Sugi is the UK’s first app to track the carbon impact of investments. How did you come up with the idea?

My background is a combination of corporate finance and sustainability. At the start of my career, I structured private investment funds. Then I worked with several global green finance organisations, helping the private sector invest in sustainable development.

All the focus was on the big players, like development banks and institutional investors. But this approach will never be enough to make a real difference. We need a change of behaviour across the board. Individual investors, and the vast pool of private capital they control, must shift to green too. That’s why I started Sugi.

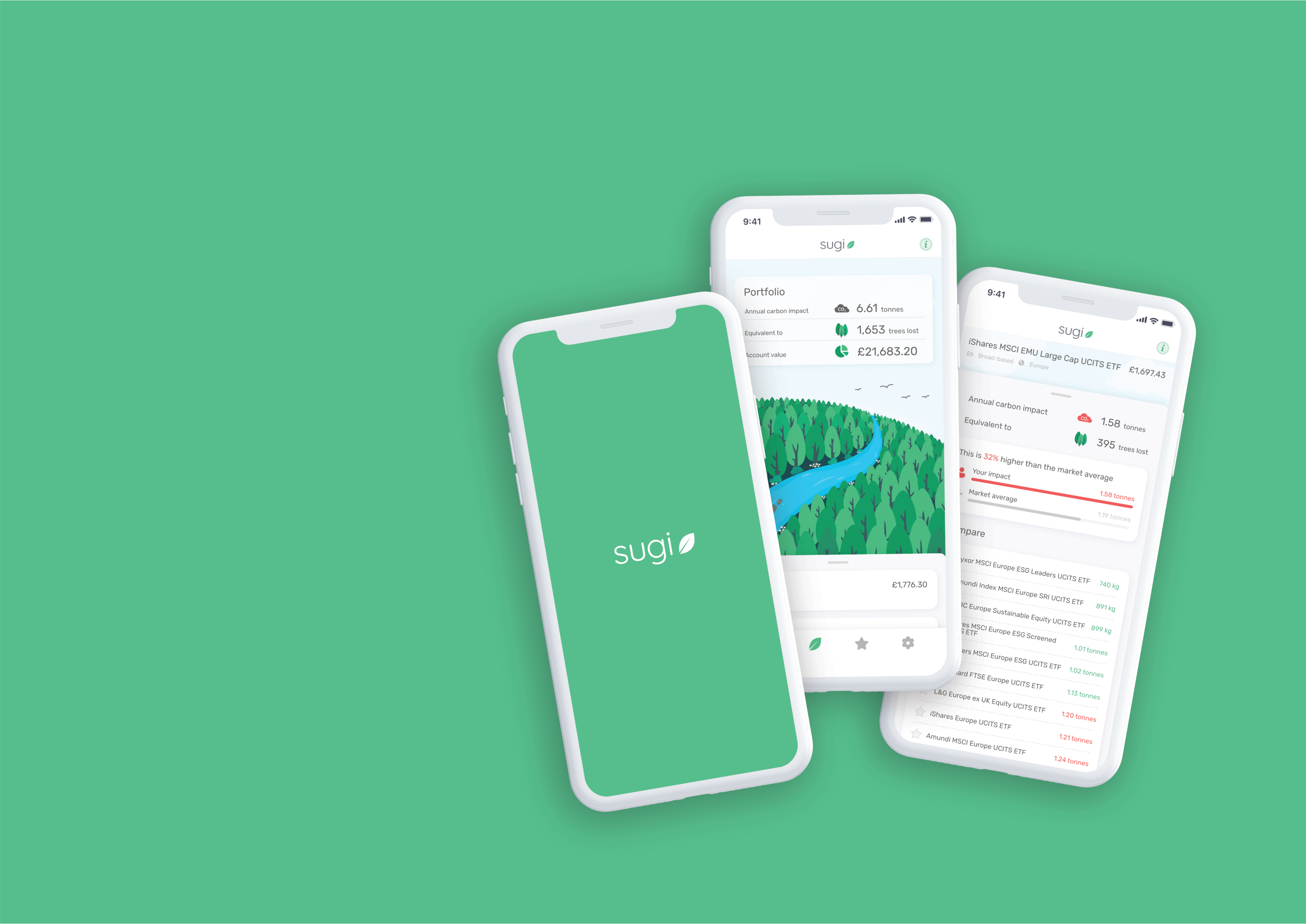

Sugi is designed specifically for retail investors and gives them a completely new way to engage with green investing. We don’t sell investments. Instead, people can connect their existing investment portfolios, see how green their investments are and take action to improve their environmental impact.

What sparked your own passion for protecting the environment? How did you decide to turn into a career?

I spent some of my childhood in Palo Alto, California, and one of my strongest memories is visiting the phenomenal redwood forests outside San Francisco. I’ve been a bit of a tree hugger ever since. Somehow, I found myself in corporate law after university. I realised pretty soon that this wasn’t for me, but during that time I encountered one of the first environmental investment funds. I was hooked by the idea that private money could be harnessed for such a positive mission. I left law fairly soon after that, took a Masters degree in Environmental Technology and have been working in conservation finance ever since.

Do you think Sugi has what it takes to transform green investing?

Absolutely! Survey after survey shows that most people want their investments to have a positive environmental impact. But very few actually engage with green investing, mainly because it’s overly complicated and confusing and the information people want isn’t available. We’re here to change that.

We provide objective, reliable data - sourced from S&P Trucost - so that investors can get a sense of their portfolios’ overall carbon impact. We also show industry benchmarks and similar investments for comparison. And it’s not just carbon - we’re developing more metrics and more features to give our users a fuller environmental picture of their investments. We’re trying to make it as easy as possible for investors to build greener portfolios.

In today’s climate, where every company is making commitments to becoming greener in order to appeal more to both customers and investors, how can we distinguish the ones who are truly committed to the environment from the ones that are using ‘greenwashing’ strategies?

There’s a lot of greenwashing out there and researching an investment can involve a bit of detective work. Some listed companies have been externally audited, for example by CDP (Carbon Disclosure Project), and you can view the results on CDP’s website. For more detail (or if a company hasn’t been audited), you can check the company’s impact report, often published on its website. Of course, such reports are produced internally and should be read with a critical eye.

A good place to start is checking whether the company is reporting on issues that are important for its sector. It’s also important to differentiate between intention and action. Ultimately, it’s what a company does in real terms - not what it promises - that matters. Scrutinise the numbers too: how much of the company’s capex is being dedicated to improving its environmental performance?

Increasingly, whether a company’s activities align with the 1.5℃ target is a measure of that company’s green credentials. While this can be hard to ascertain, if a company can demonstrate that its activities are aligned with the target, it’s an encouraging sign.

Survey after survey shows that most people want their investments to have a positive environmental impact. But very few actually engage with green investing, mainly because it’s overly complicated and confusing and the information people want isn’t available. We’re here to change that.

Be sure to look at how the company measures its carbon impact. Some companies don’t release data on their emissions, which could be a red flag. However, even when the data is provided, certain emissions may be hidden. Quite often, a company omits its scope 3 emissions - that is, indirect emissions that occur in a company’s value chain (from suppliers to end-users), which distorts the picture.

Finally - and we may be biased - download Sugi. Our data covers end-to-end carbon emissions data - including scope 3 emissions - to give the full picture of around 15,000 listed equities and a large number of managed funds, investments trusts and ETFs. Our data supplier, S&P Trucost, has been a world leader in environmental data and analysis for over 20 years.

What are your main goals for the app?

Ultimately, we’d love for Sugi to play a part in combatting climate change by helping a large number of investors make greener choices. In the short term, we’re focusing on developing a host of new features to help people understand - and reduce - their impact. There’s been a lot of international support for Sugi, especially across Europe, so longer term, we’ll be looking at international expansion.

Has Sugi launched now and why should more investors consider using it?

The app is already available on iOS through our public beta (sign up at https://sugi.earth/). We're launching on the App Store in the spring, with Android soon to follow.

If you have an online ISA, SIPP or trading account, it’s really easy to check your environmental impact with Sugi. And the app is free to use. We’d love for you to join us on this exciting journey and together we can make a real difference.