Best Virtual Data Room Providers for 2026 and Beyond: Features, Security & Pricing

Choosing the right virtual data room can quietly decide whether a deal feels controlled and efficient — or chaotic and risky.

Pick well, and everyone involved in the transaction works inside a secure, well-structured dataroom where documents are easy to find, access rights are clear, and reporting is straightforward.

Pick badly, and you get version confusion, security questions from counterparties, unexpected invoices, and a lot of time spent troubleshooting basic access issues right when the stakes are highest.

This post looks at:

- What a modern virtual data room (VDR) is

- How experienced dealmakers evaluate data room software in 2026

- A short list of the Best Virtual Data Room Providers and when to use them

- How pricing really works across different data room vendors

What is a virtual data room (VDR)?

If you’re still occasionally typing what is VDR into search, a simple definition helps align internal stakeholders.

A virtual data room is a secure online folder for sensitive documents tied to a deal or major project. Instead of forwarding the same spreadsheets and PDFs around in long emails, teams turn to data rooms when they need to share sensitive documents for things like:

- M&A due diligence on both the buy side and sell side

- Fundraising, regular investor reporting, and updates for LPs

- Joint ventures and other longer-term strategic partnerships

- Audits, compliance reviews, and regulatory or supervisory filings

- Real estate and infrastructure transactions

Unlike generic file storage, a secure virtual data room is built around control:

- Granular user and group permissions

- Watermarking, view-only modes, and screenshot protection

- Detailed audit trails of every view, download, and change

- Configurable security policies aligned with corporate standards

In short, a VDR is no longer an exotic tool. For serious transactions and regulated workflows, dedicated data room services are now part of the standard technology stack.

How experienced teams evaluate virtual data rooms in 2026

Most seasoned deal teams already know how painful the wrong platform can be. When they compare virtual data rooms, they tend to focus on five dimensions.

- Security and compliance

Security isn’t a “nice to have” in a data room; it’s the whole point of using one.

As a minimum, a professional virtual data room should give you:

- Strong encryption for data while it’s being transmitted and when it’s stored

- Two-factor authentication and, ideally, SSO/SAML for easier access control

- Permissions you can set by role, team, and document

- IP or domain restrictions for especially sensitive work

- Audit logs that you’d be comfortable putting in front of a regulator

For cross-border deals or regulated industries, you’ll also need the right hosting locations and certifications (for example, ISO 27001 or SOC 2) just to get past the internal security review.

If you’re running a competitive auction, a multi-round fundraise, or anything with several advisors and bidders, these controls stop the process from turning into a free-for-all.

2. Ease of use for all parties

Many data rooms are secure on paper but difficult to use in practice.

When assessing data room software, it helps to test:

- How quickly an external counterparty can log in and find what they need

- Whether navigation is intuitive on both desktop and mobile

- How easy it is to replicate or adapt folder structures from previous deals

- Whether bulk upload, drag-and-drop, and automatic indexing work reliably

User reviews often emphasize that Ideals is easy for non-technical participants to adopt — a valuable advantage when working with first-time sellers, management teams, or dispersed bidder groups.

3. Collaboration and workflow support

Modern online data room providers are expected to support the entire process, not just storage.

Useful collaboration capabilities include:

- Structured Q&A workflows that keep questions organized by topic or document

- Commenting and annotation features for efficient internal review

- Notification settings that avoid inbox overload

- Activity dashboards that show who is engaging with which documents

These features really matter once you’re in the middle of a live process — a competitive auction, a multi-round fundraise, or any transaction with several advisors and internal teams all pulling on the same set of documents.

- Pricing transparency and predictability

Look at the marketing pages, and most platforms seem alike. The differences appear when you dig into how you’ll actually be charged.

Many older providers still use per-page billing or layered usage tiers. That can work on a small, short deal, but once the document set grows or timelines slip, it becomes very hard to predict the final cost.

With usage-based pricing, you’re billed for what you actually use. That makes it easier to set a realistic budget at the start and reduces the chance of having to explain an unexpected overrun when the invoice lands.

This is where Ideals’ transparent approach is a point of differentiation.

5. Support quality and responsiveness

Support is frequently under-estimated until something breaks at 23:00 on the night before signing.

Good data room services should include:

- 24/7 live support, not just email tickets

- Multilingual coverage if you run cross-border deals

- Trained deal-room specialists who understand M&A, not just generic helpdesk staff

For high-stakes transactions, you’re not just buying software, but also a support team that can keep the deal moving when participants run into access or configuration issues.

Top virtual data room providers for 2026

The market for virtual data rooms is crowded, but a smaller set of providers tends to appear consistently in independent rankings and buyer shortlists.

Ideals – balanced choice for usability, security, and pricing

Ideals is a long-standing VDR provider focused on M&A, corporate finance, and legal workflows. It combines strong security controls with an easy-to-navigate interface for both administrators and external participants.

Key strengths:

- Transparent usage-based pricing

Usage-based pricing simplifies budgeting and helps prevent unexpected costs at closing.

- Intuitive user experience

Ideals keeps setup simple: fast folder import and easy user or permission changes, no training needed. And when security matters, you can lock files down with two-factor login, IP restrictions, watermarks, and screenshot-protected viewing.

- 24/7 multilingual support

Dedicated support teams can assist with setup, structure, and live deal issues, which is valuable when counterparties are in multiple time zones.

For organizations that want a single secure virtual data room platform across corporate development, legal, and portfolio companies, Ideals is a pragmatic first candidate.

Datasite – enterprise M&A specialist

Datasite is widely recognized among investment banks and large advisory firms. It is designed to handle complex, high-volume M&A transactions where advanced automation and analytics can save significant time.

When Datasite stands out:

- AI-driven tools for redaction and document analysis

- Strong reputation on very large or multi-jurisdictional deals

- Features tailored to buy-side and sell-side processes in corporate finance

The trade-off is that pricing can be more complex and sometimes higher than newer platforms, particularly for smaller projects or organizations with limited deal flow.

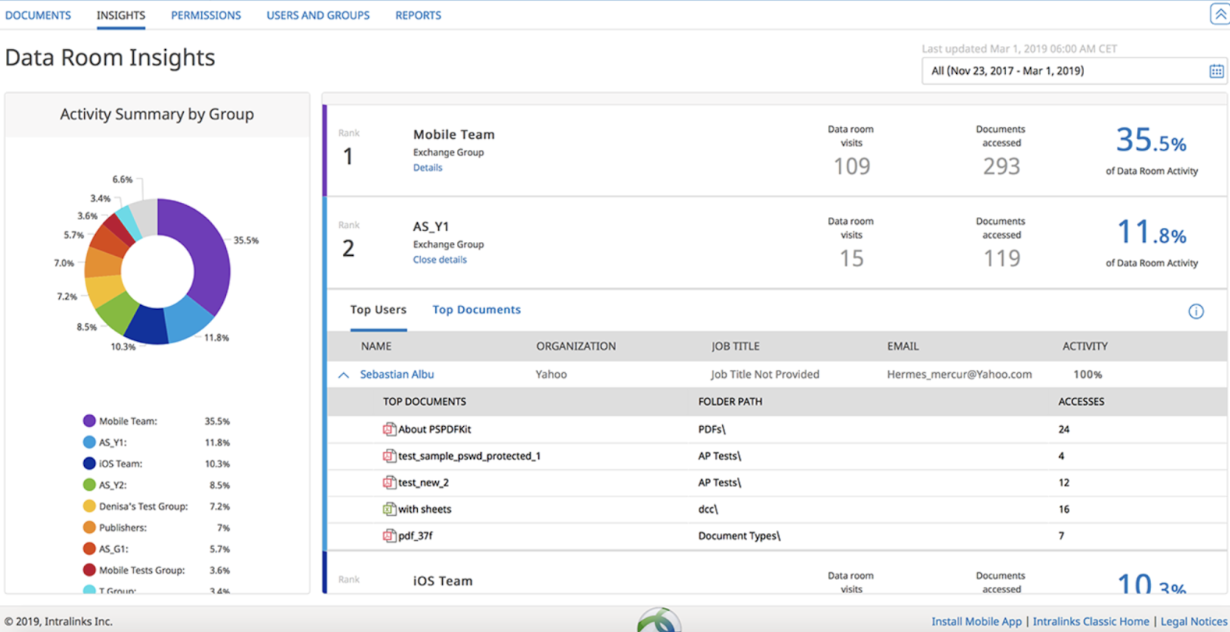

Intralinks – established enterprise VDR

Intralinks is one of the oldest data room providers and remains widely used by large, regulated institutions.

Typical scenarios:

- High-profile transactions where familiar enterprise vendors are preferred

- Institutions with existing processes tightly integrated around Intralinks

- Transactions that require detailed audit trails and conservative risk postures

In many geographies, Intralinks is perceived as a premium option, with corresponding expectations around price and implementation timescales.

Firmex – repeat usage and compliance-heavy work

Firmex focuses on scenarios where organizations run many recurring projects rather than a small number of one-off mega-deals.

It is often used for:

- Ongoing compliance and regulatory reporting

- Portfolio monitoring for private equity and infrastructure funds

- Recurring audits across multiple business units

Key characteristics include straightforward administration, strong audit trails, and pricing models that suit continuous rather than episodic use of a virtual data room.

Digify – accessible option for smaller teams

Digify serves organizations that need more control than consumer-grade file sharing but don’t require the full complexity of an enterprise platform.

Best suited for

- Startups and smaller companies preparing investor materials or running a focused, limited-scope due diligence

- Professional services firms conducting targeted document reviews

- Teams looking for a streamlined online data room with document tracking and basic analytics

It is a meaningful step up from generic cloud folders for small to mid-sized projects.

Other notable data room vendors

Depending on region and sector, you may also encounter:

- Ansarada – with deal readiness tools, AI-driven risk scoring, and checklists

- SecureDocs – flat-fee simplicity popular with mid-market companies

- Broader collaboration tools, such as Box or Citrix – convenient as they can be locked down and used as simple data rooms in some situations

- Specialist tools like CapLinked or DealRoom – especially suitable in cases where the workflow is tied to a specific industry or deal style

Taken together, these options are a reminder that it’s worth running a short, structured review rather than defaulting to the first name you recognise. A bit of comparison up front usually saves money and headaches later.

Pricing: What to look for in a virtual data room price comparison

When you compare virtual data room providers, it’s easy to focus only on headline prices. In practice, you should map out how pricing behaves over the full life of a project.

Common models include:

- Per-page pricing

A legacy model where each uploaded page incurs a fee. This can be manageable on small datasets, but becomes unpredictable on large or extended transactions, especially if the dataset grows during due diligence. - Per-user or per-admin pricing

Works reasonably well if the number of internal users is stable, but can become complicated where many external advisors, bidders, or consultants require access. - Storage-based pricing

Charges based on GB used, sometimes with additional fees for rich media or heavy bandwidth consumption. This structure can be attractive for document-light projects but needs careful monitoring. - Flat-rate or usage-based pricing

A more modern approach, where you purchase capacity or a subscription and allocate it across multiple projects. For teams with repeat deal flow, this improves predictability.

When benchmarking providers, make sure your virtual data room price comparison includes:

- Assumptions on the number of documents and users

- Estimated project durations plus likely extensions

- Archive access needs after closing

- Scenarios where the deal scope expands, and more data must be uploaded

How to choose the right provider for your situation

The “best” online data room providers depend more on your context than on any single rankings table. A practical way to narrow the field is to ask five questions:

- What does your deal pipeline look like?

- A few large, complex M&A deals each year may justify the use of enterprise-level tools.

- Many small and mid-sized projects may favor flexible, usage-based platforms like Ideals.

- Who are your counterparties?

- Experienced PE sponsors and banks can adapt to nearly any VDR.

- Family-owned businesses, management teams, and first-time founders usually cope better with a simple, clean interface than with an overloaded one.

- What are your regulatory and internal security requirements?

- Industries such as financial services, healthcare, and infrastructure may need specific certifications or data to be hosted in certain locations.

- Internal security policies may also limit which virtual data rooms you’re actually allowed to use.

- How integrated should the data room be?

- Some teams want tight links to CRM, archive, or workflow tools.

- Others prefer to keep the data room as a standalone, controlled environment.

- How important is pricing predictability?

- If you struggle with budget approvals, avoiding per-page surprises may be critical.

- If cost is secondary to brand recognition or existing relationships, enterprise platforms may still be the default.

Key takeaways

- A dedicated virtual data room is now standard infrastructure for serious transactions. Generic cloud storage cannot match the control, auditability, and security required by sophisticated counterparties.

- When comparing data room vendors, go beyond basic feature lists. Focus on security posture, usability for non-experts, and the quality of ongoing support.

- Pricing structures differ significantly. Understanding per-page, storage-based, and usage-based models is crucial.

- Ideals stands out as a balanced choice: strong security, an intuitive interface, 24/7 support, and transparent pricing that prevents legacy surprises.