A Financial Power Shift: The Billionaire Boom of 2025

2025 has become a watershed year for global wealth creation. A record number of entrepreneurs — from tech founders to real estate investors — crossed the billion-dollar threshold, signaling a new wave of self-made power players driving innovation and capital markets forward.

What sets this new class apart isn’t just their net worth; it’s how their wealth was built. Artificial intelligence, fintech, localization technology, and real estate diversification are fueling fresh fortunes in places far beyond Wall Street or Silicon Valley — redefining what it means to be among the Top 10 Richest People shaping the global economy in 2025.

As Goldman Sachs’ Chief Economist Jan Hatzius recently noted, “The next generation of billionaires are being built not on inheritance or old capital, but on disruptive innovation and platform ecosystems that didn’t exist a decade ago.”

Here are 10 of the newest billionaires who made their debut in 2025 — and the industries they’re transforming.

1. Samir Mane – The Balkan Business Mogul

Founder and President of BALFIN Group, Samir Mane stands as one of Eastern Europe’s most influential business leaders. His diversified empire spans retail, energy, construction, and tourism, employing over 6,000 people across multiple countries.

With a net worth of around $1.5 billion, Mane’s story marks a turning point for Albania — proving that strategic diversification and regional investment can yield global-level returns.

Samir Mane

2. Lucy Guo – Silicon Valley’s Youngest Female Billionaire

At just 30 years old, Lucy Guo became the youngest self-made female billionaire of 2025. Co-founding Scale AI, a data infrastructure company powering machine learning and autonomous technology, Guo later launched Passes, a platform that helps digital creators monetize content more transparently.

With an estimated $1.25 billion fortune, Guo represents the growing intersection of AI innovation, financial independence, and digital entrepreneurship — and is redefining what modern wealth looks like in the creator economy.

3. Yao Runhao – Gaming’s Quiet Billionaire

Yao Runhao, the creative mind behind Paper Games, turned interactive storytelling into a billion-dollar phenomenon. His studio’s hit titles, like Love and Producer, have captured a massive audience across Asia — particularly among female gamers.

As gaming merges with social commerce and virtual fashion, Runhao’s estimated $1.3 billion net worth shows the expanding financial potential of digital entertainment as a cultural export.

4. Phil Shawe – The Multilingual Market Disruptor

Phil Shawe, co-founder and co-CEO of TransPerfect, has turned translation and localization into a global powerhouse. The company, operating across more than 100 cities, blends AI with human expertise to deliver language solutions to Fortune 500 clients.

With an estimated $1.8 billion fortune, Shawe’s ascent shows how digitization and global connectivity can turn even traditional industries into data-driven empires.

5. Divyank Turakhia – India’s Digital Visionary

Indian tech entrepreneur Divyank Turakhia first made headlines with the $900 million sale of his ad-tech company Media.net. In 2025, his growing portfolio of SaaS and fintech ventures pushed his net worth to $3.4 billion.

Turakhia’s story is a blueprint for emerging market wealth creation — driven by digital exports and smart reinvestment into scalable, borderless technologies.

Divyank Turakhia

6. Liang Wenfeng – The AI Hedge Fund Innovator

China’s Liang Wenfeng, founder of DeepSeek, has combined artificial intelligence and finance to form one of Asia’s most talked-about hedge funds. His data-driven models optimize high-frequency trading and asset allocation strategies at a scale few can rival.

With a personal net worth nearing $1 billion, Liang’s success symbolizes how financial markets are being re-engineered through machine learning and predictive analytics.

7. Vlad Tenev – The Fintech Comeback Story

After several volatile years in the fintech sector, Robinhood co-founder Vlad Tenev made his return to billionaire status in 2025. The company’s expansion into crypto trading and global brokerage markets reignited growth, cementing Tenev’s estimated $1.1 billion net worth.

His resurgence is a testament to the resilience of fintech founders who can pivot, innovate, and rebuild credibility amid regulation-heavy markets.

Vlad Tenev

8. Alexandr Wang – The AI Industrialist

At just 27, Alexandr Wang, co-founder and CEO of Scale AI, joined the billionaire ranks with an estimated net worth of $2 billion. Scale AI provides the backbone for machine-learning systems used by major corporations and governments, cementing Wang’s role as a key player in the AI industrial revolution.

His pragmatic approach to data governance and model ethics has made him a thought leader in responsible AI commercialization.

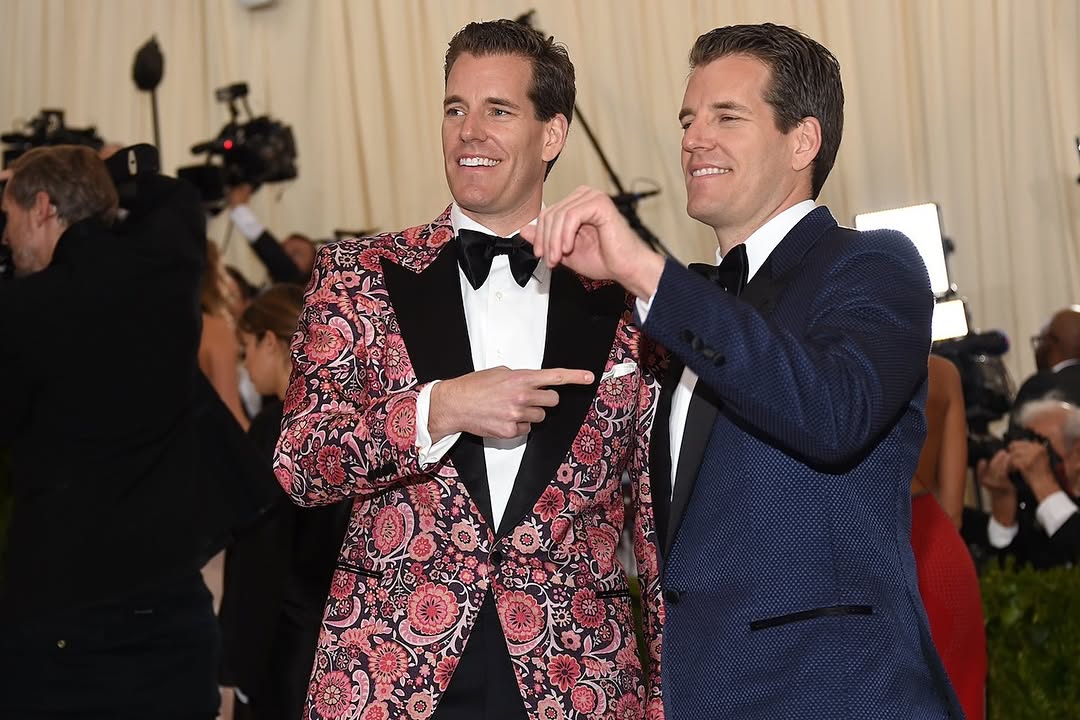

9. Cameron and Tyler Winklevoss – The Twin Crypto Architects

Cameron and Tyler Winklevoss, founders of Gemini, have reemerged stronger amid the crypto market’s latest rebound. Once early investors in Bitcoin, their combined wealth now sits at $13.7 billion, largely thanks to new digital asset custody solutions and institutional partnerships.

Their story underscores crypto’s staying power — not just as a speculative vehicle, but as a long-term infrastructure for financial systems.

The Winklevoss Twins

10. Giancarlo Devasini – The Stablecoin Strategist

Italian entrepreneur Giancarlo Devasini, co-founder and current chairman of Tether Ltd., is one of crypto’s most enigmatic figures. His estimated $11.5 billion fortune reflects Tether’s unmatched dominance in the stablecoin market, which facilitates over $100 billion in daily transactions.

Devasini’s low-profile leadership and financial engineering have made Tether the quiet engine of the digital economy though not without scrutiny from regulators.

Giancarlo Devasini

The Financial Future: From Founders to Global Influencers

This new class of billionaires reveals more than personal success — it signals a larger transformation in how wealth is generated and distributed. The emerging trend shows that technology, intellectual property, and AI-driven ecosystems are now as valuable as physical assets or industrial empires.

As PwC’s Global Wealth Report notes, “The future billionaire isn’t necessarily a financier or an oil magnate. They’re a data scientist, a creator, a coder — or a founder who turns digital ecosystems into scalable, financial realities.”

These ten new entrants represent a shifting world economy — one where innovation, ownership, and timing matter more than ever. The billionaire of tomorrow is already here — and they’re coding, designing, and investing their way into history.