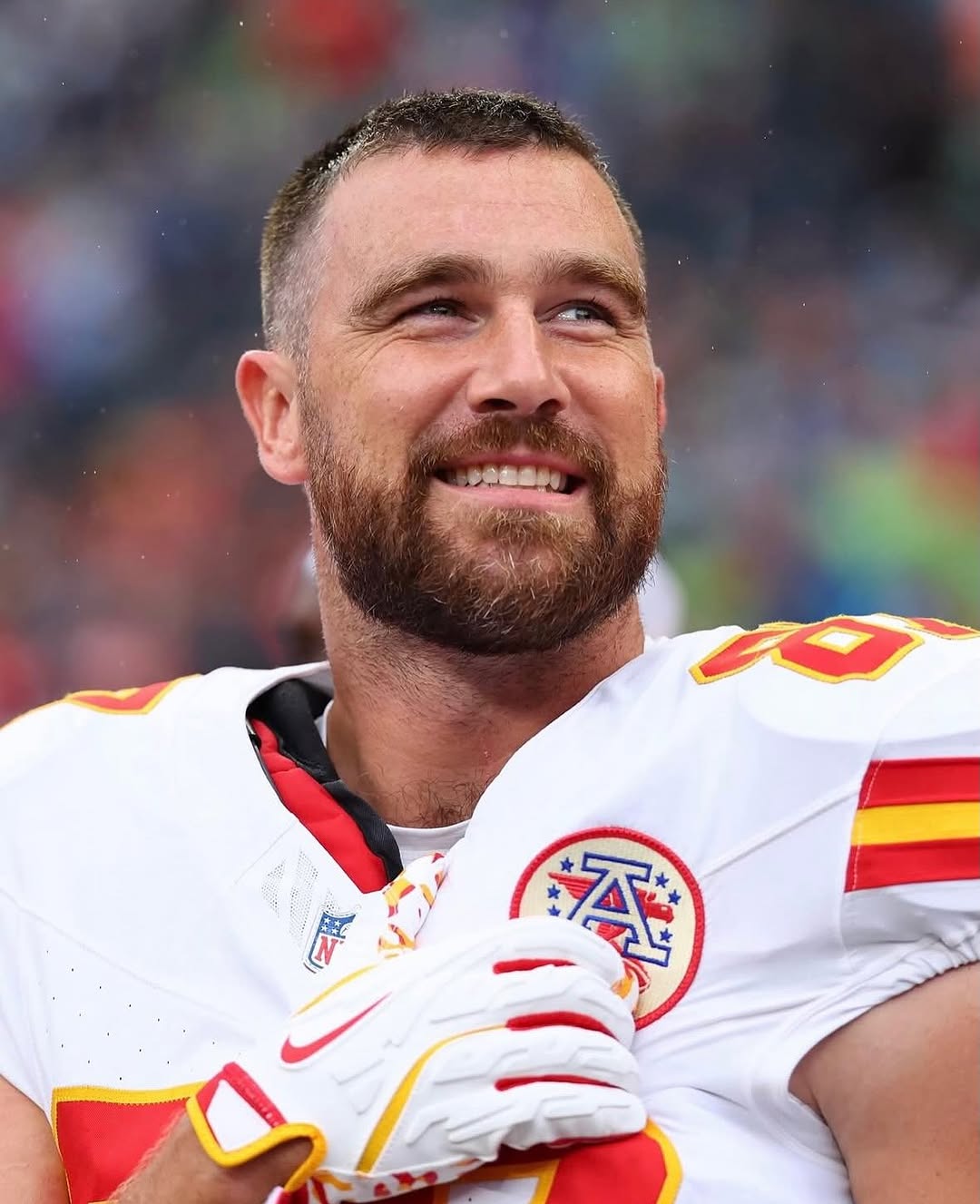

When three-time Super Bowl champion Travis Kelce announced on 21 October 2025 that he had joined forces with hedge fund JANA Partners and other executives to take a roughly 9 % economic stake in Six Flags Entertainment Corporation (NYSE: FUN), the markets responded with a surge of nearly 18 % on the day. This investment marks a pivotal shift in Kelce’s journey, from elite athlete to strategic investor, and underscores how today’s sports stars are redefining their business playbook.

From End Zone to Boardroom: How Kelce Built His Investment Empire

Kelce’s off-field portfolio spans consumer brands, hospitality, real-estate and now public-company activism. A breakdown:

-

Amusement parks: The Six Flags deal positions Kelce in 42 park-properties across North America, including Ohio’s iconic Cedar Point and Missouri’s Worlds of Fun.

-

Restaurant/hospitality: In Kansas City, Kelce partnered with quarterback Patrick Mahomes and Noble 33 to launch steakhouse “1587 Prime,” inserting himself into the fine-dining circuit. Business Insider

-

Media & content: He and his brother Jason Kelce co-host the “New Heights” podcast, which has become a major media asset in its own right.

-

Consumer-brand ventures & endorsements: Before the Six Flags move, Kelce invested in brands such as Garage Beer, smart-wear menswear retailer Indochino and others as part of a diversified consumer-brand strategy.

-

Real estate assets: He owns a high-end home in Leawood, Kansas, and other properties, blending lifestyle and investment value.

Also notable: his engagement to pop-star Taylor Swift in August 2025 has amplified his brand-reach and may indirectly boost consumer-facing ventures.

Did Travis Kelce Invest in Six Flags?

How Did Travis Kelce Get So Rich?

Kelce’s ascent is rooted in a blend of athletic performance, global brand recognition and smart diversification:

-

NFL earnings – His elite tight-end status and multiple Super Bowl wins formed a lucrative base.

-

Endorsements & global appeal – Kelce earns from major brands and benefits from high-visibility moments (including his relationship with Taylor Swift).

-

Business ventures – Rather than treating side gigs as hobbies, Kelce has actively built diverse business lines across hospitality, media, consumer goods and now publicly-traded activism.

-

Reinvestment strategy – He leverages his capital into ventures with scale, brand synergy and growth potential rather than purely passive bets.

In short: Kelce’s wealth is no accident, it’s the product of disciplined earning, brand elevation and strategic placement in high-visibility growth plays.

What Real Estate and Lifestyle Holdings Does He Own?

While his business dealings grab headlines, Kelce’s real-estate holdings offer a stable foundation:

-

His Leawood, Kansas mansion: luxury home with six bedrooms, pool, outdoor kitchen and golf-course access.

-

Additional investment homes in Florida that blend personal lifestyle, rental upside and long-term asset value.

These properties reflect a typical athlete-turn-investor move from liquid performance income into tangible asset classes.

Investment Strategy Decoded: Why This Move Matters

This is not just another celebrity branding play, it’s a sophisticated financial and strategic maneuver:

-

Activist investing: By joining JANA Partners in a major stake of a public company, Kelce enters the world of shareholder activism, not mere celebrity endorsement.

-

Turnaround potential: Six Flags is under pressure attendance down, weather headwinds, a significant loss in the first half of the year—making this a higher-risk, higher-reward proposition. AP News

-

Brand resonance: For someone who grew up in Ohio going to Cedar Point and now plays in Kansas City, the park-business link is authentic. That authenticity strengthens consumer and media appeal.

-

Diversification: Whereas many athletes invest in restaurants or tech startups, Kelce’s move into a major public-company stake adds a layer of diversification into enterprise-scale investing.

-

Timing and visibility: The investment news itself produced a market re-rating; whatever happens next, Kelce’s role in this story boosts his investor-profile significantly.

What to Watch in Late 2025 and Beyond

For those following Kelce’s business journey or considering similar athlete-investor models, key benchmarks include:

-

Six Flags’ board/management response: Will the company make changes in line with the investor group’s plans?

-

Attendance and revenue recovery: Leisure businesses depend on consumer spending, weather, macro-cycles—if Six Flags normalises these, returns could follow.

-

Kelce’s next moves: Will he further scale into public activism, consumer brands or alternate asset classes?

-

Media/brand interplay: His high-profile with Taylor Swift and global reach gives unique leverage in consumer ventures—how will that translate in his business playbook?

Final Financial Perspective

Travis Kelce’s investment in Six Flags marks a compelling evolution from elite athlete to investor-enterpreneur. By using his brand, capital and network to secure an activist stake in a public company, he demonstrates how today’s sports stars can become serious players in the business world. For consumers, the story offers more than star power it reveals the blueprint of how brand, business and diversification intersect. For investors, it signals that personal brand combined with strategic capital can move markets. Kelce’s ride may well be a roller-coaster—but one built on financial forethought, not just thrills.