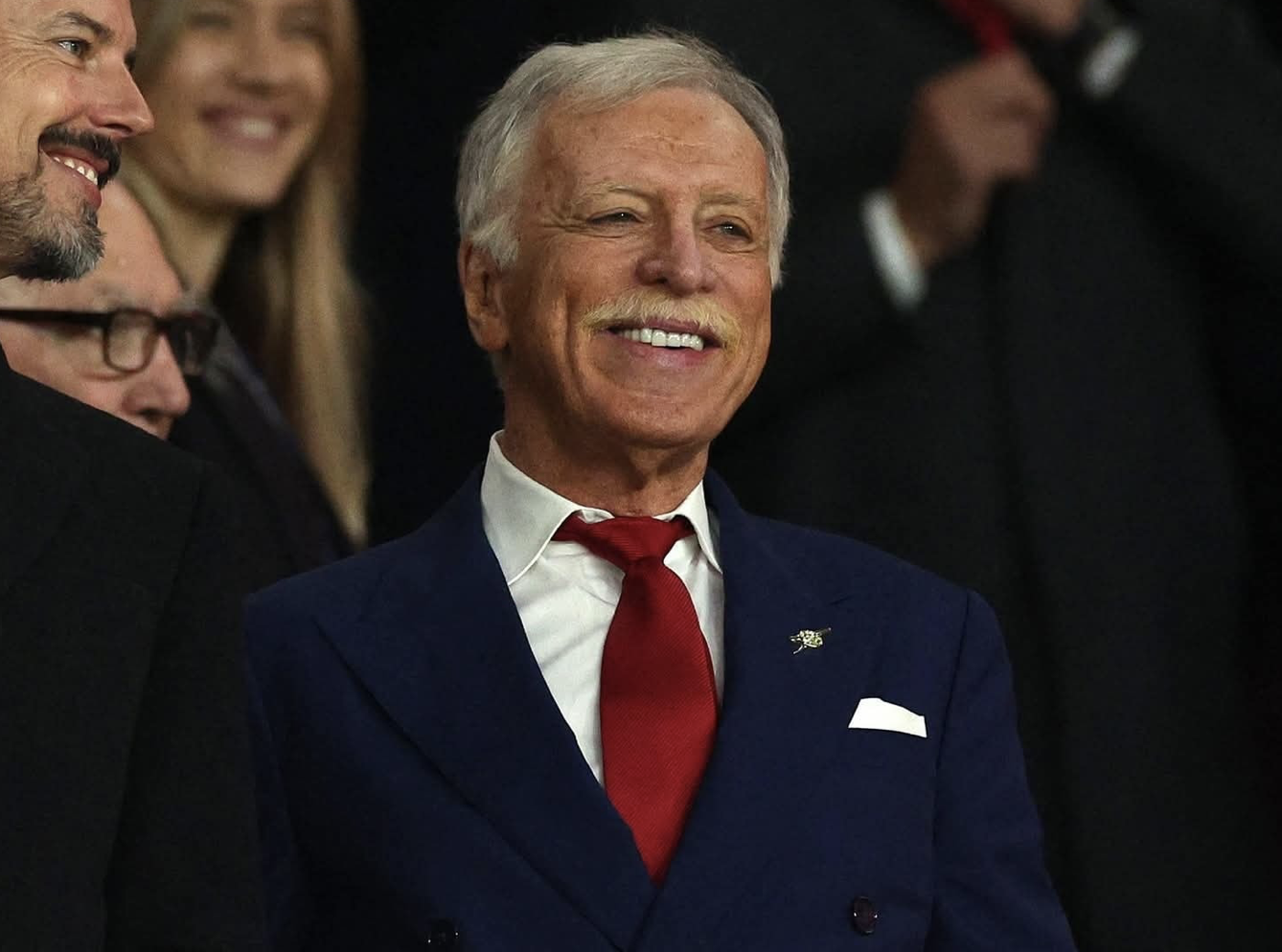

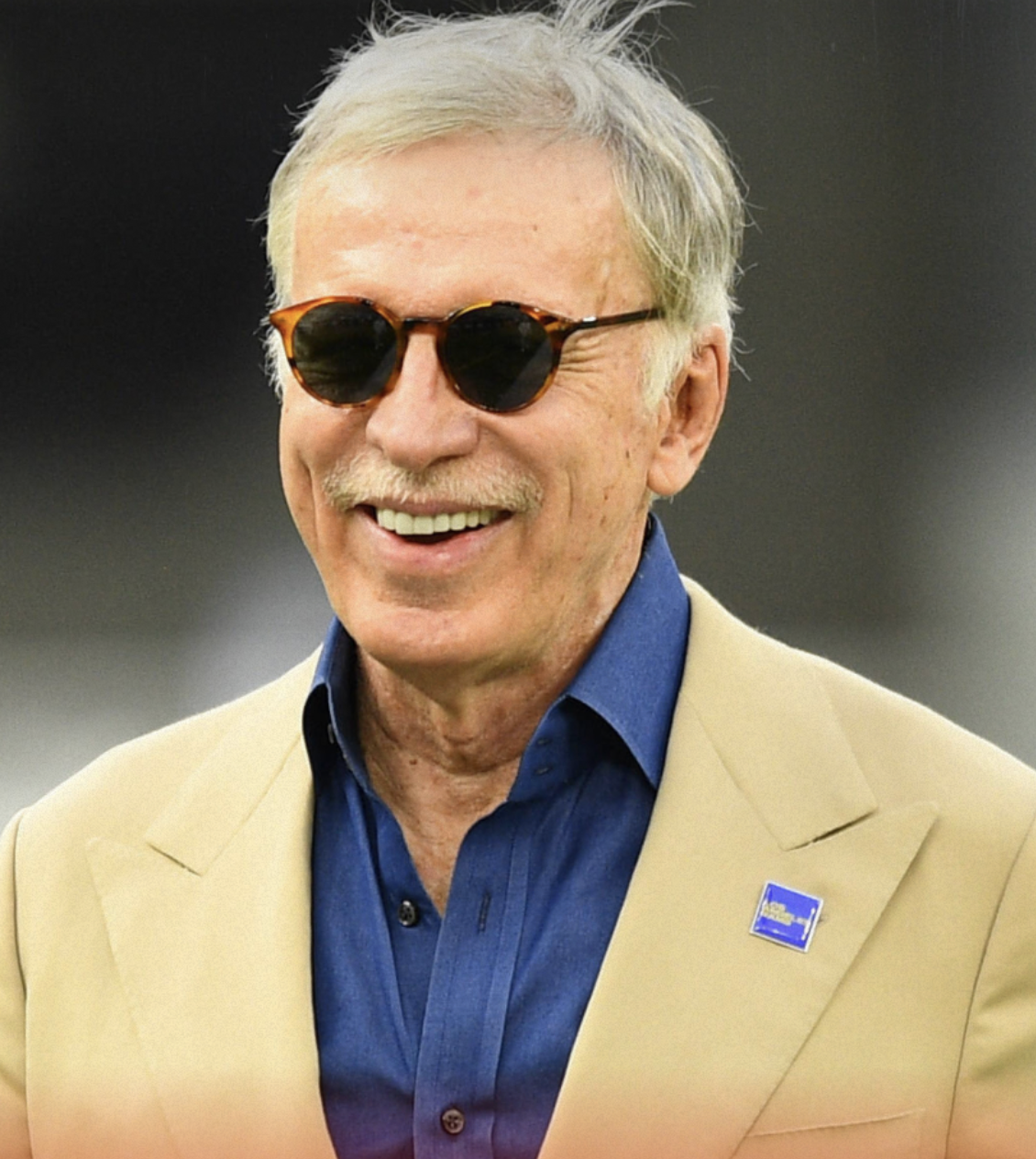

Stan Kroenke: xThe Land Baron Who Turned Sports Into Infrastructure

Current Titles:

Chairman, Kroenke Sports & Entertainment (KSE)

Owner, Arsenal Football Club (Premier League)

Owner, Los Angeles Rams, Denver Nuggets, Colorado Avalanche

Principal, Kroenke Group

Stan Kroenke is not just a sports owner or a real estate magnate. He is a control investor who treats assets—land, franchises, and media rights—as long-duration infrastructure. His influence endures because he owns scarce things that cannot be easily replicated: territory, leagues, and physical scale.

Stan Kroenke’s power does not come from public charisma or deal theatrics. It comes from ownership density. He controls assets outright, holds them patiently, and extracts value over decades rather than cycles.

His most visible international asset—Arsenal Football Club in the Premier League—illustrates this approach. The club is not run as a vanity project or short-term flip. It is treated as a global brand with compounding value tied to broadcast rights, international fan bases, and the scarcity of top-tier English football licenses.

Capital Velocity

Kroenke deploys his own capital through privately held entities. There are no external limited partners demanding liquidity. This allows extreme time arbitrage. Assets can underperform for years while structural value quietly builds.

Platform Dominance

Sports leagues function like toll bridges. Entry is capped. Media demand is global. Once acquired, the platform throws off recurring attention and cash flow. Kroenke owns multiple such platforms across the NFL, NBA, NHL, MLS, and the Premier League.

Governance Moat

Kroenke is largely immune to activist pressure. His holdings are private, family-controlled, and legally insulated. Fan criticism, media scrutiny, and political pressure have limited leverage over his core authority.

Core Vitals

-

Full Name: Enos Stanley Kroenke

-

Born: July 29, 1947

-

Primary Residences: Missouri, Colorado, California

-

Net Worth (Estimated): $16–18 billion

-

Capital Structure: Founder-led, privately held family empire

Education & Pedigree

Kroenke earned a degree in business administration from the University of Missouri. More important than the credential was geography. Missouri placed him near land, development, and agricultural wealth networks rather than coastal finance circles.

His early access to capital expanded dramatically through marriage to Ann Walton Kroenke, an heir to the Walmart fortune. That connection did not define his strategy, but it accelerated his ability to operate at national scale.

The Empire: Business & Holdings

Kroenke’s empire is best understood by function, not industry.

The Cash-Flow Engines

-

Commercial real estate developments near major retail and sports hubs

-

Ranching and agricultural land, producing steady, low-volatility returns

-

Media and venue-related revenue streams tied to sports ownership

These assets fund patience. They reduce dependence on leverage and allow Kroenke to absorb volatility without forced selling.

Stan Kroenke

The Influence Assets

-

Arsenal FC (Premier League)

-

Los Angeles Rams (NFL)

-

Denver Nuggets (NBA)

-

Colorado Avalanche (NHL)

Sports franchises generate emotional loyalty, political goodwill, and cultural relevance. Few assets combine all three at global scale.

The Growth & Optionality Bets

-

Stadium-led urban development projects

-

Media rights appreciation tied to streaming and international audiences

-

Long-term land banking near expanding metro areas

The Playbook: How Power Is Deployed

Kroenke’s signature move is quiet accumulation.

Time Arbitrage

He buys when assets are misunderstood or undervalued, then waits. Arsenal’s years of on-field stagnation were endured because Premier League broadcast economics were strengthening underneath.

Capital Recycling

Cash flow from mature assets is redeployed into higher-upside platforms. NFL stadium projects and Premier League infrastructure upgrades are funded without destabilizing the core portfolio.

Strategic Silence

Kroenke rarely explains himself publicly. This frustrates fans but protects leverage. Silence prevents negotiation through media and reduces reactive decision-making.

Risk Profile & Current Climate

Kroenke’s front line risk is reputational, not financial.

Regulatory Exposure

Sports ownership faces increasing scrutiny around competition, ownership ethics, and league governance—especially in Europe. Premier League financial rules and fan governance debates remain long-term pressure points.

Succession Risk

Control is expected to remain within the Kroenke family, with son Josh Kroenke already operating as a visible steward, particularly at Arsenal.

Conflict of Interest

His multi-league ownership portfolio raises occasional questions about competitive balance, though structural safeguards remain in place.

Governance & Power Map

-

Unilateral Control: Strategic direction across all major holdings

-

Veto Power: Family governance structures and league regulations

-

Board Composition: Internal, loyal, and aligned with long-term ownership

This is not a consensus-driven empire. It is owner-led.

How Personality Shapes Power

Kroenke’s defining trait is emotional detachment from short-term validation. He is comfortable being unpopular if the math works long term. This explains his resistance to reactive spending, public apologies, or symbolic gestures.

His patience is often misread as indifference. In reality, it is discipline. He treats volatility as noise and scarcity as signal.

Why His Influence Endures

Stan Kroenke’s influence endures because he owns what cannot be easily replaced: land, league licenses, and time.

Premier League clubs do not multiply. NFL franchises do not dilute. Strategic land near growth corridors does not regenerate once sold.

By controlling these assets outright and refusing to optimize for approval, Kroenke has built an empire that compounds quietly while others chase headlines.

He is not the loudest owner in global sport. He may not be the most beloved. But in terms of structural power, few figures in modern capitalism are harder to dislodge.