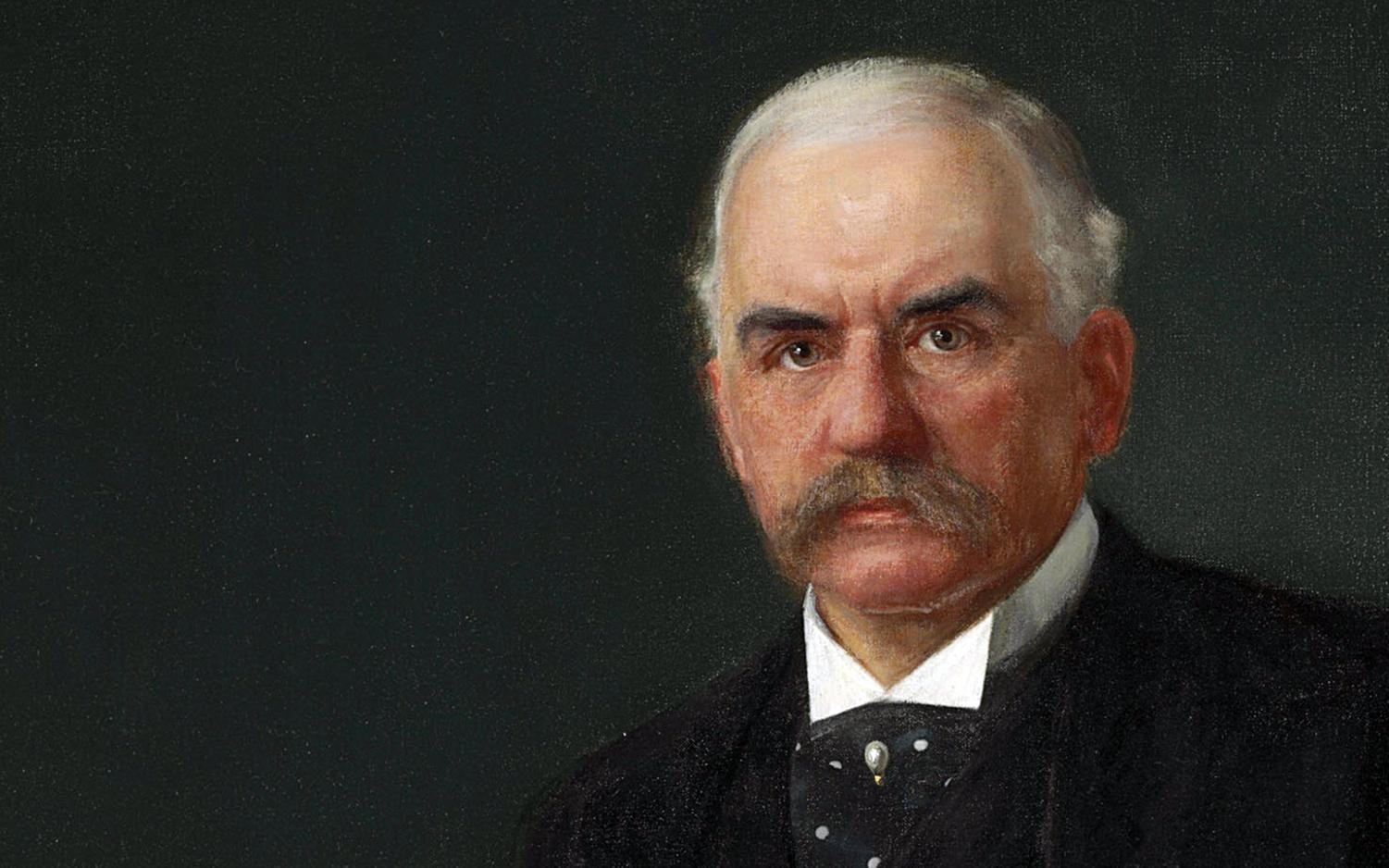

When J.P. Morgan died in 1913, his personal fortune was estimated at roughly $80 million. Even then, contemporaries understood that the number failed to capture his real position in the economy.

Morgan was not simply a wealthy banker. He was the central organiser of American capital at moments when markets seized up and governments stepped aside. Any attempt to translate his wealth into today’s terms has to start with that distinction.

Adjusted for inflation alone, Morgan’s fortune would amount to roughly $2.5 to $3 billion today. That calculation reflects purchasing power, but it strips out the source of his influence.

Morgan did not build wealth by passively holding assets. He designed systems, consolidated industries, and controlled access to credit in ways that shaped entire sectors of the economy. Inflation math captures lifestyle. It does not capture leverage.

Morgan’s real power came from architecture rather than accumulation. He orchestrated the formation of major industrial corporations, including U.S. Steel, imposed order on chaotic railroad markets, and repeatedly coordinated private banking syndicates to stabilise the financial system during panics.

In several crises, his personal intervention functioned as a stand-in for a central bank that did not yet exist. Markets did not simply follow Morgan’s money. They followed his judgement.

In today’s financial system, that role would look very different on a balance sheet. Modern financial architects are rewarded not only with fees, but with equity, governance rights, carried interest, and long-term ownership stakes that compound as markets expand.

Morgan operated before those mechanisms were fully developed. He created institutions that endured, but personal wealth extraction was constrained by the norms and structures of his era.

If Morgan’s level of control were translated into a modern framework, the valuation changes significantly.

A figure who assembled dominant financial platforms today would almost certainly retain substantial equity across them, benefiting from decades of appreciation rather than one-time deal economics.

The wealth generated by that kind of structural control scales far faster than inflation.

Most serious historical-finance models that attempt this translation arrive well above simple inflation-adjusted figures. Even conservative approaches that add only a modest premium for institutional control push Morgan’s hypothetical net worth into the high single-digit billions. Broader interpretations, which assume he would monetise control the way modern financial founders do, place his value comfortably into the tens of billions. Under those assumptions, a figure north of $30 billion becomes plausible, with higher estimates not difficult to justify.

What drives those numbers is not hindsight or hero worship, but structural change. Capital today moves faster, compounds globally, and rewards system builders more aggressively than it did a century ago. Morgan exercised his influence at the birth of modern finance, not at its most lucrative stage. The system he helped create later became vastly more efficient at converting power into personal wealth.

The most defensible conclusion is that if J.P. Morgan were alive today, operating with the same authority, centrality, and timing, his net worth would almost certainly exceed $30 billion and could plausibly approach $50 billion. That would place him among the world’s richest individuals, not because he pursued personal enrichment more aggressively, but because modern markets reward precisely the kind of systemic influence he wielded.

Morgan’s enduring relevance lies in that difference. He was not simply rich in an age of industrial expansion. He was the person markets turned to when confidence collapsed and failure threatened to spread. In today’s financial system, that position would not just command respect. It would command an extraordinary fortune.