Billionaire Poonawalla Family Acquires £42M Grosvenor Square Property Despite UK Tax Shake-Up

The Poonawalla family, among the wealthiest in India, has cemented their reputation as key players in London’s luxury real estate market with the purchase of a historic £42 million property in Grosvenor Square. This acquisition is notable not only for its opulence but also for its timing, as the UK prepares to abolish its long-standing non-domicile (non-dom) tax regime—a move expected to impact wealthy international investors.

A Landmark Property with History

Built in 1727, the five-story, 27,000-square-foot building retains 18th-century ceilings in the style of renowned architect Robert Adam. Situated in London’s prestigious Mayfair district, the property has transitioned from an aristocratic townhouse to a diplomatic hub as the Indonesian embassy. It has remained vacant for years but has been used to host exclusive events, making it a highly sought-after "blank canvas" for redevelopment.

Marketing materials describe the property as one of the "last remaining buildings from the square’s original date of construction," offering immense potential for commercial or luxury residential use.

The Poonawallas’ Growing London Portfolio

This acquisition follows the Poonawalla family’s 2022 purchase of Aberconway House, a 25,000-square-foot mansion around the corner in Mayfair. Bought for £138 million, it became London’s second-most-expensive residential transaction. The latest Grosvenor Square deal reinforces the family’s strong foothold in one of the world's most prestigious property markets.

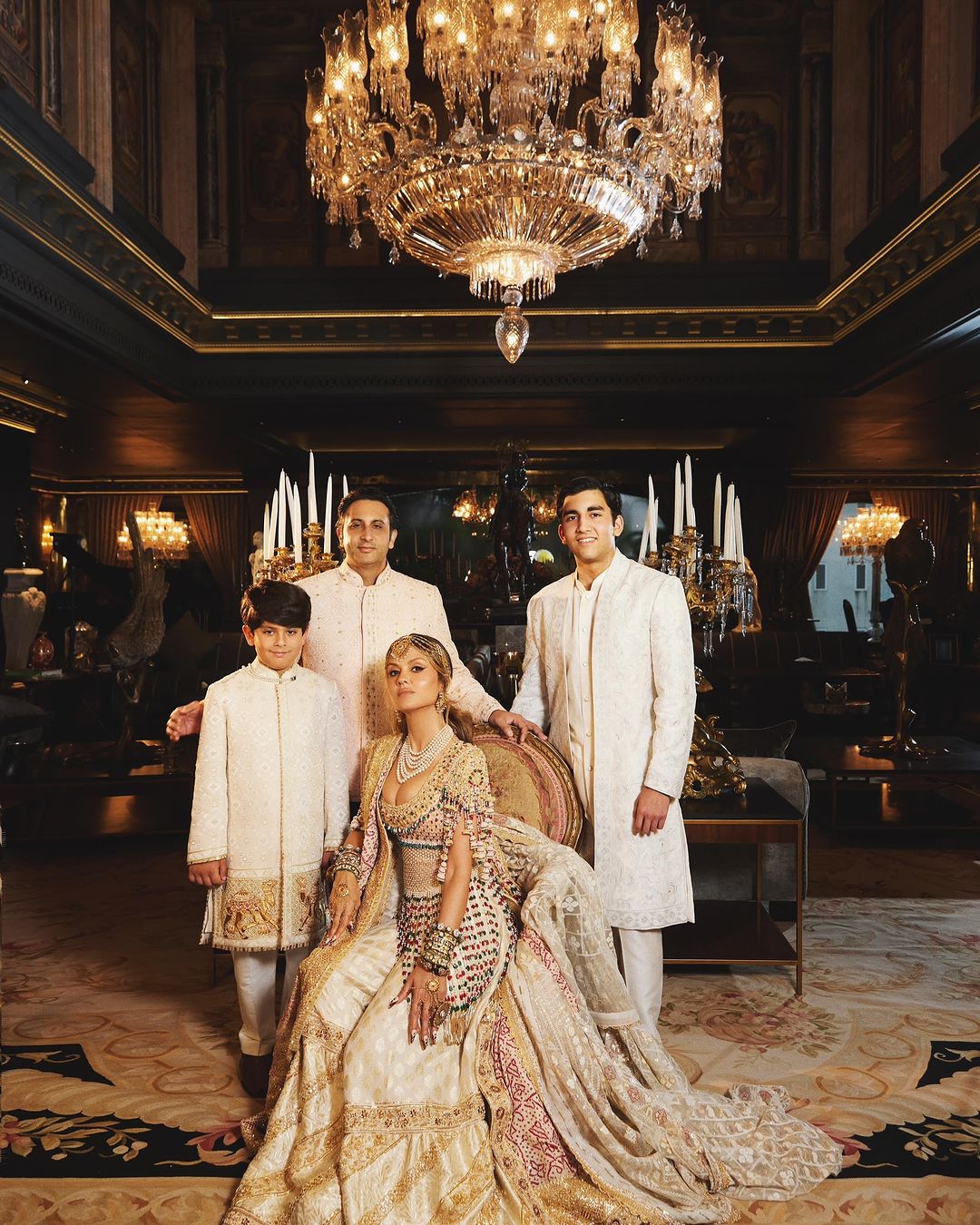

UK public records reveal that Grosvenor, the property company owned by the Duke of Westminster, granted a long lease for the building to Phinity Developers Ltd., a company controlled by Natasha Poonawalla. Natasha, a fashion influencer and executive director at the Serum Institute of India, finalized the purchase in May 2023.

Related: Cyrus Poonawalla: A Life Defined by Innovation, Impact, and Influence

Balancing Luxury with Tax Policy Concerns

The acquisition has drawn attention not only for its scale but also for its context. The UK government’s plan to abolish non-dom tax status by 2025 threatens to deter wealthy international investors, including families like the Poonawallas. The non-dom regime allows UK residents with permanent homes abroad to avoid UK taxes on international income and gains.

Adar Poonawalla, who leads the family’s vaccine business, expressed concerns about the changes earlier this year in an interview with the Financial Times. “The policy should be such that it encourages individuals to come and invest and stay in the UK. Instead of doing that, you’re making rules which would make people stay away,” he said.

Although Adar himself is unaffected due to limited time spent in the UK, he acknowledged that his wife Natasha could lose the tax benefits. Despite these challenges, the family remains committed to investing in London, with Adar stating, “Some people are willing to pay that cost like I am, but most others aren’t… They can easily move out.”

Related: Mauricio Umansky: A Real Estate Mogul Transforming Luxury Living

The Serum Institute: A Global Legacy

Beyond their real estate ventures, the Poonawallas have made a lasting impact on global health. The Serum Institute of India, founded by the family, is the world’s largest vaccine manufacturer. It played a pivotal role during the COVID-19 pandemic by producing hundreds of millions of doses of the Oxford/AstraZeneca vaccine.

The family’s deep ties to the UK extend to their significant investments in vaccine research and production facilities in Oxford, further enhancing their global reputation. Natasha Poonawalla, known for her philanthropic work and bold fashion choices, balances her high-profile public life with her executive role at the Serum Institute.

Related: India’s Richest: Wealth Reaches Record-Breaking $1.1 Trillion

Grosvenor Square: A Symbol of Prestige

The Grosvenor Square property exemplifies the blend of history and exclusivity that defines Mayfair. As one of the last remaining original buildings on the square, it holds historical significance while offering redevelopment potential for the future.

Although the property’s intended use remains undisclosed, its prime location and historic charm ensure that it will be a crown jewel in the Poonawalla family’s portfolio.

The Poonawallas’ latest investment underscores their confidence in London as a global hub for wealth and opportunity, even amid uncertainties surrounding tax reforms. By acquiring one of Grosvenor Square’s most iconic properties, they reaffirm their place among the elite families shaping the city’s luxury property market.