CEOs to Watch in 2026: The Leaders Redefining Power, Performance, and Accountability

Executive leadership has entered a new phase of scrutiny. By 2026, the role of the chief executive has expanded well beyond operational command into a multidimensional position shaped by capital markets, regulatory exposure, workforce dynamics, and public credibility. Boards and investors are no longer asking whether a CEO can grow revenue. They are asking whether that growth can survive pressure, volatility, and reputational stress without destroying enterprise value.

This shift explains why CEO evaluation in 2026 looks materially different from even three years ago. The leaders drawing attention now are not defined by charisma or market cycles alone. They are being assessed on how they allocate capital, manage institutional risk, defend margins under political scrutiny, and maintain strategic coherence as technology compresses decision timelines. These CEOs are not simply running companies. They are managing power in full view of markets.

The executives to watch in 2026 sit at the intersection of performance and pressure. Their companies touch artificial intelligence, energy transition, healthcare access, platform economics, and sovereign regulation. Each decision carries valuation consequences. Each misstep invites activist interest. Leadership has become a live financial instrument.

Leadership Credibility as a Balance Sheet Asset

In 2026, leadership credibility functions as an intangible asset that markets actively price. CEOs such as Satya Nadella at Microsoft illustrate how consistency in decision making compounds trust with investors, customers, and regulators. Nadella’s handling of cloud expansion, artificial intelligence integration, and enterprise partnerships has reinforced Microsoft’s premium multiple despite broader volatility across the Nasdaq.

That premium rests not on hype but on disciplined communication and predictable execution. Analysts now model management credibility into forward projections because leadership instability has proven costly across sectors. Boards have taken note. CEO credibility now sits alongside liquidity and margins as a core risk metric. In this environment, governance failures are punished faster and harder than earnings misses.

This dynamic has elevated executives who understand narrative control without overstating ambition. Leaders who overpromise on innovation or cost reduction face immediate credibility erosion. Those who frame progress conservatively and deliver incrementally are rewarded with strategic patience from capital markets.

Photo: LE WEB PARIS 2013 - CONFERENCES - PLENARY 1

Capital Allocation Under Permanent Scrutiny

The modern CEO is expected to act as chief capital allocator under near-constant examination. Share buybacks, dividends, M&A activity, and internal investment are no longer viewed as mechanical decisions. They are interpreted as signals of confidence, fear, or strategic drift.

Tim Cook at Apple continues to attract attention in this context. Apple’s capital return strategy remains one of the largest in corporate history, yet it has avoided the perception of underinvestment by sustaining innovation across hardware, services, and silicon design. That balance protects valuation while insulating the company from activist pressure.

By contrast, leaders in capital-intensive sectors face sharper trade-offs. Darren Woods at ExxonMobil must navigate long-cycle energy investments while responding to climate-driven investor mandates. Every allocation decision now carries reputational and regulatory weight. The CEOs to watch in 2026 understand that capital discipline is no longer an internal metric. It is a public referendum.

Talent Strategy as Competitive Defense

Labor dynamics have shifted irreversibly. The war for technical talent, executive depth, and operational leadership has become a structural constraint on growth. CEOs who treat talent as a cost line rather than a strategic asset are increasingly exposed.

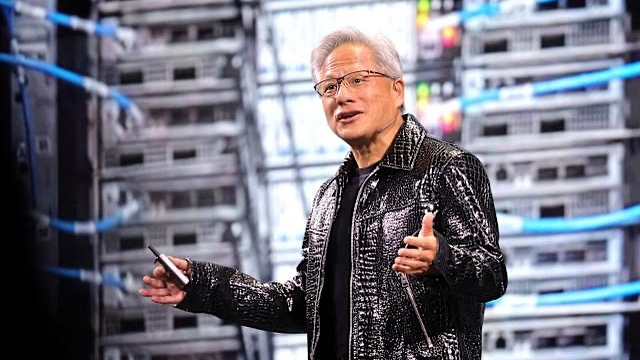

Jensen Huang at NVIDIA exemplifies a different approach. NVIDIA’s dominance in AI infrastructure is inseparable from its ability to retain elite engineering talent while scaling globally. Compensation structures, internal mobility, and cultural clarity have become competitive moats that rivals struggle to replicate.

This reality extends beyond technology. In healthcare, Emma Walmsley at GSK faces pressure to attract scientific leadership while managing pricing controls and patent cliffs. Talent decisions directly affect pipeline credibility and long-term revenue visibility. In 2026, CEOs are judged on whether they can attract and retain scarce expertise under intense market competition. Talent has become a defensive strategy, not a perk.

Regulation as a Strategic Variable

Regulatory exposure has evolved from a compliance function into a core strategic variable. CEOs operating across borders must now manage overlapping regimes that influence pricing, data usage, and supply chain configuration.

Sundar Pichai at Alphabet remains under continuous regulatory attention across the United States, Europe, and India. Antitrust scrutiny, content governance, and AI oversight shape product strategy and investment timelines. The ability to engage regulators without conceding strategic ground has become a defining leadership skill.

This environment favors CEOs who integrate legal foresight into commercial planning. Regulatory misalignment can erase years of growth in a single ruling. Leaders who underestimate this risk invite volatility that markets increasingly refuse to tolerate. In 2026, regulation is not a constraint to be endured. It is a terrain to be navigated deliberately.

Sundar Pichai CEO of Google

Valuation Pressure and Market Signaling

Equity markets have grown less forgiving. High-growth narratives unsupported by cash flow or execution discipline are discounted aggressively. CEOs who once benefited from momentum now face sustained valuation pressure.

Elon Musk remains a central figure in this conversation. Tesla’s market value reflects both technological leadership and governance risk. Musk’s decisions influence not only Tesla but also SpaceX and adjacent ventures, creating interconnected exposure that investors must continuously reassess. The market’s response underscores how leadership behavior can amplify or compress valuation independent of fundamentals.

In contrast, leaders like Lisa Su at AMD have cultivated reputations for operational precision and conservative guidance. AMD’s valuation reflects confidence in execution rather than speculative upside. This distinction matters in 2026, where capital costs remain elevated. Valuation is increasingly a referendum on leadership reliability.

Platform Power and Strategic Scale

CEOs overseeing platforms rather than products face unique scrutiny. Platform scale magnifies both opportunity and risk. Decisions ripple across ecosystems, partners, and regulators simultaneously.

Andy Jassy at Amazon continues to recalibrate the company’s cost structure while defending AWS leadership against aggressive competition from Microsoft and Google. Each investment choice affects margins, partner economics, and long-term dominance. Platform CEOs must balance scale efficiency with innovation velocity under relentless comparison.

This balance requires a tolerance for short-term discomfort in pursuit of structural advantage. Leaders unwilling to endure margin compression risk strategic irrelevance. Those who overextend invite financial strain. In 2026, scale without discipline is punished as harshly as stagnation.

Andy Jassy - CEO of Amazon

Crisis Readiness and Institutional Resilience

The defining CEOs of the coming cycle will not be measured by growth alone but by their ability to absorb shocks. Supply chain disruptions, cyber incidents, geopolitical conflict, and reputational crises are no longer hypothetical.

Mary Barra at General Motors has navigated labor negotiations, electrification risk, and global supply volatility while maintaining operational continuity. Her tenure highlights the importance of institutional preparedness. Crisis response capability now factors into executive evaluation alongside strategy.

Boards increasingly test leadership resilience through scenario planning and stress simulations. CEOs who lack depth beneath them or rely on personal control rather than systems expose organizations to cascading failure. In 2026, resilience is a priced attribute.

Which CEO Holds the Highest Approval Rating Today

CEO approval ratings in 2026 are less about popularity and more about perceived execution under pressure. Among large-cap public companies, Satya Nadella of Microsoft continues to rank at or near the top across employee sentiment surveys, institutional investor feedback, and governance assessments. His approval strength is not driven by charisma or media visibility, but by operational predictability, cultural stability, and a sustained ability to convert long-term strategy into measurable returns.

What distinguishes Nadella’s standing is consistency across stakeholder groups. Employee approval remains high due to Microsoft’s relatively stable workforce strategy during broader tech-sector volatility. Investor confidence is reinforced by disciplined capital allocation and a measured approach to artificial intelligence deployment that balances growth with regulatory awareness. In an environment where CEO approval can swing sharply following layoffs, activist pressure, or public missteps, Nadella’s steadiness has translated into reputational durability, which markets increasingly interpret as a proxy for execution risk.

Approval ratings now function as an early-warning signal for boards. A sustained decline often precedes leadership challenges, talent attrition, or valuation compression. CEOs with the highest approval are not necessarily the most visible, but they are the ones whose decisions create fewer surprises across earnings calls, regulatory interactions, and internal culture.

Who Is Considered the Greatest CEO of All Time

The title of greatest CEO of all time remains contested, largely because the criteria have evolved. Historically, Jack Welch of General Electric dominated this conversation due to scale, financial performance, and shareholder returns during his tenure. However, retrospective analysis has complicated that legacy, as GE’s later struggles revealed the long-term cost of financial engineering and aggressive restructuring.

In contemporary executive circles, Warren Buffett is increasingly cited as the benchmark for enduring CEO excellence. His leadership at Berkshire Hathaway redefined capital allocation as a core executive discipline and demonstrated that restraint, patience, and governance alignment can outperform more aggressive growth models over decades. Buffett’s reputation rests not on operational control alone, but on trust, decentralization, and an unmatched track record of value preservation across cycles.

The shift in this debate reflects broader changes in how greatness is defined. Longevity, institutional resilience, and ethical credibility now carry more weight than short-term outperformance. Boards and investors in 2026 are less interested in myth-making and more focused on whether a CEO leaves behind a company that can thrive without them. By that measure, the greatest CEOs are those whose influence outlasts their tenure without destabilizing the enterprise.