Australia’s Billionaires: Who Earns the Most?

Australia’s billionaires are making staggering amounts of money—an average of A$67,000 per hour, according to Oxfam’s latest report. That’s over 1,300 times the average Australian’s income, highlighting the growing wealth gap in the country.

While many of these fortunes come from real estate and mining, a significant portion is also inherited, sparking fresh debate about wealth inequality and taxation policies. Oxfam has called for a 2-5% wealth tax on billionaires, arguing that even a modest levy could generate billions in public revenue.

So, who are the richest Australians in 2025, and how are they making their fortunes?

The Top 5 Richest Australians

1. Gina Rinehart – $45 Billion

- Industry: Mining

- Company: Hancock Prospecting

- Earnings: Over $5.1 million per hour

The mining magnate remains Australia’s wealthiest person, thanks to her vast iron ore empire. While Gina Rinehart and her mother, Hope Hancock, each held one-third of Hancock Prospecting shares, she did not inherit her father’s one-third shareholding. Prior to his passing, her father sold his shares, including his controlling share, which became an ordinary share upon transfer. Rinehart has since expanded Hancock Prospecting into one of the world’s most profitable mining companies.

Related: 12-Year-Old Australian Millionaire Pixie Curtis Makes a Comeback to Business

Related: Larry Ellison: The Billionaire Who Built Oracle from Scratch

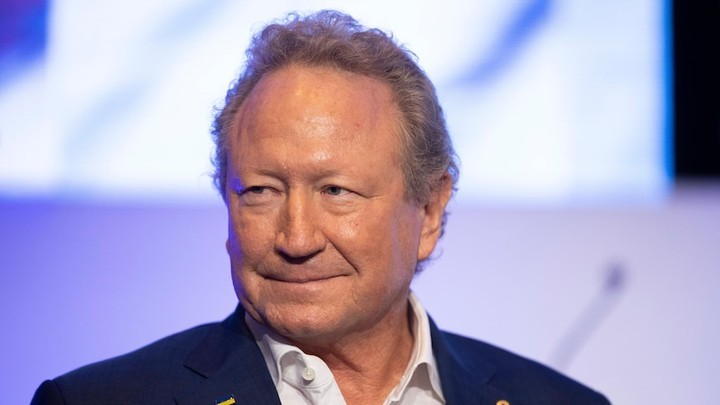

2. Andrew "Twiggy" Forrest – $25 Billion

- Industry: Mining & Green Energy

- Company: Fortescue Metals Group

- Earnings: Over $2.8 million per hour

Forrest made his fortune in iron ore but has recently pivoted towards green hydrogen and renewable energy projects. He has pledged to give away most of his wealth through philanthropy.

Related: Billionaire’s List : Africa’s Richest People in 2025

Related: Ranking Canada's Richest: The Ultimate Top 10 List

3. Mike Cannon-Brookes – $21 Billion

- Industry: Tech & Investments

- Company: Atlassian

- Earnings: Over $2.3 million per hour

As the co-founder of Atlassian, Cannon-Brookes made billions in tech. He is now a leading investor in renewable energy projects, pushing for Australia to transition away from fossil fuels.

4. Scott Farquhar – $20 Billion

- Industry: Tech

- Company: Atlassian

- Earnings: Over A $2.2 million per hour

Farquhar, the other half of Atlassian, has also built his fortune through software. Like his co-founder, he is actively investing in green initiatives.

5. Anthony Pratt – $19 Billion

- Industry: Manufacturing & Recycling

- Company: Visy Industries

- Earnings: Over A$2.1 million per hour

Pratt’s fortune comes from recycling and packaging, making him one of the wealthiest figures outside of mining and tech. His company, Visy, is a global leader in sustainable packaging.

Why Is Australian Billionaire Wealth Growing So Fast?

1. Mining & Real Estate Dominate

Most of Australia’s richest individuals owe their fortunes to natural resource extraction and property investments, industries that have historically benefited from colonial land ownership and minimal taxation.

2. Inheritance & Privilege

Oxfam reports that 35% of Australian billionaire wealth is inherited, reinforcing generational wealth gaps. Meanwhile, one-third of First Nations peoples remain in the poorest 20% of the population.

3. Minimal Taxation on Wealth

Despite their massive earnings, billionaires often pay lower tax rates than everyday Australians. Oxfam argues that much of their wealth is “unearned privilege” and should be taxed to fund public services.

Should Australia Tax Billionaires More?

Oxfam’s report suggests that a 2-5% wealth tax could bring billions into Australia’s economy, funding schools, hospitals, and housing. Billionaires would still remain extraordinarily wealthy, but the tax could help bridge the growing inequality gap.

With some experts predicting that the world’s first trillionaire will emerge within a decade, the debate over taxing the super-rich is only just beginning.

What do you think? Should Australia introduce a billionaire tax?