The Winklevoss Twins: How Conviction Became Capital

From Privilege to Pressure-Tested Ambition

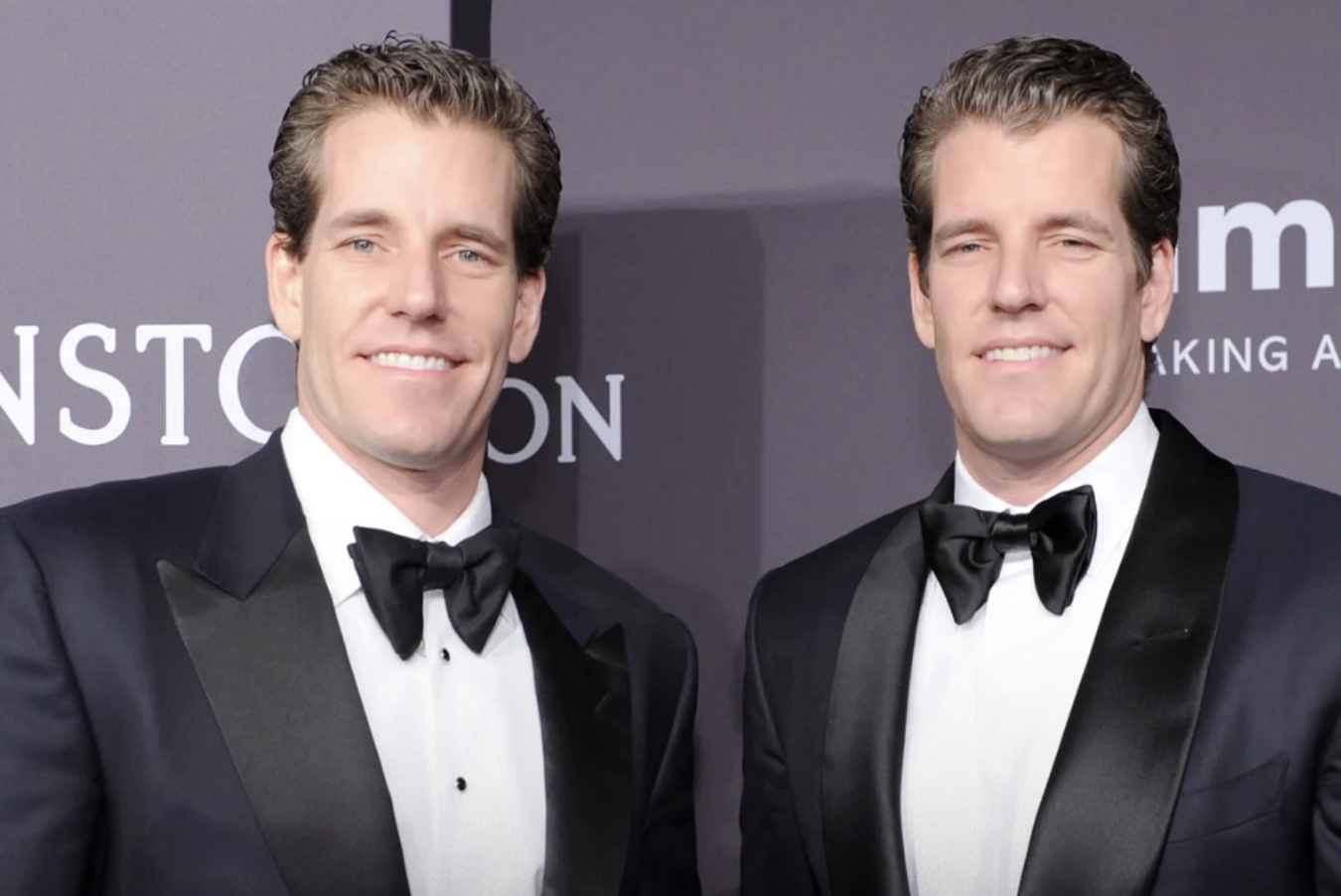

Cameron and Tyler Winklevoss are often introduced as identical twins, Olympic rowers, or early figures in Silicon Valley lore. None of those descriptions capture why they matter now. Their relevance lies in how they converted early opportunity into long-term strategic positioning, then stayed disciplined while an entire industry oscillated between hype and collapse.

They were born into advantage, educated at elite institutions, and entered adulthood with access most entrepreneurs never see. Yet privilege alone does not explain their endurance. What distinguishes the Winklevoss twins is not where they started, but how deliberately they chose their second act.

After Harvard and competitive rowing careers that culminated in the Olympics, they became widely known through litigation tied to the founding of Facebook. The legal settlement that followed gave them financial freedom. What they did with that freedom became the real test.

Rather than chasing status or lifestyle validation, they began searching for asymmetric bets—ideas where conviction, not consensus, would determine returns.

That search led them to Bitcoin.

Discovering Bitcoin Before It Had a Reputation

When the Winklevoss twins began accumulating Bitcoin in the early 2010s, the asset had no institutional legitimacy. It was volatile, poorly understood, and often dismissed as a novelty or a tool for fringe use cases. Most investors ignored it. Many actively mocked it.

Their thesis was not built on short-term price appreciation. It was rooted in scarcity, portability, and monetary history. They viewed Bitcoin as a response to systemic fragility in fiat systems and a digital evolution of gold’s role as a store of value.

This framing mattered. It allowed them to withstand volatility without losing conviction. They were not trading narratives. They were positioning for a structural shift.

Over time, their Bitcoin holdings became a core pillar of their wealth, but just as importantly, Bitcoin became the foundation of their identity as builders rather than speculators.

Building Gemini: Regulation as Strategy, Not Constraint

The next phase of their journey was not about owning Bitcoin, but about enabling others to access it responsibly.

In 2014, Cameron and Tyler founded Gemini, a cryptocurrency exchange designed to operate within existing regulatory frameworks. This decision ran counter to prevailing norms in crypto at the time, where speed and disruption were often prioritized over compliance and trust.

Gemini’s founding philosophy was simple but contrarian: if digital assets were going to mature, they would need infrastructure that institutions could trust.

This meant engaging regulators early, investing heavily in security, and accepting slower growth in exchange for durability. It also meant weathering criticism from parts of the crypto community that viewed regulation as antithetical to decentralization.

The twins absorbed that criticism. They believed legitimacy would ultimately matter more than applause.

That belief proved prescient. As regulatory scrutiny intensified across the industry, Gemini’s compliance-first posture became a strategic asset rather than a liability.

Wealth, Discipline, and the Refusal to Overextend

Estimating the twins’ net worth has always been imprecise, largely because so much of it is tied to long-term holdings rather than liquid speculation. Their wealth stems from three primary sources: early Bitcoin accumulation, equity in Gemini, and disciplined capital preservation.

What is notable is not the scale of their wealth, but how they deploy it.

The Winklevoss twins are not known for extravagant consumption. Their spending patterns skew toward investment, advocacy, and infrastructure rather than visibility or indulgence. This restraint reinforces their broader philosophy: capital is leverage, not decoration.

That mindset has allowed them to stay solvent and credible through multiple crypto cycles, including periods when excess leverage destroyed competitors overnight.

The Winklevoss twins, Cameron and Tyler

Bitcoin at $1 Million: Forecast or Framework?

Few statements have defined the twins’ public profile more than their belief that Bitcoin could eventually reach $1 million per coin. On its surface, the number sounds provocative. In context, it is less a prediction than a framework.

Their argument hinges on Bitcoin competing not with currencies, but with gold.

Gold’s market capitalization has historically been measured in the tens of trillions. If Bitcoin captures even a portion of that role as a global store of value, the implied price per coin rises dramatically. The twins view this not as inevitable, but as plausible under conditions of continued adoption, institutional participation, and monetary instability.

They consistently emphasize time horizon. This is not a call for quick gains. It is a thesis built on decades, not quarters.

Critics argue that volatility, regulation, and technological risk undermine the comparison. The twins acknowledge those risks. They simply believe the asymmetry remains compelling.

Politics, Policy, and the Fight for Regulatory Clarity

As crypto matured, so did the twins’ understanding of power. Technology alone does not shape markets. Policy does.

In recent years, Cameron and Tyler have become increasingly vocal in political and regulatory discussions surrounding digital assets. They have supported candidates and initiatives aligned with clearer, innovation-friendly crypto regulation.

This engagement has drawn criticism from those who prefer founders remain apolitical. The twins reject that framing. In their view, neutrality is not an option when regulation can determine whether an industry thrives or withers.

Their approach is pragmatic rather than ideological. They advocate for rules that protect consumers without strangling innovation. They argue that regulatory ambiguity benefits bad actors while punishing compliant firms.

This stance reflects their broader pattern: leaning into friction rather than avoiding it.

Gemini’s Public Evolution and Industry Signal

Gemini’s transition into a publicly traded company marked a symbolic moment for the crypto sector. It signaled that crypto infrastructure firms could meet the standards of public markets, not just venture capital.

The public listing also imposed new accountability. Transparency, earnings discipline, and investor scrutiny replaced private flexibility. The twins accepted this trade-off, viewing it as a natural evolution rather than a constraint.

For the industry, Gemini’s trajectory reinforced a key lesson: credibility compounds.

Not every crypto firm will survive regulatory tightening and market cycles. Those that do will likely resemble Gemini more than its less disciplined peers.

Lessons for Aspiring Builders and Investors

The Winklevoss twins’ story offers more than inspiration. It offers instruction.

First, conviction matters most when it is unpopular. Their Bitcoin thesis formed before consensus arrived, not after.

Second, infrastructure outlasts speculation. Building systems that others rely on creates durability that price charts cannot.

Third, regulation is not the enemy of innovation. In many cases, it is the gateway to scale.

Finally, wealth is most powerful when treated as a tool rather than a trophy.

These lessons resonate beyond crypto. They apply to any emerging industry navigating the transition from novelty to necessity.

The Long View

Cameron and Tyler Winklevoss are no longer defined by lawsuits or headlines. They are defined by consistency.

They chose a path that required patience, absorbed criticism in exchange for credibility, and resisted the temptation to chase short-term validation. In an industry known for excess, that restraint stands out.

Whether Bitcoin reaches $1 million or not, the twins have already achieved something rarer: relevance across cycles.