Almost all start-ups pivot at some point in their evolution, but only a few are successful. A common myth in the industry is that altering the product or its positioning will make the business pivot; just focusing on the product will limit the degrees of freedom and constrain execution.

Deciding When to Pivot

Although this is part art and part science, there are some key questions to be considered to inform this critical decision. The first criteria to assess is the traction i.e., the target market, the response to the product in that market, the ability to reach that market and at a velocity that is optimised for capital and resources. If the answers to more than two appear to be sub-optimal, chances are that the company needs to consider a pivot. In simple words, it means that your product might not be solving the right problems, not reaching the right people facing the intended problems or that the route to reach those specific people is not correctly configured. Hitting stagnation, playing catch up or losing market share are consequences of a business posture right for a business pivot.

There are a few additional indicators to analyze before a company embarks on a pivot.

Market Crowding

The original product idea might have made sense at a certain given point in time but is quickly replicated by others. Larger companies could throw more capital, resources and execution capacity at the same idea, while many different start-ups come in and reach the same target market with very similar messaging. This situation will lead to rethinking how you could beat the competition by doing something different.

Asset Performance

Another sign is that if some of your organisational assets perform a lot better than other parts of the business (e.g., a few products or features of a product gather momentum in specific markets and customers), it may be time to focus on accelerating momentum through a heightened focus on those aspects. At times, a single feature can become the entire product focus and at other times, the initially conceived product could be positioned as a premium feature as the product extends to solve broader problems.

Customer Responses

In my experience, customers tend to respond well to beta testing, product demos and even freemium models creating misleading momentum. They even say that they are keen on the product and would be willing to pay for it. But when it comes to committing funds for the product, they stall the decision or even back out. This is the time to introspect and evaluate the situation; either the product is not exciting enough in real life or the product positioning is flawed. The company might also realise that the product test was partly confirmed and solve the right problem but for a different economic buyer than originally anticipated. If you don’t want to burn capital or human resources, a pivot is the right answer here.

New Insights

Pivots are not necessarily driven by products, markets, channels and brand alone. At times, CEOs learn new perspectives, insights and foresights by speaking with experts, customers and other entrepreneurs. This also informs new wisdom on the way scale and opportunities are evaluated. A pivot might be rooted in the new understanding and focused on unlocking opportunities that were previously not visible.

Economic Logic

Companies realise a different or easier way to monetise their product by altering the underlying economic logic of their business models. Some examples are moving from low volume/high margin to low margin/high volume or shifting focus from a product to a platform or the other way around. This sort of a pivot can also be undertaken to optimise for valuation rather than for cash flow e.g., pivoting from licensing software to subscription-based SaaS.

A Framework for Executing Pivots

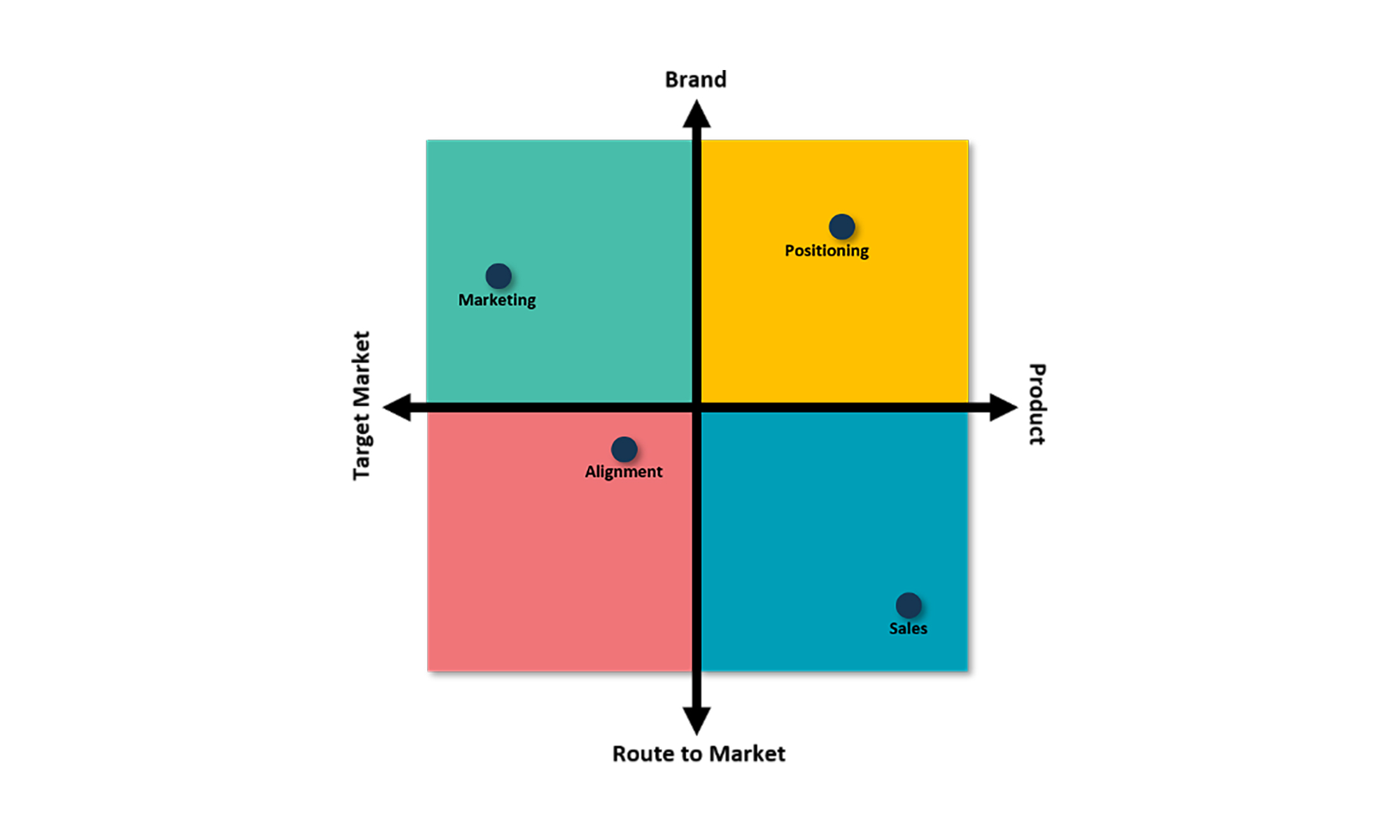

Brand, Target Markets, Route to Market (Channel) and Product are the four primary anchor points to design a good pivot. At any given point, all these levers must stay aligned. For example, if a company picked the product as the pivot point then brand, target markets and channel strategy and execution must align very quickly behind the new value proposition of the product.

A good pivot also has some secondary levers such as human capital (getting the right skills and people) and finance (an appropriate level of capitalisation and funding). Alignment of the secondary levers is critical to make sure a pivot can succeed.

Leading practices for successful pivots:

- Capitalise: Planning for the pivot without having adequate funding and capitalisation is futile. A shift in direction entails a shift in work, processes, roles, KPIs, people and assets; all requiring financial resources that are prioritised, allocated and sequenced. Without enough funding, a pivot is likely to end up being incomplete or unsuccessful.

- Focus on solving the problem: Do not build a problem around the product, analyze the problem to be solved and then build the right product with the right features. A pivot is successful only when focused on “what you solve” not “what you sell”.

- Understand specificity and magnitude of change: Change efforts must be very specific and sized in the plan with well-defined success criteria, measures and expectations. What is changing cannot be fluffy—don’t just say that you are changing, get down to what specifically is changing and where (sales processes, technology, reporting lines, pricing, etc.).

- Test quickly: Adopt a “fail fast, fail well, fail cheap” strategy and create some test runs with customers and partners; they maximise the organisation’s chances of success.

- Execute the pivot holistically: Most pivots fail because organisations fail to consider all of its dimensions (Commercial, Financial, Operational, Technical and Talent), not weaving them into a cohesive plan. Partly undertaken pivots rarely succeed.

There are also times when you should not pivot - a lot of companies pivot for the sake of it and prematurely adopt a trajectory that is very deviant from reality. Sudden, unplanned and gut-feel based decisions can result in failure, losing customers and burning cash at a faster rate to a point of no return. Premature and unplanned pivots don’t always result in scale and could elongate the path to profitability. My counsel is to always evaluate the need, look at all the anchors, align the right anchors and pull the right levers in a well-informed manner.

Q&A with Nitin Kumar, CEO of Appnomic

What does a good pivot entail?

In Silicon Valley, ‘pivot’ has now become a buzzword. While there are many success stories, a lot of companies do not make it through. A good pivot is about letting go of the old trajectory of a business and embracing the new direction. Pivot can still have the same end goal, but a company picks a different path, style and approach reach there. A lot of executives in the Technology sector believe that changing the product alone will create a pivot—this is far from the truth.

A good pivot is holistic and practical. It does entail looking at all aspects of the business and aligning them and I could dimension them across Commercial, Operational, Technical, Financial and People as the broad areas to align with each other. Taking one in isolation could create both business and execution risks - it is important to consider everything and base your decisions on data and facts rather than gut feel.

It has four primary anchors - Brand, Target Market, Routes to Market and the Product, which I explained earlier. In addition, one should analyze market trends, customer behaviour, competitor behaviour, profit shifts, valuation trends and structural changes in the industry creating headwinds or tailwinds for the business.

A good pivot is holistic and practical.

Adequate consideration should be given to sustaining the pivot or future-proofing the company’s assets, IP and business model to create a structural advantage.

It appears that Appnomic has gone through a big pivot. What has changed?

Appnomic has indeed gone through a big pivot, we have changed a lot of things. For one, we took a hard look at our assets and decided that we had both technology and talent firepower to pivot into a new category-defining space called self-healing based on AI and Machine Learning. A vision for helping our customers become self-healing attracted top executive talent to our company, including a Chief Revenue Officer and a Chief Marketing Officer to strengthen a very talented executive team.

We have changed the product significantly to move it away from the APM space, APM capabilities are now features within the self-healing product rather than being the core of the product. We also moved to a multi-product company by retiring our legacy product called AppsOne and replacing it with a new brand called HEAL. HEAL truly represents what Appnomic does with more pointed value propositions like Heal Cloud, Heal Enterprise, Heal SAP, Heal Edge and Heal Serverless (which is launching soon).

We added strength and depth to creating a robust partner ecosystem by adding ISVs, resellers, system integrators and OEM partners to our go-to market capabilities.

We also noticed new opportunities with customers in the area of IT operations that legacy players were not addressing, and we decided to grab the opportunity, given our strength in AI and Machine Learning.

Why did you decide to pivot?

We had four primary reasons to embark on the pivot.

- We saw an unmet need in the market which our technology and patents could solve. There were a lot of players talking automation, but no one was addressing the need for autonomous operations and self-healing. When we ran a few rapid tests with prospects, customers and our target market, we saw the energy and enthusiasm for it. We were also able to successfully run a few pilots in this space. The results were very encouraging.

- The whole area of AI Ops was quickly becoming a very overused and hyped term in the industry. Everyone from legacy monitoring tools, pure infrastructure players, APM vendors and log analysis folks were all branding themselves as AI Ops and were speaking the same terminology. While they were all addressing parts of the solution, not many were thinking of this holistically. We had an opportunity to partner with some of these players where it made sense to do so and compete with them in a few other areas. We could work along with these solutions to make them self-healing.

- We also clearly saw a need for more pointed solutions for on-premise, edge and cloud, and distinct solutions for workloads processed on each model made a lot of sense. This also picked up quicker sales velocity and closures for us, as opposed to selling a large catch-all solution.

- We saw a huge opportunity in new target markets like Telecommunications, e-Commerce and the European region which we had historically underserved. We brought in some top-notch go-to-market executives with deep market understanding and connections who could add reach to the killer product teams that we had.

In summary, we saw a huge opportunity for a repositioned product, value proposition, target markets and an unmet need.

How did you earn the industry reputation for being a master of the pivot? How did you acquire these skills?

My ability to add the ‘pivot’ skill was purely accidental. My experience of working within M&A allowed me to work alongside companies who were acquiring to change their own business models. Having taken over a dozen organisations through these business model integrations and transformations made me good at the pivot skills. Although I did not realise this for a while, my clients, personal and professional network made me aware of this aspect of my skill set. A professional network today amplifies your professional brand in the industry, which is why I quickly gained this reputation. I am thankful to people who have helped me harness this potential in me.

In addition to this, a broad background of experiences always helps. I have played many roles in my career ranging from CEO, Chief Growth Officer, Chief Transformation Officer, M&A Integration/Separation Leader, Business Unit Head and Management Consulting Partner. These roles offered a full P/L and a 360-degree view of a business and the industry, giving me depth within many functions such as strategy, operations, products, sales, marketing and M&A in a very hands-on manner. I am very fortunate for having experiences like these - it’s easier to think through the big picture, test a hypothesis in the market very quickly, adjust the go-to-market motion and structure operations to enable rapid execution.

In short, the roles I played and the opportunities I got created the runway to change business models of companies on the Tech, Media and Telecom sectors. At some point, the market realised this ability in me and made me aware of it. So overall, I believe that the amalgamation of my experiences made me good at business pivots.

What are the outcomes of a good pivot? How do you measure success?

Measuring the success of a pivot can be very subjective - teams should even be commended for making “no go” decisions which save time, energy, capital and resources. However, quantified results can be measured across a few different dimensions like revenue trajectory, customer acquisition, time to achieving the desired scale, valuations, product adoption, etc. Not every pivot takes the same time. Some are short and quick whereas some take a bit more time to execute. For example, a brand pivot is a lot harder to measure and takes longer than a product or target market pivot.

A good pivot should always achieve the optimal outcome; that is to complete the alignment between products, target markets, brand and routes to market and achieve the desired outcome the company was chasing.

What are some of the lessons learned from your experience with many different companies?

There are many different learnings and many battle scars, no two pivots have been the same. But here are some general lessons I have gathered over time:

- An attempt to make a pivot around the product or fixing go-to-market is not a pivot; a pivot needs to be holistically conceptualised and executed.

- People, particularly product-centric executives, tend to under weigh the brand pivot. Marketing is a very powerful and visible function during the change, so having a good CMO helps.

- Don’t let the old kill the new trajectory - one must decide to let go of the old. Think about it as cutting your losses.

- Make sure the company is capitalised for the pivot execution. A capital shock midway will force short cuts, ultimately derailing the pivot.

- A lot of times, companies burn more capital trying to fund the legacy business and the new direction, resulting in excessive cash burn.

- Do not create job descriptions around people, create job descriptions and pick the right people with the right skills to fill those jobs.