From Courtside to Courtroom: The NBA Gambling Scandal That’s Rocking the League’s Financial Foundations

The financial playbook of the NBA’s highest-paid athletes has evolved far beyond endorsement deals and shoe contracts. Today’s top earners are building diversified portfolios that span real estate, venture capital, technology, and entertainment. Yet recent headlines, including the FBI’s Operation Zhen Diagram probe, which led to the arrests of NBA legend Chauncey Billups and Miami Heat guard Terry Rozier have brought renewed attention to how wealth and risk intersect in professional sports. While most players pursue legitimate investments that rival Fortune 500 strategies, incidents like this underscore the need for stronger financial governance and clearer ethical boundaries in a league now deeply entwined with the global betting economy.

When the Whistle Blows on Wall Street’s Game: The NBA’s Financial Scandal Unfolds

The arrest of Portland Trail Blazers head coach Chauncey Billups and Miami Heat guard Terry Rozier has thrust the NBA into a high-stakes crisis where sport, finance, and federal law collide. What began as a gambling probe has evolved into a sweeping federal investigation with potential to disrupt the league’s financial ecosystem—from sponsorships to stock market ripple effects.

For a business-savvy readership, this isn’t just a sports scandal. It’s a cautionary tale of how financial opacity, digital currencies, and regulatory gaps can expose even billion-dollar brands to existential risk.

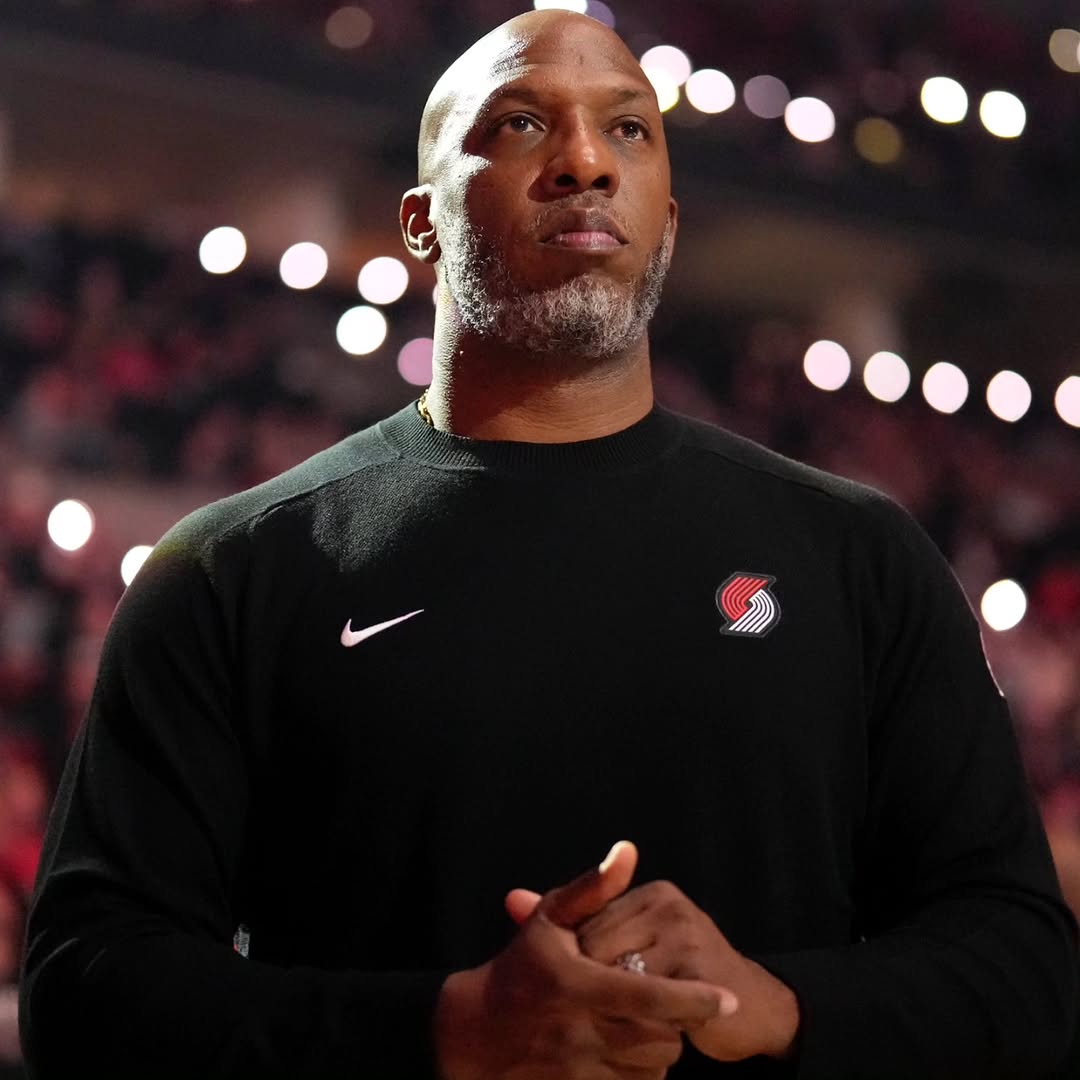

Chauncey Billups

The Financial Fallout: Betting, Brands, and the Cost of Trust

The NBA’s aggressive integration of sports betting partnerships, now worth over $2.5 billion globally—faces renewed scrutiny after the FBI confirmed that proceeds from the illegal ring were laundered through cryptocurrency. The allegations of rigged poker games, stat manipulation, and La Cosa Nostra ties have spooked sponsors and investors alike.

Companies like FanDuel, DraftKings, and BetMGM all closely aligned with professional sports leagues—may soon face a tougher compliance environment. According to analysis reviewed by CEO Today, investors are already evaluating risk exposure and brand reputation, particularly as regulatory agencies weigh stricter oversight.

“This isn’t just a sports ethics issue—it’s a financial integrity issue,” said Richard Painter, former White House ethics lawyer and professor at the University of Minnesota. “If gambling-related manipulation infiltrates pro leagues, it undermines investor confidence in any enterprise built on fan engagement and fair competition.”

Operation Zhen Diagram: A Legal and Economic Earthquake

The FBI’s Operation Zhen Diagram is being described by federal sources as one of the largest gambling-related operations in sports history. The probe uncovered over 3,000 recorded meetings and phone calls, cryptocurrency laundering, and collusion schemes allegedly involving current and former NBA players.

Legal experts say this marks a turning point for U.S. sports regulation. Should federal prosecutors pursue charges under anti-racketeering (RICO) statutes, the resulting discovery could reveal an unprecedented look into the hidden economy surrounding professional sports betting.

“If a regulated market begins to look manipulated, public markets will react the same way they would to insider trading,” said Nora V. Demleitner, dean of St. John’s University School of Law, in a statement discussing sports-betting oversight.

For the NBA, that means reputational risk could rapidly become valuation risk, affecting everything from sponsorship renewals to future expansion negotiations.

The Legal Reckoning: How the Courts Could Reshape the Business of Sports

If Billups or Rozier face federal charges tied to organized crime or wire fraud, the case could extend beyond the courtroom and into the financial frameworks underpinning modern sports. Legal analysts warn of ripple effects across the media rights market, where networks like ESPN and Warner Bros. Discovery rely heavily on the credibility of live competition to justify billion-dollar deals.

The potential introduction of tighter federal gambling controls could also impact Wall Street’s optimism around the sports tech sector, which includes fantasy platforms, betting apps, and AI-driven performance data analytics—all sectors that have surged since 2020.

NBA Integrity and Investor Confidence

Commissioner Adam Silver has championed sports betting as a controlled, transparent revenue stream since its legalization in 2018. But this scandal could mark the biggest test yet of that model’s resilience. If fans perceive corruption, engagement drops—and with it, advertising revenue, franchise valuations, and licensing income.

As the FBI prepares to hold its press conference, investors, legal analysts, and executives across the sports industry are bracing for fallout. The NBA, once a symbol of modern business sophistication, now faces a question that echoes from boardrooms to locker rooms: Can a brand built on competition survive a crisis of credibility?

When the Game Becomes the Gamble

The intersection of crime, crypto, and corporate sport has rarely felt so volatile. The arrests of Chauncey Billups and Terry Rozier serve as a stark reminder that in 2025, professional sports are no longer just games—they’re global markets.

The stakes have shifted from winning championships to protecting balance sheets. As this investigation unfolds, the NBA’s next moves won’t just define its season—they’ll determine whether the league’s financial empire can withstand its biggest integrity test yet.

FAQs: Operation Zhen Diagram and Its Financial Fallout

1. What is Operation Zhen Diagram?

Operation Zhen Diagram is an ongoing FBI investigation launched in 2025 targeting a nationwide gambling and money-laundering network allegedly tied to organized crime. NBA coach Chauncey Billups and Miami Heat guard Terry Rozier were among 31 people arrested in connection with the probe.

2. Why does this investigation matter to the NBA and its partners?

The arrests expose vulnerabilities in the league’s growing relationship with sports-betting companies. Any hint of manipulation or financial misconduct could threaten sponsorship deals, investor confidence, and the long-term commercial value of NBA franchises and media rights.

3. Could this case change how athletes and teams manage finances?

Legal and financial experts predict tighter compliance policies, mandatory financial-ethics training, and greater scrutiny of player investments—especially those involving cryptocurrency or betting platforms. According to analysis reviewed by CEO Today, this could reshape the business governance models used across professional sports.