One of the most painful aspects of growing a business are surprise shocks or accidents that hit the reputation, cash, profitability or business plans with such impact that it threatens the very future of the company and potentially the founder.

Richard Branson’s risk-taking is legendary. He has said it is the essence of entrepreneurship to take calculated risks, but one must protect the downside. This in essence is risk management.

It baffles me to see how undervalued risk management is when it:

- Efficiently supports challenging decisions with a clear methodology

- Reduces volatility and enhance profitability

- Increases safety

- Avoids strategic risks

- Compensates if disaster strikes to ensure business continuity.

So, why does it get left in the toolbox during those crucial decisions in the life of a growing business?

There is a constant tension in business between making the right decision and making a fast decision, focusing on positive outcomes, and seeing the potential landmines on a route that could trip you up or more.

As business leaders, we are constantly reminded with facts about the speed of change and the risk of getting left behind. However, when we over-value speed and undervalue risk management, it can ruin a business. Imagine any one of these scenarios happening in your business:

- A worker on your site falling from a height or caught in a machine without protective equipment in place.

- Contracts signed with “greater than contract value” or unlimited liability where the liabilities are then triggered.

- An exchange rate pivot or commodity price with a cost change that wipes out margin on a long term fixed contract

- A sole source supplier that would take more than 6 months or a year to replace that goes into liquidation or fundamentally changes their strategy.

- A customer that has more than 30% of your business that drops you as a supplier

- A fire on a site that destroys 30% of global capacity in the industry.

- A component costing 0.15$ that stops a product being delivered with a value of over 40m$.

- A regulatory change or behaviour in your company that puts you on the wrong side of a major compliance issue.

I have seen each one of the above and many others in businesses I have owned or led with suppliers, customers, and with clients over the last years.

So today, let’s look at the practical risk management techniques I use that support and protect accelerated growth in a business:

Identify the Risks

First, we need to identify the key risks we have in our business and our business plans.

When I look at a business, I model it considering the critical resources and assets on the left supporting the value proposition with customers and markets on the right, supporting the revenue and growth.

Doing this helps me step back and take an objective view on where and what are the risks to the business model that will slow down the creation of value or could destroy value. I separate these into four main categories;

- Category 1: Critical resources – For example, people, equipment, suppliers, partners, buildings, cash and lines of credit.

- Category 2: Critical activities – projects, new product introduction, marketing, recruitment, sales, sourcing, funding, supply chain and logistics

- Category 3: Markets - For example key influences - political, economic, social, technological, legal, environmental and competitors

- Category 4: Key customers and factors influencing their buying behaviours that could impact revenue

For example, we have identified a specific sole source supplier as a risk.

Assess the Risks

When assessing risk, we first need to consider its two components:

- Likelihood of an event happening

- The impact (often financial) of an event if it takes place

Simple stuff, right?

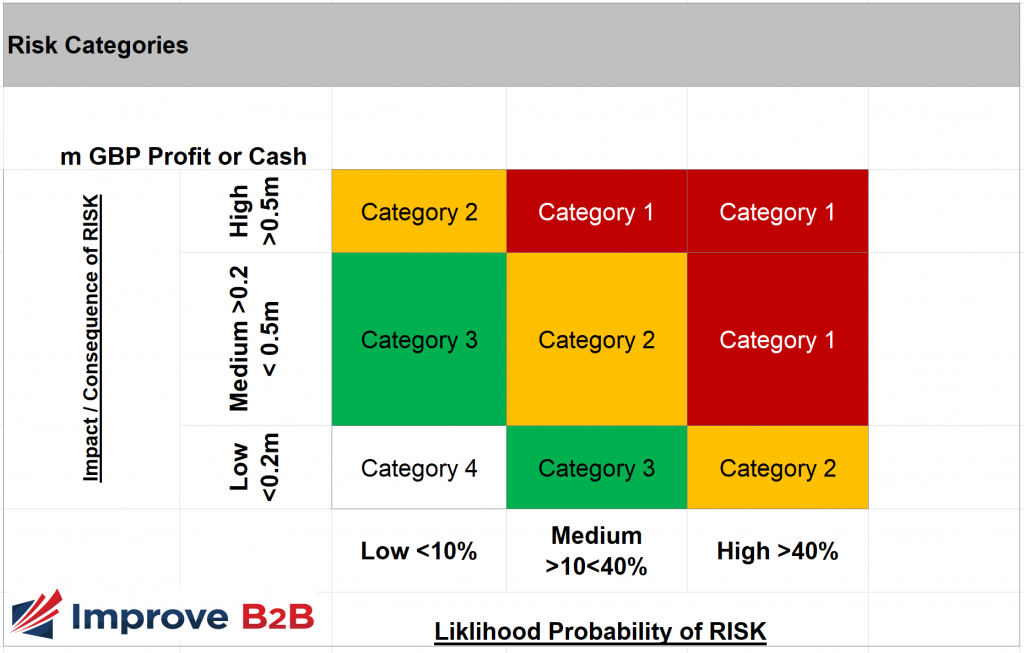

Set the boundaries on impact concerning what your business would consider an acceptable low, medium and high impact on your profits. Then categorise each risk with the probability of the risk occurring.

Like any huge to-do-list, a list of risks needs structuring, prioritising, actioning or putting on the not to do list. The prioritising or categorisation comes from the simple matrix of impact against likelihood.

In the example model below, the vertical axis represents the potential financial impact of the risk, and the horizontal axis represents the likelihood of that risk occurring.

With our sole source supplier, we consider the risk of their insolvency as the primary risk and therefore, the loss of supply during the period of resourcing to a new supplier. The disruption we calculate to be five months given the six months sourcing and qualification plus start time and the one month of stock we hold. This would hit one product line with a projected loss of earnings of £1million.

Probability can be estimated from historical data you have and or external sources of statistics available. And of course experience.

Identifying and understanding risk is one thing, but being able to know how to deal with it effectively? That’s how businesses conquer their sector. Now here’s where it gets really fun.

The Two Components of Risk Management: What could go wrong? And What Can We Do If it Goes Wrong?

Once we’ve determined how likely a risk is of occurring and the potential impact of the risk, we can start looking at solutions. Take off our “worried mother” cap and replace it with your “I’m the James Bond of Business” one and figure out all the potential solutions.

A life long belief I have is when we ignore opportunities they don’t disappear, they simply go to others, but when we ignore risks they grow. It’s basic maths, if you have a probability of an event occurring in a given period and you extend the period, the likelihood of it occurring can increase. You continue to roll the dice.

Most of you reading this will have heard of the “4 Ts” in Risk Management, which I’ve put in my “matrix of risk approach”. I would say more than 80% of the time the risk approach will follow this pattern:

| Low Likelihood | High Likelihood | |

| Low Impact | Tolerate | Treat |

| High Impact | Transfer | Terminate |

TOLERATING – We accept the risk as negligible and / or cannot be mitigated cost-effectively and move forward.

TREATING - This is the most widely used approach. The purpose of treating a risk is to continue with the activity which gives rise to the risk, but to bring the risk to an acceptable level by taking action to control it in some way through containment actions, reducing the likelihood or consequences of a risk applied before the risk materialises. This might be using audits for sole source suppliers and red flags when suppliers ask for early payment. Also the introduction of a new second source supplier, even if they are more expensive and serve only 10% of the demand, could potentially cut switching time to weeks not months.

TERMINATING Simply not accepting the risk or associated project.

TRANSFERRING - Transferring some aspects of the risk to a third party, EG via insurance, or by paying a third party including the vendor to take the risk in another way. This is also an excellent way to get a professional to assess the risk and put a price on it. If no insurance company will touch the risk or the premium is so large that any potential profit from the deal would be consumed, then this gives a clear indication that perhaps the best way forward is to terminate.

The Next Steps

Effective management of risk is one of the key defining factors in the businesses that I’ve helped grow and protect profits. Your organisation's ability to identify the risk landscape and make effective logical decisions is what takes a business to the next level.

Richard Branson is an excellent example of someone who takes risks but regularly comes out on top (probably because he follows the exact methodology above). You focus on applying the following principles:

- Get a little paranoid about all the things that could happen in a project, deal or your business. However, do not get overwhelmed, negative, discouraged or in ‘paralysis by analysis’ mode. This process should not take weeks and months; it is an iterative process that can be completed initially in a few days or less for a small business.

- Get creative about handling risk.

- Terminating a project or activity where the risk is considered too high is a valid form of risk management - it is also a good cure for insomnia.

Jonathan Watt is an 8th generation descendant to the world-renowned inventor genius James Watt. Today, Jonathan Watt, also a born engineer, spends his time solving problems for his business clients who are based at home and abroad.

As well as bringing practical and pragmatic, he is able to provide his insight to increase businesses’ revenues. He is an expert in supply chain management, manufacturing, energy, batteries and electric vehicles. In addition, he consults firms on sales forecasting, risk management and minimising operational costs. And because he’s one himself, he can tell you exactly how to make sure you are getting value from your management consultant.

Jonathan Watt empowers multi-million-pound business to accelerate growth, automate sales systems, and protect profits.