When Star Investors Exit AI Winners, the Real Risk Isn’t the Trade — It’s the Capital Behind It

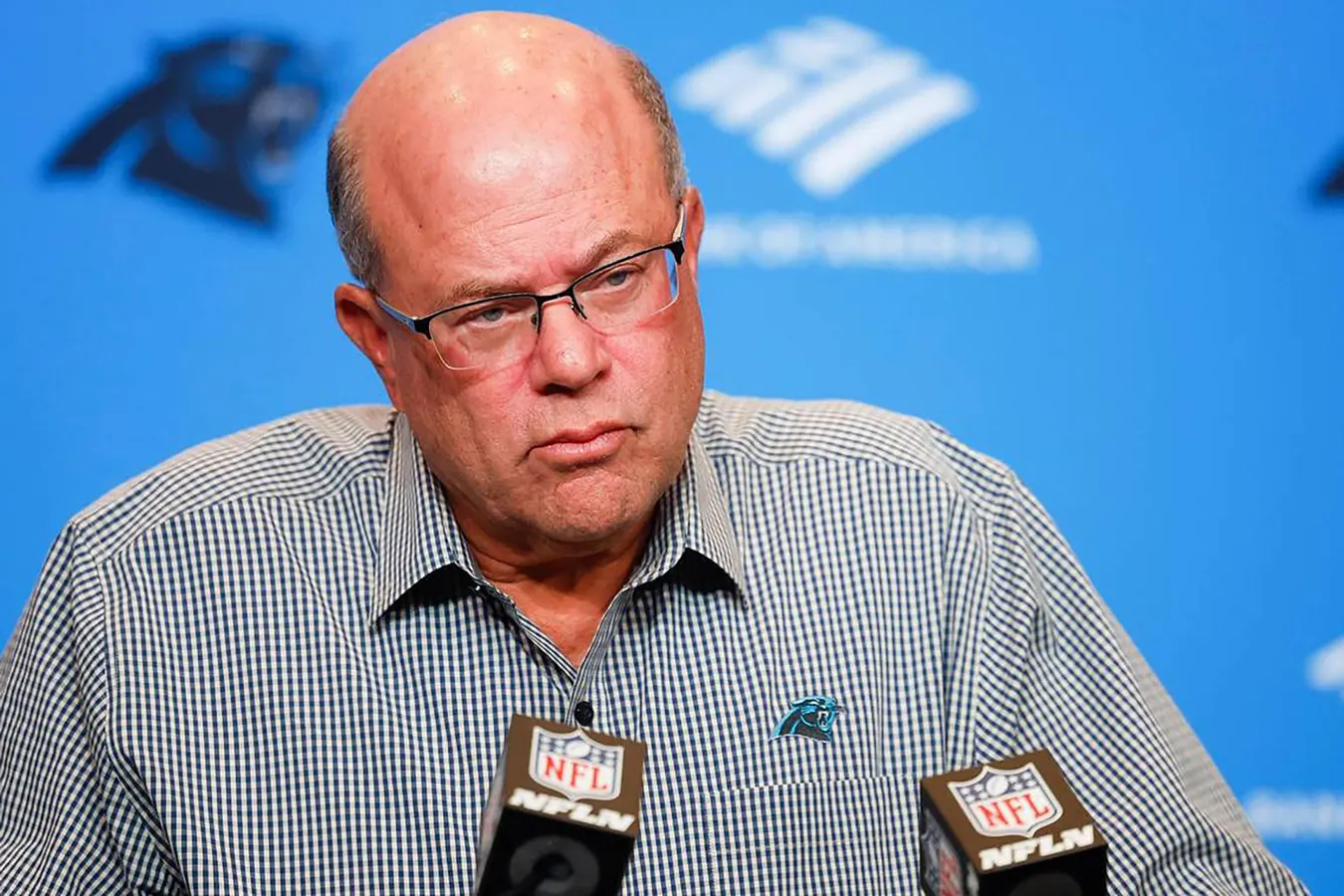

When David Tepper trims exposure to some of the market’s most celebrated AI-linked companies, it’s tempting to read the move as a question of timing or taste. But that framing misses the more consequential shift taking place beneath the headlines. The real story isn’t about which stocks were sold or bought. It’s about how the risk profile of the AI boom has quietly changed — and where the real exposure now sits.

As artificial intelligence moves from promise to deployment at scale, the danger no longer lives in the technology itself. It lives in balance sheets, long-term contracts, and the governance decisions that lock companies into assumptions they may not be able to unwind.

Where the real risk begins

AI infrastructure is no longer experimental. It demands sustained capital spending, heavy borrowing, and confidence that future demand will arrive on schedule. That is the moment legal and commercial exposure begins to accumulate, often without any obvious warning sign.

Risk starts building when capital expenditure runs ahead of predictable revenue and when debt is justified by forecasts rather than signed commitments. It deepens when growth becomes dependent on a narrow set of customers or ecosystem partners, and when timelines stretch just far enough that delays feel survivable — until they aren’t. At that point, informal reassurance replaces discipline, and optimism starts doing the work contracts and safeguards were meant to handle.

This is why timing matters so much. AI investment rarely fails because the technology disappoints. It fails because financial structures were built for speed, not resilience.

The decision moments that change outcomes

This phase creates decision pressure that boards and executives routinely underestimate. Early momentum can create the illusion of control, encouraging leaders to double down rather than pause. Expansion feels justified because competitors are spending aggressively and markets are rewarding ambition.

But mistimed expansion in AI is unforgiving. Fixed costs lock in quickly, while revenue can slip just slowly enough to avoid immediate alarm. Long-term agreements for compute, supply, or infrastructure often concentrate risk in ways that only become visible when counterparties renegotiate, delay, or face pressure of their own. None of that requires operational failure — only dependence.

Disclosure decisions matter just as much. Companies often hesitate to acknowledge these pressures, worried that transparency will dent confidence. That delay is where ordinary commercial risk can escalate into governance questions, investor challenges, or regulatory scrutiny.

What usually happens next

When AI-driven growth outruns fundamentals, the fallout follows a familiar path. Investor confidence softens as leverage and dependency become clearer. Analysts begin questioning capital allocation and the assumptions behind it. Boards face pressure over oversight and risk controls, while strategic retreats — slower build-outs, asset sales, or leadership changes — occur under less favourable conditions than if the risks had been addressed earlier.

None of this implies wrongdoing. It’s simply what happens when long-term commitments meet short-term reality.

Why this matters beyond one portfolio move

Shifts involving companies such as Intel, Oracle, Micron Technology, or Qualcomm are not verdicts on whether AI will succeed. They are signals that the market has entered a different phase of risk.

Early gains were driven by belief and scarcity. The next phase rewards balance-sheet discipline, contractual flexibility, and governance that can withstand slower-than-expected returns. Companies that fail to adjust often discover that while markets forgive optimism, shareholders and regulators are far less patient once assumptions are tested.

AI stops being a growth story the moment capital commitments outpace contractual and governance safeguards.

For leadership teams, the real risk isn’t missing the AI boom. It’s betting on it without asking what happens if demand arrives later than planned, how exposed the business is to a small number of partners, and whether today’s disclosures would still feel reasonable if momentum slowed.

In the AI era, the most expensive liabilities rarely come from failed technology. They come from decisions made when confidence was at its peak.