The Top 5 Crypto Billionaires and How They Spend Their Fortunes

Cryptocurrency has produced one of the fastest wealth-creation cycles in modern financial history. In just over a decade, digital assets have turned programmers, traders, and early believers into billionaires whose fortunes rival those of Silicon Valley’s most established figures.

But crypto wealth is different. It is volatile, ideological, and often deeply tied to the belief that financial systems themselves are being rewritten. How these billionaires earned their money—and what they choose to do with it—offers a rare window into where the industry believes it is heading next.

These are the five most influential crypto billionaires today, how they made their fortunes, and how they deploy wealth that was created at internet speed.

Changpeng “CZ” Zhao: The Architect of Global Crypto Liquidity

Changpeng Zhao, widely known as CZ, remains the most powerful individual in cryptocurrency despite stepping back from day-to-day leadership. As the founder of Binance, the world’s largest crypto exchange by trading volume, Zhao built infrastructure that became central to how digital assets move across borders.

His fortune, estimated in the tens of billions, stems largely from his ownership stake in Binance and holdings of its native token. Binance’s rise was fueled by speed, global reach, and an ability to serve markets that traditional finance ignored or underserved. That scale, however, also attracted regulatory scrutiny across multiple jurisdictions.

Zhao’s spending habits are notably restrained. He does not cultivate a luxury-forward public persona. Instead, his wealth circulates back into the crypto ecosystem through early-stage investments, infrastructure funding, and educational initiatives. His focus has consistently been on scale and durability rather than personal indulgence.

For Zhao, wealth functions less as lifestyle leverage and more as strategic ballast—used to support the systems that made Binance indispensable to global crypto trading.

Giancarlo Devasini: The Stablecoin Power Broker

Giancarlo Devasini is one of crypto’s least visible billionaires—and one of its most influential. As a senior figure behind Bitfinex and a key force in the creation of Tether, Devasini helped build the world’s most widely used stablecoin.

Stablecoins are the backbone of crypto markets. They provide liquidity, reduce volatility during trading, and act as a bridge between digital assets and traditional currencies. Tether’s dominance has made Devasini extraordinarily wealthy, with personal assets estimated well into the tens of billions.

Unlike exchange founders or public evangelists, Devasini operates with minimal public exposure. His spending patterns reflect that preference. Capital is directed into private investments, financial vehicles, and strategic holdings that reinforce stablecoin infrastructure rather than high-profile consumer assets.

His wealth illustrates a quiet truth about crypto: the most powerful figures are often not those building brands, but those controlling liquidity.

Giancarlo Devasini

Brian Armstrong: The Institutional Bridge Builder

Brian Armstrong represents the institutional face of cryptocurrency. As the co-founder and CEO of Coinbase, he helped translate crypto from a niche experiment into a regulated, publicly traded business.

Armstrong’s wealth—estimated between ten and twelve billion dollars—derives primarily from his equity stake in Coinbase. His strategy was not to outpace regulators, but to work alongside them, positioning Coinbase as a compliant gateway for retail and institutional investors.

That philosophy extends into how Armstrong spends his money. He has committed significant resources to philanthropy focused on financial access, economic inclusion, and digital infrastructure in developing regions. His giving reflects a belief that crypto’s long-term value lies in expanding participation, not just speculation.

Armstrong’s approach to wealth is deliberate. He invests in legitimacy. In doing so, he has helped position crypto as an asset class that traditional finance can no longer ignore.

Brian Armstrong

Michael Saylor: Bitcoin as a Corporate Strategy

Michael Saylor is less a crypto billionaire than a Bitcoin absolutist. As co-founder of MicroStrategy, Saylor made one of the most aggressive corporate treasury bets in modern history by converting large portions of the company’s cash reserves into Bitcoin.

That decision reshaped his personal fortune, now estimated around ten billion dollars, and tied his wealth directly to Bitcoin’s long-term performance. Unlike others who diversify out of crypto after achieving scale, Saylor has doubled down.

His spending reflects conviction rather than consumption. Saylor invests in Bitcoin education, public advocacy, and global speaking engagements. He treats wealth as a tool for persuasion, using capital to reinforce the narrative that Bitcoin is a superior store of value.

Saylor’s fortune is not designed for liquidity. It is designed for belief.

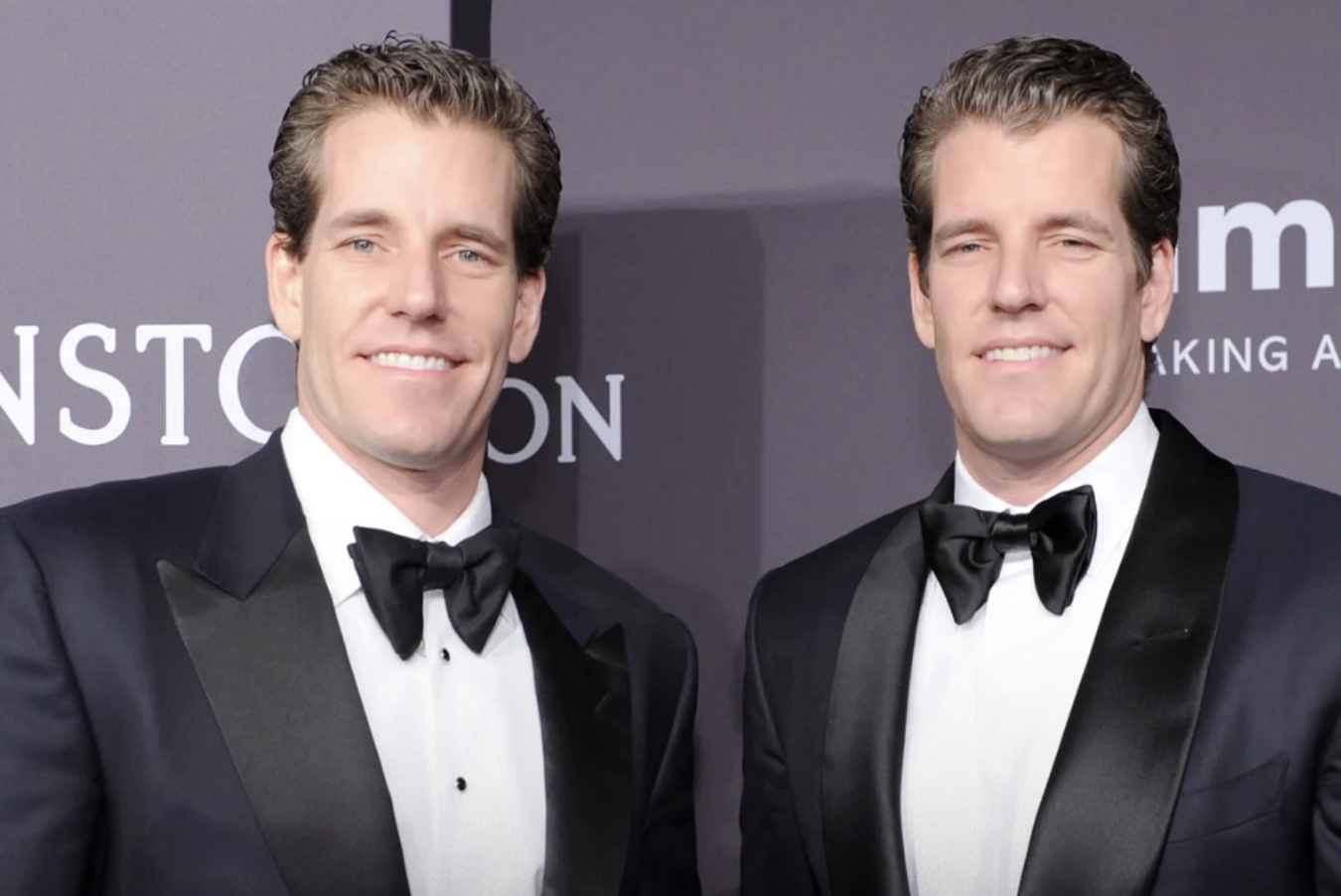

The Winklevoss Twins: From Early Bet to Regulated Growth

Cameron and Tyler Winklevoss were among Bitcoin’s earliest high-profile adopters. After reinvesting proceeds from their early technology ventures, they accumulated significant Bitcoin holdings before founding Gemini, a U.S.-based crypto exchange focused on regulation and institutional trust.

Their combined wealth has consistently ranked among the highest in crypto, driven by early asset accumulation and ownership stakes in exchange infrastructure.

The twins spend strategically. Capital flows into blockchain startups, regulatory engagement, and long-term ecosystem development. They have funded educational initiatives, supported crypto research, and invested in companies that emphasize compliance and security.

Their approach reflects a long view: crypto’s survival depends on integration with existing financial systems rather than permanent opposition to them.

The Winklevoss twins, Cameron and Tyler

How Crypto Billionaires Actually Spend Their Money

Despite popular assumptions, most crypto billionaires are not defined by extravagant lifestyles. Luxury exists—real estate, art, travel—but it is not the defining feature of this wealth class.

Instead, spending patterns reveal three dominant themes:

First, reinvestment. Many deploy capital back into crypto infrastructure, startups, and protocol development.

Second, advocacy. Wealth is used to shape narratives, fund education, and influence policy discussions.

Third, insulation. Crypto fortunes remain volatile, leading many to preserve liquidity inside digital assets rather than liquidating into traditional wealth structures.

Crypto billionaires tend to spend less like celebrities and more like system builders.

What Their Wealth Signals About Crypto’s Future

These fortunes are not static. They expand and contract with regulatory shifts, market sentiment, and technological change. Yet collectively, they reveal where power in crypto now sits.

Liquidity controllers matter more than product builders. Compliance-oriented leaders gain influence as regulation tightens. Ideological conviction can still drive massive capital concentration.

Above all, crypto wealth is no longer experimental. It is embedded in global finance.

And how these billionaires spend their money—quietly, strategically, and often back into the system itself—suggests they are not preparing for an exit. They are preparing for permanence.