Why TSMC’s Profit Leap is a Hidden "AI Tax" on Your 2026 Smartphone

TSMC’s record-breaking Q4 profit isn't a victory for the tech industry; it is a warning that your next smartphone will cost $100 more.

By prioritizing high-margin AI silicon for data centers, TSMC has effectively triggered a "zero-sum" war for manufacturing capacity that starves the consumer market. While the headlines celebrate a 20.45% revenue jump to $33.11 billion, the strategic reality is that triple-digit premiums for AI allocation are driving up your personal hardware costs. You are footing the bill for the AI revolution through "component inflation" as smartphone giants pay a premium just to keep their places in the production line.

The Insider Shift:

-

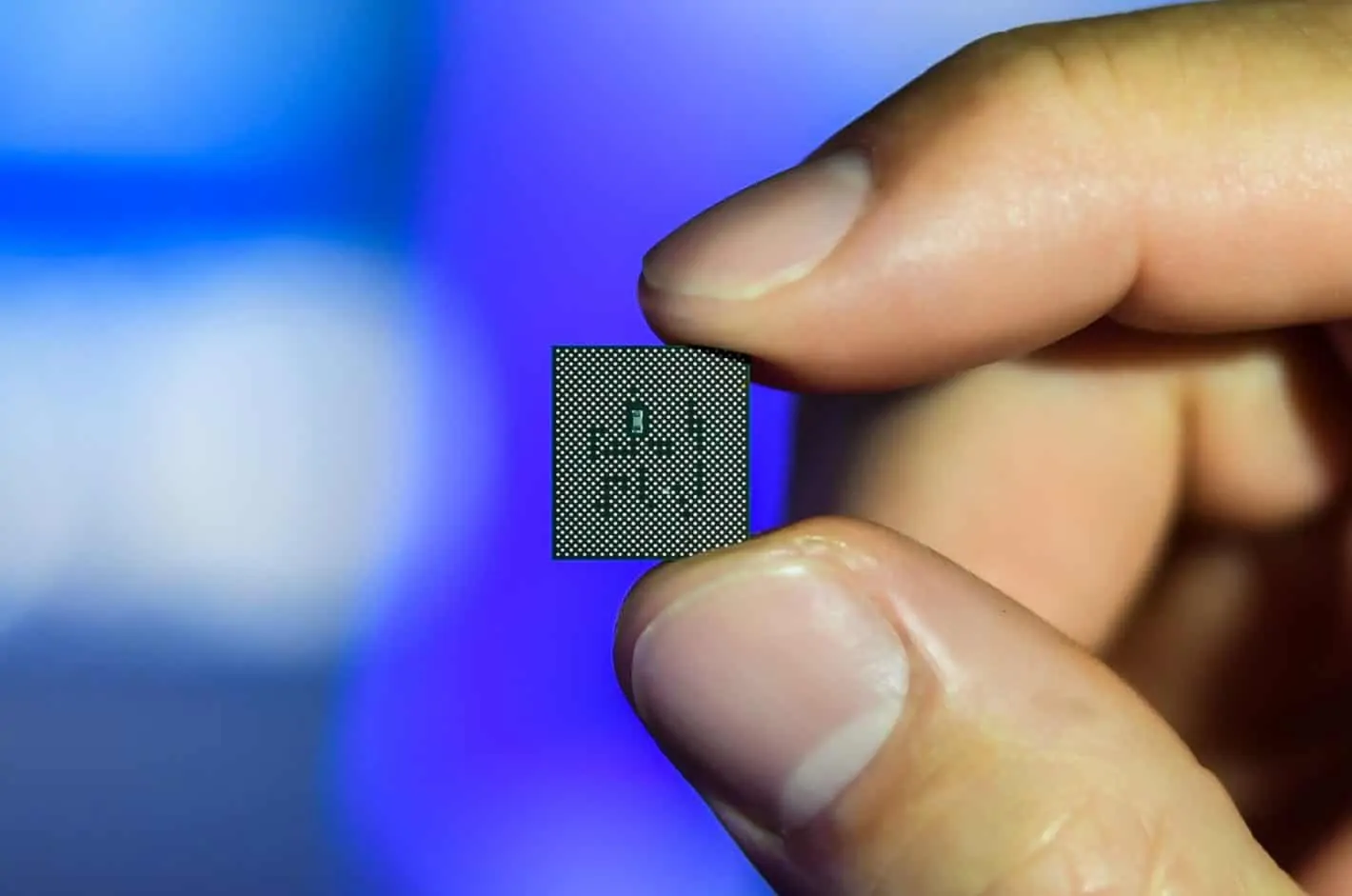

The 2nm Pricing Shock: Next-gen 2nm wafers are projected to hit $30,000 each, forcing a record $280 unit cost for the processors inside the 2026 flagship phone cycle.

-

The Memory Squeeze: High-performance DRAM is being diverted to AI "Hyperscalers" like OpenAI, causing a projected 40% surge in smartphone memory module prices by mid-2026.

-

The Spec Downgrade: To avoid passing a $200 price hike to you, mid-range brands are being forced to "recycle" older chips or strip out RAM to maintain margins.

The Authority Close: In 2026, the "AI Boom" has become a structural tax on consumer hardware, turning formerly affordable flagship features into high-priced luxury items.