The US dollar will be an important player in the global financial landscape in 2023.

Its rally against major currencies, especially in the late summer and early fall, indicates a strong inflow of foreign capital into the US economy. Decision-makers need to be vigilant; currency strength reflects the global influx of funds, a key indicator for multinational corporations to gauge their financial standing.

Central bank policies are sacrosanct in this rapidly evolving financial climate. As of the latest Federal Reserve meeting, minutes indicate a hawkish stance, fueling conversations about future rate hikes. And it's not just about keeping an eye on Federal Reserve actions—globally, central banks like the ECB (European Central Bank) are also making bold moves that affect currency valuation. CEOs must be agile in their strategies to account for these global shifts.

Political instability, particularly in regions like the Middle East, also factors into the dollar's strength. CEOs of today cannot afford to view currency management as solely an economic endeavour; it's a multidimensional chessboard that requires a detailed understanding of geopolitical considerations.

Treasury Management and the U.S. Dollar

Source - CNBC US 10 Year Treasury Yield

The US dollar remains the linchpin of global finance, bolstered by a resilient US interest rate environment, currently hovering around 5.5%. This stability has elevated the currency to a "safe harbour" status amid geopolitical and economic uncertainties, such as China's economic slowdown. For CEOs and high-level professionals, tools like MetaTrader 4 (MT4) become valuable for real-time market analysis and trading in this context.

MT4's advanced technical indicators provide insights that are key to optimizing treasury management strategies, particularly when dealing with currency pairs involving the US dollar. As Federal Reserve minutes point towards a hawkish monetary policy, executives must consider how rising rates—reflected in the 10-year Treasury yield touching 4.99%—impact capital allocation decisions like M&A and share buybacks.

Currency Dynamics and Risk Management: The Yen and Yuan

Source - Barchart.com

Japan's intervention in stabilizing the yen, involving a sum exceeding 1 trillion yen, serves as a case study in proactive currency risk management. Here again, platforms like MT4 can facilitate real-time tracking of currency pairs like USD/JPY, enabling more timely and informed decisions.

On the flip side, China's yuan presents a more complicated narrative. Its current peg against the US dollar stands at 7.3105, reflecting a complex interplay of economic and geopolitical factors. MT4's capability to integrate expert advisors (EAs) for automated trading can assist in executing predefined strategies in response to such market complexities.

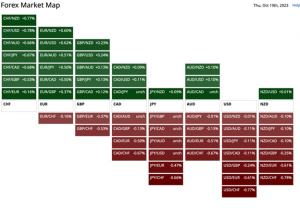

Market Data and Metrics

The US Dollar Index (DXY) currently at 106.22, which measures the dollar against a basket of six major world currencies, is projected to rise, fueled by robust US consumer price data. This granular metric should be central to any CFO's dashboard in an era where data-driven decision-making is not an option but a requirement.

A robust currency risk assessment has never been more vital for corporations with significant exposure to the euro and Australian dollar, which have weakened to $1.06 and $0.63, respectively.

Geopolitical Factors and Inflationary Trends

While economic indicators are critical, the role of extrinsic factors like geopolitical instability cannot be underestimated. A conflagration of tensions in the Middle East has bolstered the dollar's position as a safe-haven currency, necessitating a reevaluation of currency risk from a geopolitical standpoint.

Concurrently, rising global inflation rates, now at 3.2%, have a bifurcated impact. While they lead to increased costs for companies in the energy, agriculture, and manufacturing sectors, they also present opportunities for revenue enhancement if firms can transfer these additional costs to the end consumer.

*Source: https://www.imf.org/en/Publications/WEO

Regulatory Landscape and Market Sentiment

On the regulatory front, proposed changes like MiFID III in Europe and prospective tax reforms in the US could significantly alter the dynamics of currency trading and corporate repatriation strategies.

These developments highlight the need for an adaptive regulatory strategy that can respond to changes in real-time. Market sentiment, often shaped by financial press and analyst outlooks, can be volatile but exerts considerable influence over currency values. Hence, constant monitoring of these channels is advised for timely and informed decision-making.

*Source: https://www2.deloitte.com/content/dam/Deloitte/lu/Documents/financial-services/lu-rna-mifid-r-iii-finally-coming.pdf

Conclusion

The current financial landscape, punctuated by the US dollar's rally, demands an intricate understanding of economic, geopolitical, and regulatory factors. The importance of data-backed strategies coupled with a proactive approach to risk management is paramount. The objective is not merely to adapt but to strategically position the organization to capitalize on these trends, thereby gaining a competitive edge.