money laundering (AML) program in the U.S. As part of an unprecedented settlement, he agreed to resign as Binance CEO and pay a $50 million personal fine, while Binance was fined a staggering $4.32 billion.

In April 2024, CZ was sentenced to four months in prison—a lenient term given his clean record and acceptance of responsibility—serving his confinement from April to late September 2024. Despite these formidable legal challenges and his resignation, his net worth has largely remained intact, resilient due to his colossal equity stake in Binance and the dynamic crypto market. A separate SEC lawsuit against Binance and CZ, filed in June 2023, was officially dismissed in May 2025, closing another challenging chapter.

Recent News Developments: The Evolving Financial Landscape

Following his September 2024 prison release, CZ maintains a discernible, strategic presence in the crypto space. His formidable net worth has rebounded significantly to an impressive $64.8 billion by May 2025, largely due to the invigorated crypto market rally and robust performance of Bitcoin and BNB, where he holds most of his wealth. The January 2025 pivot of Binance Labs into YZi Labs, a family office, signals a mature focus on long-term wealth preservation and diversification.

Furthermore, on May 25, 2025, CZ provocatively suggested nations like the U.S. and China are printing "unlimited money" to buy Bitcoin as sovereign demand accelerates, predicting "trillions of dollars" will flow into crypto. This bold projection underscores his belief in Bitcoin's long-term value and influence on his vast holdings. CZ also expresses deep intent for philanthropy, notably with Giggle Academy, offering free education. Though no longer CEO, his estimated 90% ownership ensures his profound influence within Binance and the evolving crypto industry.

The Enduring Impact of Wealth

Changpeng Zhao's extraordinary journey from relatively humble beginnings to multi-billionaire status vividly encapsulates the often-volatile yet immensely rewarding nature of the cryptocurrency industry. His colossal net worth is not merely a personal triumph but stands as a powerful testament to the transformative power of digital assets and the burgeoning realm of decentralized finance.

Despite navigating a labyrinth of complex regulatory challenges and facing very real legal repercussions, CZ's financial empire, meticulously built upon the bedrock of Binance, has demonstrated a truly remarkable resilience.

As he gracefully transitions into a new phase of life, focusing on strategic wealth management and significant philanthropic endeavors, his enduring impact on the global financial landscape, profoundly driven by the sheer, colossal scale of his wealth, remains utterly undeniable.

People Also Ask

Is CZ still a billionaire? Yes, absolutely. As of May 2025, Forbes estimates Changpeng Zhao's (CZ) net worth at a staggering $64.8 billion.

Who is the richest bitcoin owner? While precise figures for individual Bitcoin holdings are difficult to ascertain due to the pseudonymous nature of cryptocurrencies, Changpeng Zhao is often considered one of the wealthiest individuals primarily due to his massive holdings in Binance Coin (BNB) and his significant ownership stake in Binance, the world's largest crypto exchange. Other notable figures like Satoshi Nakamoto (the presumed creator of Bitcoin) are theorized to hold vast amounts, but their identity and status remain unknown.

How much is Changpeng Zhao worth in billion? Changpeng Zhao's net worth is estimated at $64.8 billion as of May 2025, according to Forbes.

How did CZ get so rich? CZ's immense wealth primarily stems from founding and building Binance, which quickly became the world's largest cryptocurrency exchange.

His initial significant investment in Bitcoin in 2013, selling his property to go "all in," provided crucial early capital. He holds an estimated 90% equity stake in Binance, and a substantial portion of his personal wealth is held in Binance Coin (BNB), the exchange's native token, which has seen considerable appreciation. His expertise in high-frequency trading systems and strategic business acumen were key to Binance's explosive growth and his subsequent wealth accumulation.

Further Reading on CEO Wealth and Legacy:

Explore how Canada’s richest baron help build the Thomson Reuters empire in David Thomson's Net Worth, dive into Paris Jackson’s rising net worth, explore Amazon's CEO Andy Jassy Net Worth 2025, and how Jassy is betting big on AI and revisit the rock-fueled fortune of Metallica front man James Hetfield.