Drake’s Business Empire: Inside His Lucrative Ventures

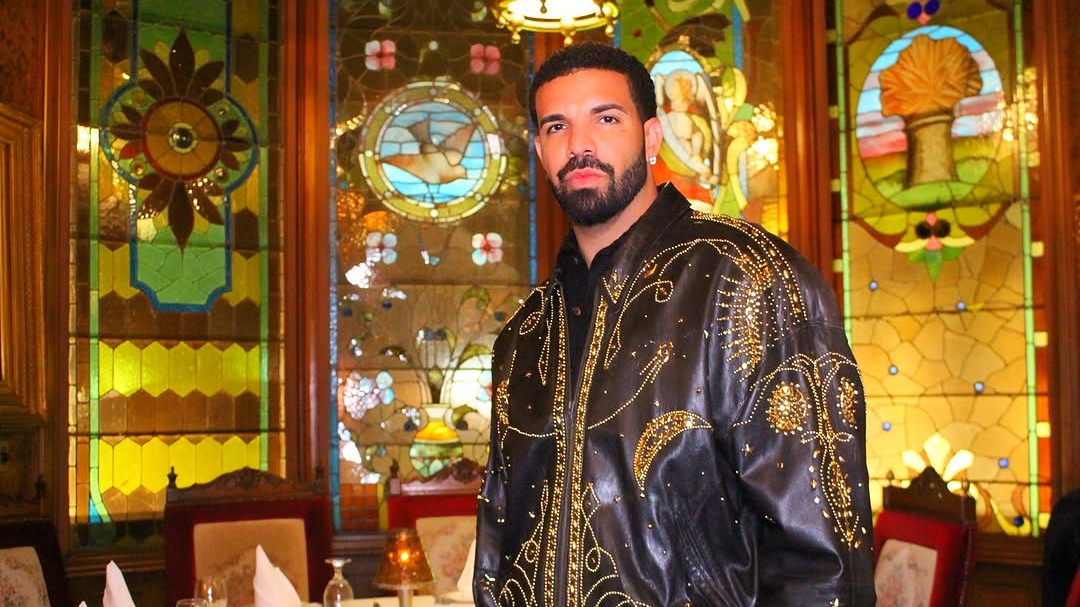

Drake is still far more than a chart-topping artist. In 2025, he remains a force in music, media, fashion, spirits, sports, and entertainment — all built on a tightly controlled portfolio of companies and brand stakes. Many sources agree his net worth in 2025 is around USD 250 million, based on streaming, touring, business revenue, and major deals.

What sets Drake apart is the range and integration of his ventures — many of which have matured, pivoted, or expanded significantly in recent years. Let’s dig into what’s new and more precise in 2025.

DreamCrew: Dominating TV and Film Production

One of Drake’s most well-known companies is DreamCrew, a media production company that has helped produce hit shows such as:

- Top Boy (Netflix) – Critically acclaimed British crime drama.

- Euphoria (HBO) – Award-winning teen drama starring Zendaya.

DreamCrew has been instrumental in securing lucrative deals in the entertainment industry. With the global success of Top Boy and Euphoria, DreamCrew has generated millions through licensing and production deals.

Virginia Black: Luxury Whiskey Brand

Launched in 2016, Virginia Black is a high-end whiskey brand co-founded by Drake and Brent Hocking, a spirits entrepreneur. The brand gained traction due to Drake’s star power and creative marketing. Within its first year, Virginia Black sold over 60,000 cases, making it one of the most successful celebrity-backed alcohol brands.

In 2021, Drake announced plans to take Virginia Black public, further boosting the brand’s valuation. To date, Virginia Black has reportedly made over $50 million in sales.

Related: The 10 Greatest Diss Tracks in Hip-Hop History

Related: Drake vs. Kendrick Lamar: UMG Allegations Shake the Industry

OVO & NOCTA: Fashion, Lifestyle & Limited Drops

Drake’s fashion arms remain central to his business identity. OVO (October’s Very Own) continues to release streetwear collections, often in collaboration with major brands like Canada Goose and Nike. The brand holds flagship stores in global cities and retains a loyal fan base.

Under the broader OVO umbrella is NOCTA, Drake’s partnership label with Nike, focused on premium streetwear and late-night ‘creative’ attire. Limited drops from NOCTA tend to sell out quickly and command high resale value.

In 2025, the fashion side appears less about mass growth and more about maintaining cultural relevance, scarcity, and brand prestige — a model more suited to Drake’s style than high-volume retail.

Silence Policy, LLC: Mysterious Venture

One of the more intriguing ventures in Drake’s portfolio is Silence Policy, LLC, a now-defunct entity that once listed Drake as its manager. Little is known about the company, but its name sparked speculation about its purpose before being dissolved.

More Life Growth Co.: Cannabis Industry Foray

Drake ventured into the cannabis industry in 2019 with the launch of More Life Growth Co., a wellness-focused cannabis company based in Canada. Though the company has faced challenges in the competitive cannabis market, it remains a part of Drake’s diversified business portfolio.

Financials & Net Worth in 2025

Most credible trackers still estimate Drake’s net worth in 2025 at about USD 250 million. Some sources suggest small variations upward given new business deals or valuations. The Universal Music Group contract he signed in 2022 — reportedly valued at USD 400 million — remains a cornerstone of his financial foundation.

His income streams are diverse: streaming, touring, music catalog royalties, business equity, endorsements, and brand licensing. With less reliance exclusively on live performance, Drake is seeking future stability from businesses rather than just hits.

How Much Has Drake Made from His Businesses?

Drake’s business ventures have brought in over $200 million combined, contributing significantly to his overall net worth. His ability to strategically invest in diverse industries has allowed him to build a brand that extends far beyond music.

What’s Next for Drake’s Business Empire?

Looking ahead, these likely paths stand out:

-

Continued investment in global IP and experiential ventures (like the Luna Luna project).

-

Potential expansions of Virginia Black or spin-offs into luxury beverages beyond whiskey.

-

Further sports and entertainment acquisitions (e.g. minority stakes in clubs, stadiums, or venues).

-

More selective creative partnerships and brand collaborations aimed at preserving cultural capital.

Drake’s 2025 strategy appears less about scaling new industries and more about deepening control, brand integrity, and curated growth.