Lehman Brothers: How a Wall Street Giant Collapsed

The Rise of Lehman Brothers

Founded in 1850, Lehman Brothers started as a modest dry goods business in Montgomery, Alabama, before evolving into one of the most influential investment banks in the world. Over the decades, it built a reputation for aggressive expansion and risk-taking, eventually becoming a key player in the global financial system with a hand in nearly every major market.

By the early 2000s, under the leadership of CEO Richard Fuld, Lehman had become a dominant force on Wall Street. But its rapid growth was largely fueled by one thing: the housing market.

Richard Fuld

The Mortgage Gamble That Broke a Giant

Lehman heavily invested in subprime mortgages loans given to borrowers with poor credit packaging them into mortgage-backed securities (MBS) and collateralized debt obligations (CDOs). These risky products were incredibly profitable during the housing boom, but dangerously unstable.

When the U.S. housing market began to crumble in 2007, Lehman was left holding billions in toxic assets. The firm had leveraged itself to dangerous levels reportedly 30:1 meaning it had $30 in debt for every $1 in actual assets. When the mortgage market tanked, that fragile foundation cracked instantly.

Related: Top 7 Biggest Business Collapses in History

No Bailout, No Buyers, No Rescue

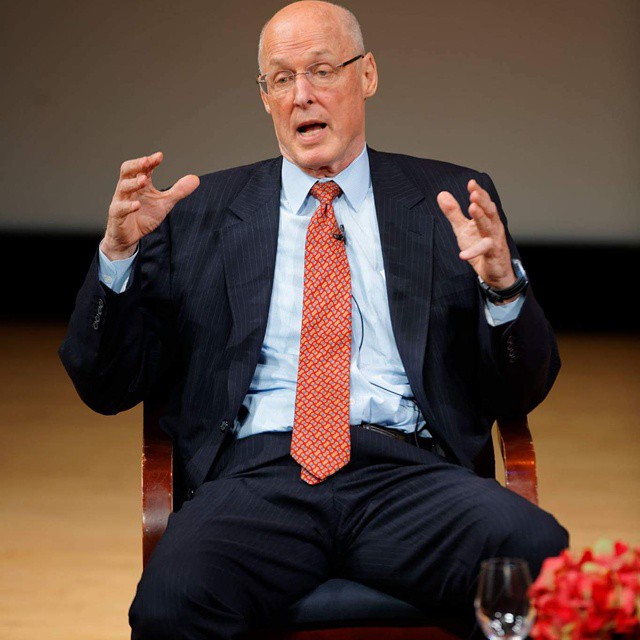

As panic spread and Lehman’s balance sheet deteriorated, the firm desperately sought a buyer. Talks with potential saviors like Bank of America and Barclays collapsed when the U.S. government, unlike with Bear Stearns, refused to bail Lehman out. Treasury Secretary Henry Paulson and Federal Reserve Chair Ben Bernanke held firm, believing the market needed to absorb the consequences of risk.

On September 15, 2008, Lehman Brothers filed for Chapter 11 bankruptcy, listing over $600 billion in assets—the largest bankruptcy filing in U.S. history. The shock was immediate: global markets plummeted, credit froze, and investor confidence evaporated.

Henry Paulson

The Aftershock Heard Around the World

Lehman’s collapse wasn’t just a financial failure it triggered a global chain reaction. Credit markets seized up, other banks teetered on the brink, and consumer confidence nosedived. The event forced the U.S. government to rush through emergency measures like TARP (Troubled Asset Relief Program) to stabilize the system.

The crisis that followed led to millions of foreclosures, lost jobs, and a deep global recession. Lehman Brothers became the cautionary tale of unchecked greed, poor regulation, and systemic risk.

Related: Booted from His Own Empire: Travis Kalanick and the Fall of Uber’s Toxic Titan

Legacy of a Collapse

Richard Fuld, once dubbed “The Gorilla of Wall Street,” became the face of financial hubris. He defended his actions in Congressional hearings but never faced criminal charges. Meanwhile, the fall of Lehman reshaped financial regulation, fueling reforms like Dodd-Frank aimed at preventing another systemic meltdown.

Today, the name Lehman Brothers is a warning: even the mightiest financial institutions can fall — fast, hard, and with global consequences.