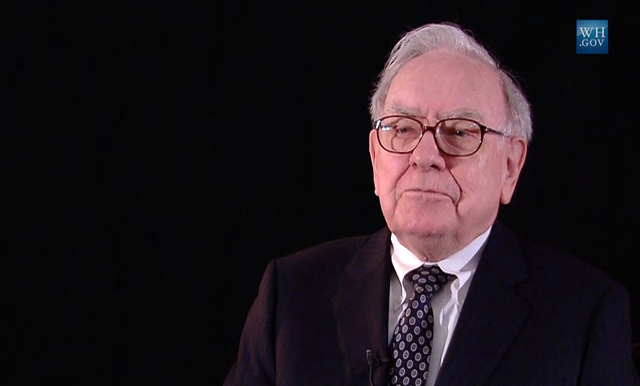

Is Warren Buffett Losing Faith in Stocks? What His Latest Moves Tell Us About the Market

Warren Buffett, the world’s most renowned investor, has long been regarded as a beacon of optimism in the world of finance. Known for his value investing principles and patient approach to building wealth, Buffett has become synonymous with belief in the power of the stock market to generate wealth over the long term. However, recent actions from Buffett and his company, Berkshire Hathaway, suggest a more cautious outlook than usual. So, is the "Oracle of Omaha" losing faith in stocks, or is he simply being more selective in the face of changing market conditions?

Berkshire Hathaway’s Record Cash Pile: A Sign of Caution

Warren Buffett’s latest moves speak volumes about his outlook on the stock market. In the third quarter of 2024, Berkshire Hathaway reported a jaw-dropping cash reserve of $325.2 billion, a record high for the company. This marks a sharp increase from the $276.9 billion cash pile Berkshire held just a quarter ago. While Buffett has long been an advocate for maintaining ample cash reserves, this increase in cash holdings is far from ordinary, especially when it exceeds the amount of stock Berkshire owns. With this cash position, Berkshire now holds more cash than stocks, signaling a more defensive strategy than we've seen in previous years.

Buffett's cautious approach is evident in the company’s actions in recent quarters. Berkshire Hathaway has become a net seller of stocks for the eighth consecutive quarter, offloading $36.1 billion worth of stock in the third quarter alone. This move contrasts sharply with Buffett's historical approach, where the company has often been a major buyer of stocks. The $1.5 billion in stock purchases during the third quarter is a stark contrast to the $27 billion in stock repurchases Berkshire made in 2021.

Selling Off Big Positions: The Case of Apple

One of the most notable aspects of Buffett’s strategy shift is his decision to significantly reduce Berkshire Hathaway’s position in Apple, which has been one of the company’s most lucrative investments. Over the past year, Berkshire Hathaway has slashed its holdings in Apple from $170 billion to $69.9 billion. While this doesn’t suggest that Buffett is entirely abandoning Apple—still a highly profitable company—it does signal that he may believe the stock is becoming overpriced. Buffett’s decision to reduce exposure to Apple is consistent with his long-standing investment philosophy: buy low and sell high. As the stock market continues to rise, Buffett may feel that the risk-reward ratio of holding certain stocks, even top-tier ones like Apple, has shifted.

It’s worth noting that Apple is no small part of Berkshire Hathaway’s portfolio. The tech giant has represented a significant portion of the company’s equity holdings for years. The fact that Buffett is willing to part with such a large chunk of Apple stock suggests that he sees limited upside potential in the stock at current levels. Additionally, this move could be a reflection of Buffett’s desire to diversify Berkshire’s portfolio and reduce its reliance on a single company—especially as market conditions become more uncertain.

The S&P 500 and Market Valuations: Are Stocks Overpriced?

Buffett’s decision to sit on such a large cash pile is tied to his concerns about stock market valuations. The S&P 500, a key indicator of the broader U.S. stock market, is currently trading at levels that are significantly higher than historical averages. With stocks continuing to reach new heights, many experts believe that the market is becoming overpriced, and Buffett may be among those who share this view.

One of the key metrics that Buffett likely watches closely is the cyclically adjusted price-to-earnings (CAPE) ratio, also known as the Shiller P/E ratio. This ratio compares the price of the market to its long-term average earnings, adjusted for inflation. Currently, the CAPE ratio stands above 36, more than double its long-term average. Historically, when the CAPE ratio has been this high, significant market declines have often followed. In fact, markets have historically lost anywhere from 20% to 90% of their value when the CAPE ratio has exceeded 30, which serves as a red flag for Buffett and other value investors.

Beyond the CAPE ratio, other market indicators reinforce the notion that stocks may be overvalued. For instance, the U.S. Treasury yield curve remains inverted, a phenomenon that has often preceded economic slowdowns and market corrections. The inverted yield curve reflects the difference between short-term and long-term interest rates, and when short-term rates are higher than long-term rates, it can signal a recession. Combined with the M2 money supply’s decline—an indicator that has decreased for the first time since the Great Depression—these signals further suggest that the market may be due for a correction.

A Strategy of Patience: Waiting for the Right Opportunity

Despite his caution, Buffett’s heavy cash reserves should not be viewed as a sign that he is abandoning the stock market. Instead, it reflects his trademark strategy of patience. Buffett has always been an advocate of waiting for the right opportunities and being selective about the investments he makes. His massive cash pile allows him the flexibility to move quickly when the market presents favorable conditions.

Historically, Buffett has used periods of market uncertainty and downturns to scoop up undervalued stocks. For example, during the 2008 financial crisis, he famously invested $5 billion in Goldman Sachs when the bank was struggling. That investment paid off handsomely as the financial services giant rebounded. More recently, during the COVID-19-induced market crash of 2020, Buffett remained on the sidelines, preferring to keep his cash reserves intact rather than buying stocks in the midst of market turmoil. This strategic patience has paid off for Buffett, as he has consistently managed to make shrewd investments when the market conditions are more favorable.

In this context, Buffett’s current cash position can be seen as preparation for future opportunities. As the market continues to operate at high valuations, Buffett is biding his time, waiting for market dislocations that will allow him to capitalize on undervalued assets. With $325 billion in cash, Berkshire Hathaway is well-positioned to take advantage of such opportunities when they arise.

Related: Warren Buffett’s $166 Billion Warning to Wall Street

Buffett's Legacy: A Long-Term View Amid Short-Term Volatility

At 94 years old, Warren Buffett is not just planning for the next market cycle—he’s thinking about the legacy he leaves behind. While his strategy may seem conservative, it aligns with his long-term view of investing. Buffett has always advocated for buying companies that he believes have long-term value and holding them for the long haul. This mindset has made him one of the wealthiest individuals in the world, and his cautious approach in recent months is likely a reflection of his desire to ensure that Berkshire Hathaway remains a strong and profitable company long after he steps down.

Berkshire Hathaway’s massive cash pile, coupled with the reduction in stock holdings, signals that Buffett is navigating the current market with a keen sense of caution. It’s not that he has lost faith in the stock market, but rather that he believes the market is overvalued and may be due for a correction. As always, Buffett is positioning his company to take advantage of opportunities when they arise—opportunities that may come with a market downturn or dislocation.

A Cautious Yet Strategic Approach

Is Warren Buffett losing faith in stocks? While his recent moves may suggest caution, they also reflect his consistent investment philosophy of patience, discipline, and a focus on long-term value. Buffett is not one to chase the highs of an overheated market, and his $325 billion cash reserve is a testament to his belief that the right opportunities will eventually present themselves. Investors looking to follow in Buffett’s footsteps should take note of his strategy—waiting for the market to present bargains rather than buying in during a period of high valuations.

Ultimately, Buffett’s approach is not about abandoning the stock market, but about waiting for the right conditions to make his next big move. For those who have followed Buffett for decades, this cautious approach is just another part of his long-term strategy to create lasting wealth.