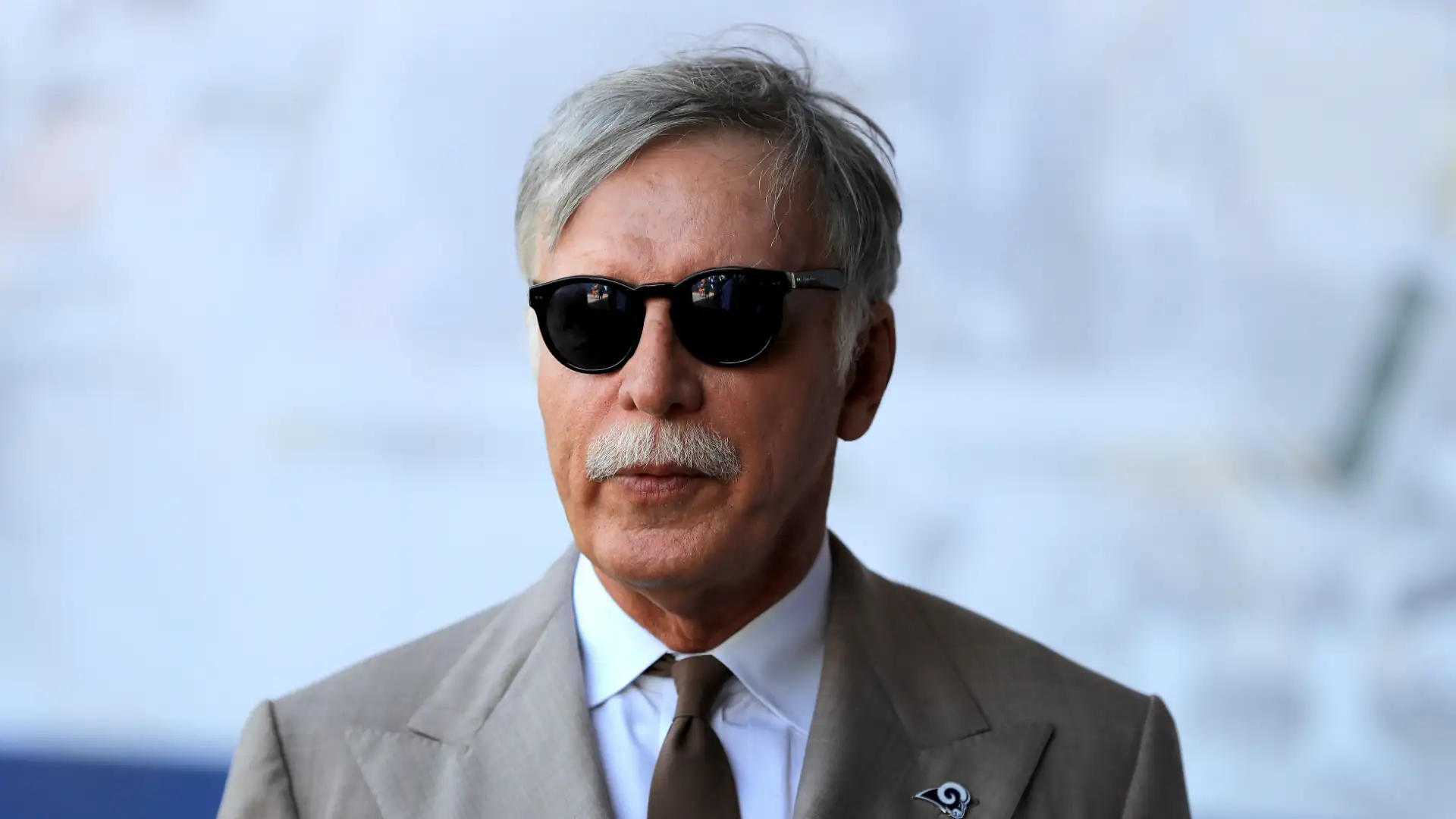

Stanley Kroenke: The Sovereign of Scarcity & The $376M Inglewood Standoff

Chairman & Owner, Kroenke Sports & Entertainment (KSE)

Stanley Kroenke matters now because he is engaged in a high-stakes test of municipal authority—launching a $376 million infrastructure lawsuit against the City of Inglewood that challenges the traditional limits of stadium-district power.

The Executive Dossier

Strategic Authority

Kroenke’s authority flows from consolidated ownership and balance-sheet independence. By controlling KSE outright, he avoids the minority vetoes and "committee-think" of private equity consortiums. This independence enables capital deployment on multi-decade horizons.

His leverage is asset-native. He owns the "dirt," the seats, and the surrounding development. Unlike fund-led models that prioritize quarterly returns, Kroenke internalizes revenue streams typically lost to third-party promoters. His influence is silent and structural, reinforced by the stability of family-office scale and the lack of external board pressure.

Core Vitals

- Full Name: Enos Stanley Kroenke

- Age: 78 (born July 29, 1947)

- Place of Birth: Columbia, Missouri

- Primary Residence(s): Texas; Colorado; California

- Estimated Net Worth: ~$21.3 billion (January 2026)

- Capital Structure: Founder-led private holding company. His wealth is anchored in sports equity and over 1.6 million acres of North American land holdings, providing immense collateral depth

Education & Pedigree

Kroenke holds an MBA from the University of Missouri. This regional, operational pedigree shaped an approach rooted in land use and municipal negotiation rather than financial-elite abstraction. His power was built through control of physical infrastructure, allowing him to absorb massive political pressure during high-profile asset relocations, such as the Rams' move from St. Louis to Los Angeles.

The Empire: Business & Holdings

As of Q1 2026, Kroenke oversees a portfolio valued at approximately $25 billion.

- Cash-Flow Engines: High-scarcity franchises with inflation-protected revenues: LA Rams (NFL), Arsenal FC (Premier League), Denver Nuggets (NBA), and Colorado Avalanche (NHL). Arsenal alone generated over $770 million in revenue in the previous fiscal year.

- Influence Assets: SoFi Stadium and Ball Arena. These venues function as multi-revenue platforms that capture everything from naming rights to global concert tours.

- Growth & Optionality Bets: The 300-acre Hollywood Park development. This mixed-use district functions as a "city-within-a-city," monetizing fan traffic 365 days a year

The Playbook: How Power Is Deployed

Kroenke’s signature strategy is "Sovereign Concentration." He funds projects off-balance sheet to maintain total autonomy from partners and public markets.

Key elements include:

-

Infrastructure Primacy: Owning the land to control the team's destiny and capture all ancillary revenue (parking, retail, signage).

-

Strategic Silence: Tolerating years of public or political vitriol (the "Silent Stan" persona) to secure a long-term structural win.

-

Vertical Integration: Buying out minority holders (as with the 2018 Arsenal buyout) to eliminate outside oversight and reporting requirements.

Risk Profile & Current Climate

Kroenke’s current front line is legal and governance-centric.

-

The $376M Infrastructure Suit: In January 2026, Kroenke’s legal team filed a massive claim against Inglewood, alleging the city repudiated its obligation to reimburse Hollywood Park for public infrastructure improvements. This follows a dispute over digital billboards that Kroenke claims will "siphon consumer spending" away from his complex.

-

The FIFA Re-Engineering: SoFi Stadium is currently undergoing a radical renovation for the 2026 World Cup. This involves installing a complex, integrated grass-on-top-of-turf system and removing corner seating to meet FIFA's 68m x 110m pitch requirements.

-

Municipal Friction: The Inglewood Mayor has publicly accused Kroenke of "criminal misconduct," marking a total breakdown in the partnership that originally brought the Rams to Los Angeles.

Governance & Power Map

- Unilateral Control: Total capital allocation and strategy within KSE and Kroenke Signature Properties (KSP).

- Shared Control: League governance via the NFL’s "Old Guard" and Premier League executive boards.

- External Oversight: Municipal partners in Inglewood and FIFA regulators for the 2026 cycle. His removal risk remains near zero due to 100% equity control of his primary assets.

The Human Element

Kroenke maintains a low public profile, reinforcing his "Silent Stan" moniker. His resilience is backed by his wife, Ann Walton Kroenke, whose Walmart stake provides an unparalleled capital floor that allows him to "out-wait" any market or political cycle. He is increasingly delegating operational leadership to his son, Josh Kroenke, while he focuses on massive ranching and winery interests.

Editorial Bottom Line

Stanley Kroenke is the archetype of the “landlord of sport,” exercising sovereign-style control through asset ownership rather than fund governance. His success now hinges on navigating municipal resistance in Inglewood while proving SoFi Stadium can operate as the premier global venue heading into the 2026 World Cup.

As governance-driven operators like Behdad Eghbali and personality-led consortium models associated with Todd Boehly face their own structural constraints, the next 12 months will test whether Kroenke’s privately financed, owner-controlled approach represents the future of sports capital—or a model increasingly out of step with public accountability and regulatory pressure.