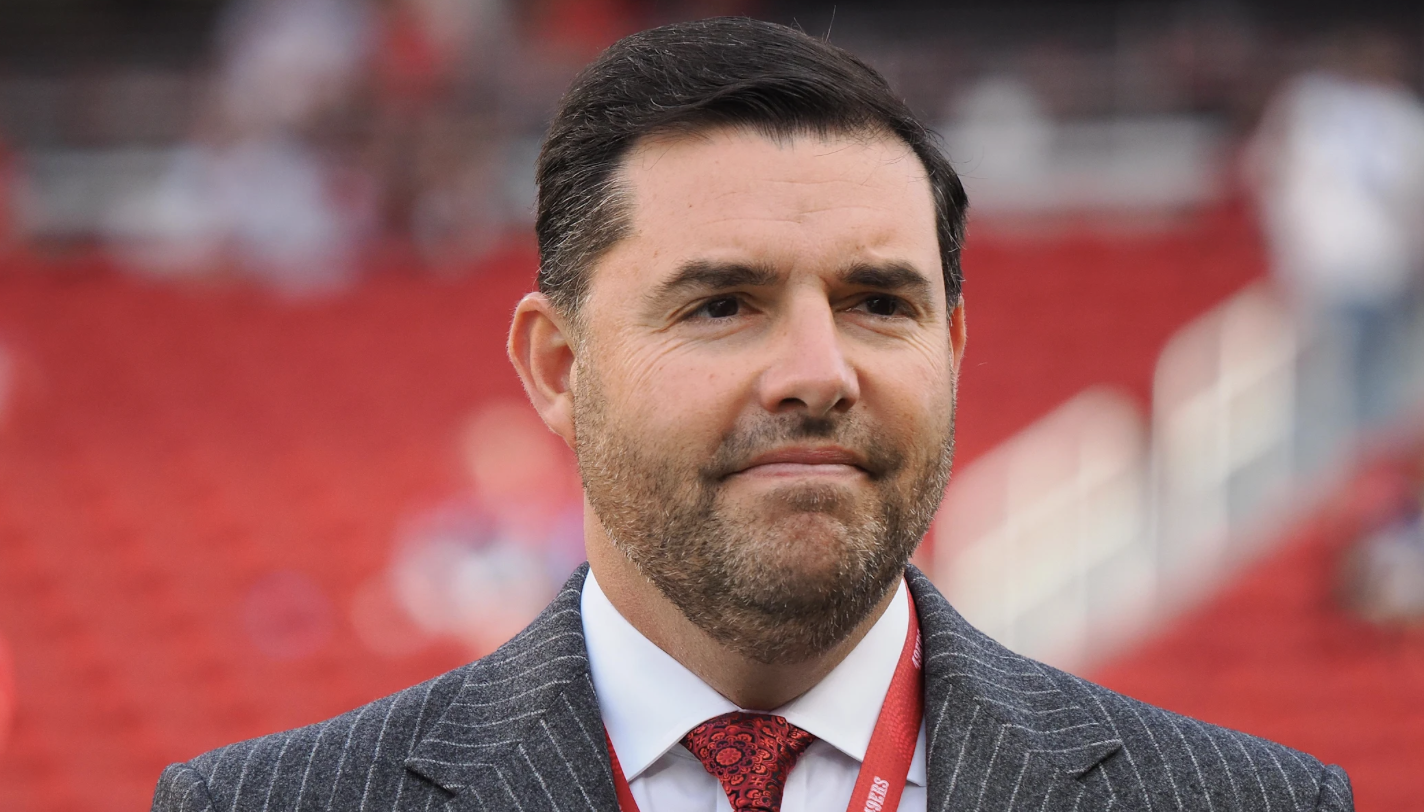

Jed York: The Custodian of an NFL Dynasty Rebuilding Power for a Modern Era

Current Titles

-

Principal Owner & Chief Executive Officer, San Francisco 49ers

-

Co-owner, Leeds United F.C.

-

Co-owner, Rangers F.C.

A Franchise Passed Down — Authority Built Up

Jed York did not “buy” the San Francisco 49ers in the conventional sense. His authority emerged through generational transfer, consolidation, and governance discipline inside one of American sport’s most enduring ownership families.

The 49ers entered the York family’s orbit in 1977 when Edward DeBartolo Sr. acquired the franchise as part of a wider real-estate-backed investment strategy. What began as a regional NFL asset became, over decades, a global sports property embedded in broadcast media, sponsorship ecosystems, and international fan markets. In scale and cultural reach, the franchise now occupies a position comparable to long-established Premier League clubs—institutions where ownership is measured in decades, not deal cycles.

York’s rise to principal ownership was neither abrupt nor symbolic. It followed years of internal leadership, operational responsibility, and strategic decision-making. By the time ownership control formally shifted, York had already become the franchise’s functional center of gravity—the executive accountable for both competitive direction and institutional stability.

This distinction matters. Like the most effective Premier League custodians, York is not an absentee inheritor. He operates as a long-term steward of a capital-intensive, reputation-sensitive enterprise where continuity, governance, and restraint are often more valuable than short-term ambition.

Education, Finance, and Institutional Fluency

Born in 1980, York was raised in an environment where professional sport, large-scale capital, and public scrutiny overlapped. That exposure informed his decision to pursue a dual academic focus in finance and history, a combination that shaped both his analytical discipline and his appreciation for institutional legacy.

After university, York spent time in financial services, working in wealth management and analysis. Though brief, this period provided exposure to capital allocation, risk assessment, and long-term value creation — skills that later translated directly into franchise governance.

Unlike many sports executives whose learning curve begins inside a locker room, York entered the NFL ownership sphere with an understanding of balance sheets, leverage, and capital structure. That background would quietly shape his leadership style: deliberate, data-driven, and structurally cautious.

Ascension Inside the 49ers Organization

York joined the 49ers organization in a strategic planning role before rising through executive ranks to become Chief Executive Officer in 2008. His mandate extended well beyond marketing or commercial growth. He was tasked with aligning football operations, stadium development, fan engagement, and league-level governance under a single strategic vision.

His early tenure was marked by public scrutiny. High expectations, leadership turnover, and competitive fluctuations tested both his resolve and credibility. Rather than retreating, York recalibrated — shifting emphasis from visibility to infrastructure, from rhetoric to execution.

Over time, this approach yielded results. The 49ers re-established themselves as a perennial contender, while the organization itself matured into a disciplined, professionally run enterprise capable of weathering competitive cycles without existential risk.

From Operator to Principal Owner

York’s transition to principal owner formalized what had already become reality. Operational control, strategic authority, and long-term accountability converged under his leadership.

The move also served a governance function. By clarifying succession and consolidating decision-making authority, the York family reduced ambiguity — a common fault line in legacy-owned sports franchises. In an industry where internal disputes often spill into public dysfunction, the 49ers instead reinforced stability.

York’s ownership model prioritizes durability. Capital is deployed carefully. Debt is managed conservatively. Competitive ambition is balanced against institutional health. This posture has allowed the franchise to remain resilient even as league economics grow more volatile.

Expanding the Sports Portfolio

Under York’s leadership, the organization broadened its scope beyond American football. Investments in European football clubs signaled a long-term view of global sports ownership — one that treats clubs as both competitive entities and cultural platforms.

These holdings are not speculative. They align with a broader strategy centered on brand extension, operational learning, and international audience development. York’s role in these ventures reflects a belief that modern sports ownership requires cross-market fluency and diversified exposure.

Rather than chasing rapid expansion, the strategy emphasizes patience, local expertise, and governance alignment — mirroring the same principles applied in San Francisco.

Wealth, Valuation, and Control

The York family’s wealth is largely concentrated in long-term assets rather than liquid speculation. Real estate foundations, franchise equity, and media-driven valuation growth define the family’s capital base.

The San Francisco 49ers now rank among the most valuable franchises in global sport. That valuation reflects not only on-field success, but also stadium economics, media rights, sponsorship sophistication, and operational credibility.

While minority stakes have been sold to strategic partners, the York family retains overwhelming control. York’s personal wealth is therefore best understood as embedded capital — tied to stewardship rather than extraction.

Leadership Style and Public Presence

York is measured, articulate, and increasingly restrained in public forums. Early in his career, visibility came easily; with experience, discretion followed. Today, he engages selectively — on governance, league structure, and institutional reform — rather than personal profile.

Internally, his leadership style emphasizes accountability and alignment. Football operations are empowered, but not insulated. Commercial strategy supports competition, but does not override it. The organization functions less like a personality-driven enterprise and more like a mature institution.

Personal Life and Private Discipline

Despite operating in one of the most scrutinized industries in American business, York maintains a low personal profile. He lives with his family in Northern California and avoids the performative visibility common among high-profile owners.

This privacy is not incidental. It reflects a broader philosophy: leadership as responsibility, not spectacle.

The Custodian Phase

Jed York is no longer proving legitimacy. He is preserving relevance.

His current phase is defined by institutional defense and strategic refinement — ensuring that a legacy franchise remains competitive without compromising its foundations. In an era of aggressive leverage, rapid turnover, and owner volatility, York’s restraint has become a differentiator.

He represents a modern evolution of legacy ownership: less theatrical, more structural, and increasingly rare.

In professional sport, where noise often substitutes for competence, Jed York’s influence lies in his refusal to confuse the two.