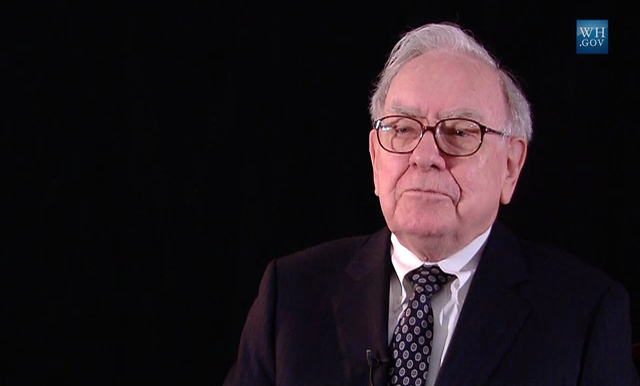

The Unprecedented Gift: A $6 Billion Statement from Warren Buffett

In a move that reverberates far beyond the world of finance, Warren Buffett has just made his largest single philanthropic donation to date: a staggering $6 billion in Berkshire Hathaway Class B shares. This monumental gift, distributed across five key foundations in June 2025, elevates Buffett's lifetime giving to an astonishing over $60 billion. It's not merely a donation; it's a profound declaration, cementing his status as perhaps the most impactful philanthropist in modern history.

The 12.36 million Class B shares were strategically allocated:

- 9.43 million shares flowed to the Bill & Melinda Gates Foundation, the cornerstone of his philanthropic endeavors.

- 943,384 shares were directed to the Susan Thompson Buffett Foundation, honoring his late wife.

- 660,366 shares each were distributed to the Howard G. Buffett Foundation, Sherwood Foundation, and NoVo Foundation—each championed by one of Buffett’s adult children, reflecting their individual passions and leadership.

Remarkably, even after this colossal transfer, the 94-year-old "Oracle of Omaha" retains a substantial 13.8% ownership stake in Berkshire Hathaway. This preserves his enduring financial influence and strategic oversight within the $1.05 trillion conglomerate he has masterfully built and led since 1965.

Legacy Unveiled: The Strategic Calculus of a Philanthropic Titan

The sheer scale and timing of Warren Buffett’s recent $6 billion donation adds gravity to a pivotal moment in his legendary career: Buffett has announced he will retire as CEO of Berkshire Hathaway at the end of 2025. At 94, his decision marks the beginning of a carefully orchestrated leadership transition—but not a complete departure from the company he’s led since 1965. In a recent interview with the Wall Street Journal, Buffett made it clear: “I’m not going to sit at home and watch soap operas.” Instead, he plans to continue contributing his market insights and decision-making skills from Berkshire’s Omaha headquarters.

Consider the deliberate shifts in his personal governance:

- A Revised Will for Global Impact: In 2024, Buffett famously rewrote his will, enshrining that an extraordinary 99.5% of his remaining wealth will transition into a charitable trust upon his passing. This isn't just about charity; it's about optimizing the deployment of capital for societal good on an epic scale.

- Empowering the Next Generation: His children—Susie (71), Howard (70), and Peter (67)—are designated to oversee this vast trust. Their mandate is clear: they must unanimously agree on and distribute the funds over approximately a decade. This model ensures both rigorous governance and the flexibility to adapt to evolving global needs, all while upholding Buffett’s core philanthropic values.

- A "Spend Down" Philosophy: Buffett has openly stated that his support for the Gates Foundation will conclude after his death. This isn't a retraction of commitment but a strategic signal that he is empowering existing, highly effective organizations now, rather than accumulating wealth indefinitely within his own estate for optics or an ambiguous future.

This strategic shedding of direct control over his fortune, while retaining substantial influence at Berkshire, is a masterclass in governance by design. It's a pragmatic and powerful illustration of transitioning from a lifetime of wealth creation to an active, intentional phase of global wealth distribution.

The Buffett Playbook: Precision Philanthropy in Action

Buffett's philanthropic philosophy has always been characterized by its pragmatism, humility, and unwavering focus on impact. Eschewing the creation of his own massive foundation, he has consistently channeled his monumental wealth through established organizations already equipped with proven infrastructures and expertise.

The Bill & Melinda Gates Foundation, his primary beneficiary, stands as a testament to this strategy, leveraging its vast resources to combat global health crises, reduce poverty, and advance education. This model reflects Buffett’s conviction that scaling existing solutions is often more effective than reinventing the wheel.

His family's foundations—each receiving significant portions of his wealth—further underscore his diversified approach to impact:

- Susan Thompson Buffett Foundation: A steadfast focus on reproductive health and access to education.

- Howard G. Buffett Foundation: Direct engagement in combating global hunger, human trafficking, and mitigating conflict in vulnerable regions.

- Sherwood Foundation: Dedicated to supporting impactful nonprofits and fostering early childhood education initiatives within Nebraska, his home state.

- NoVo Foundation: A powerful advocate for Indigenous rights and advancing gender equity on a global scale.

Each of these choices reflects not only Buffett's personal values but also his profound trust in the next generation to lead with clarity, conscience, and a commitment to measurable outcomes.

Warren Buffett with two of his children

Beyond the Gates: A Paradigm Shift in CEO Philanthropy

Buffett’s historic gift isn't an isolated event; it's a powerful accelerant in a broader, evolving trend of billionaire CEOs redefining their role in global problem-solving. From MacKenzie Scott’s disruptive, trust-based grant-making to Elon Musk’s high-profile investments in education and climate solutions, the narrative for ultra-wealthy executives is undeniably shifting from mere accumulation to strategic allocation.

Yet, Buffett’s philanthropic style remains distinct, serving as a rare model in an era where "performative giving" can sometimes overshadow genuine impact:

- Disciplined Scale: Consistent, massive donations, meticulously planned over decades.

- Operational Trust: Empowering existing, proven institutions rather than building new, parallel bureaucracies.

- Simplicity Over Spotlight: A notable absence of personal foundation galas, luxury headlines, or self-promotional interviews, prioritizing substantive impact over public adulation.

In a world increasingly scrutinizing wealth and its influence, Buffett’s approach stands out for its clarity, its quiet yet immense execution, and its profound, understated humility.

The Ultimate Investment: Letting Go With Intent

Warren Buffett once famously quipped, "The best investment you can make is in yourself." With this unprecedented $6 billion donation, he is, in essence, making the ultimate investment: an investment in humanity itself, channeled through institutions and causes he profoundly believes are equipped to outlast him and drive lasting change.

This transaction is far more than a simple transfer of financial assets. It represents a masterclass in legacy transfer, governance by design, and profound value articulation.

Whether or not he formally announces his full retirement in the immediate future, this record-breaking gift stands as a poignant, powerful punctuation mark in the final chapter of Buffett’s active stewardship of Berkshire Hathaway. It delivers a resonant message that transcends the world of billionaires and applies to every leader:

A life of true impact isn't ultimately measured by what you accumulate, but by the purpose, precision, and profound intent with which you choose to give it away.