Most economists predict that 2019 will see economic conditions worsen with numerous political and trade driven headwinds impacting growth. This will put ever greater pressure on leadership teams to ensure strategies deliver maximum return on investment. Despite this, too many are failing to ask the right questions and continue instead to pursue outdated strategies. This failure is rooted in traditional concepts of value as well as in legacy structures and systems that now represent barriers to growth. The result is that the full commercial potential of the organisation is not being realized, to the detriment of innovation, growth and profitability.

In 1975, intangible assets were estimated to make up around 17% of the value of the S&P 500. Fast forward to 2015 and the percentage of value attributed to intangibles rose to 87% (Ocean Tomo report). In a 2013 report commissioned by the UK Intellectual Property Office, the value of intangible assets of UK companies was estimated to be in the region of 70-80%. Conclusions about value could not be any easier to draw from these trends.

Building on this data is an Economist Intelligence Unit business survey conducted in 2015 that found that 94% of senior managers thought managing intangible assets was important, with half of them saying that intangible assets represent the primary source of long-term shareholder wealth creation. Importantly, the survey found that 95% thought their organisations were not equipped with the systems needed to effectively manage these assets. Clearly, leadership teams are not lacking awareness of the importance of the problem. So why are businesses still failing to execute the right strategies and extract maximum value from intangible assets? These are questions that the CEO must begin to understand and tackle head-on.

Knowledge and capability

When we conduct interviews with business leaders one important set of questions aims to assess knowledge and capabilities in relation to intangible assets. Findings can be benchmarked both against industry norms and internal KPIs. It won’t come as a surprise that an extremely high proportion of leadership teams lack essential knowledge in two critical areas.

The first relates to asset identification. Leaders routinely lack the knowledge required to identify what and where intangible assets are within the organisation, including within their own functions. In instances where they can identify the asset, very few are able to articulate what, if any, control positions are possible and how these positions can drive competitive advantage.

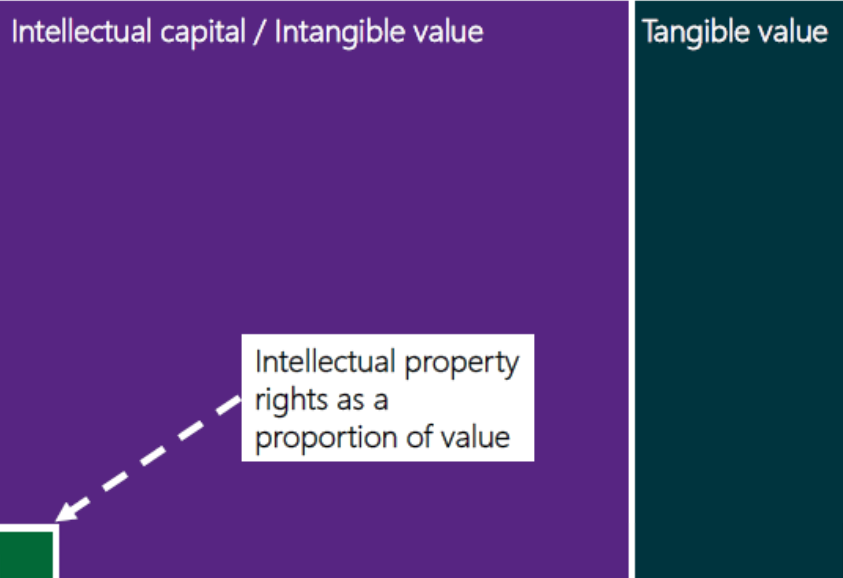

One of the things that comes through in the identification process is that business people often misunderstand the relationship between intangible assets and intellectual property (IP) rights. Although still not ideal, stakeholders tend to be better at identifying IP rights, particularly patent and trademark rights, and knowledge levels of the control positions that these rights grant is also a lot higher. This is important; IP performs a valuable role in business strategy, allowing the owner to exercise control over any competitor that wishes to use or infringe those specific rights. However, IP is a (small) subset sitting within a much broader class of intangible assets (see visual). This is an important distinction that business leaders will need to be better at identifying, particularly as the competitive landscape shifts towards new forms of intangible value. These new forms of value are often expressed in dynamic new ecosystems, in the myriad of relationships that bind together online communities and that support open innovation models, or in data and know-how that help create new value chains. This transformation in value is also occurring at speeds unfamiliar to traditional businesses and reflected in the meteoric rise of companies like Airbnb, Facebook, Tencent and Uber. For the many companies that lag behind these industry disruptors, CEOs will need to be the ones leading a transformation in knowledge and understanding of intangibles.

The second area of knowledge weakness relates to value. Very few business leaders can effectively prioritise the value of different intangible assets to their business strategy. There are many reasons for this and CEO’s would benefit from learning what these barriers to knowledge are. One that is particularly obvious is the disconnect between business and law. The fact is that intangible assets only have value when they are expressed in the form of control. While expressing control does not require the application of law, the foundations of control lie in the law. While I’m not suggesting that business leaders learn the law, or that lawyers transform into business people, there is a clear need for improved knowledge sharing and understanding between these two stakeholder groups.

Organisational structures

When we look at an organisation’s ability to extract maximum value from their intangible assets one of the biggest barriers relates to structure. Most have classic organizational structures designed for the 20th century, with key functions and responsibilities built around tangible assets. CEO’s must have a clear strategy to transition their organisations away from these legacy structures, creating responsibilities from top to bottom that reflect the new value drivers of the organization. Most clients we work with are doing this but recognize that the transition is happening too slowly and that the main barrier to change comes from the top. In fact, the lower down the organization we go the more willing and prepared stakeholders are for change. This structural dynamic can be seen in the same way that organisations respond to climate change. Without a fundamental change in mindset at the top progress is slow.

Systems, data, and better ROI

An effective strategy doesn’t exist in a vacuum. It requires a granular understanding of the assets in play across the organisation as well as the potential and real ROI. Due to the above mentioned structural deficiencies, most organisations we work with lack the necessary systems and processes to make informed, data-driven decisions about intangible assets. This is less the case in relation to intellectual property assets, particularly patents, where systems and processes are fairly well established but it is a systemic weakness when it comes to other forms of intangible value. Therefore, one of the most important streams of work, highlighted in the EIU survey, is to look from the ground up at these underlying systems and design changes that will enable better flow of data and more informed decision making.

One client we have worked with in the fashion sector implemented a new system to help improve the assessment of design value. By changing their processes and introducing better quality data the lawyers were able to have better and earlier conversations with the business about value. It also resulted in immediate cost savings where certain designs were identified as delivering little if any value and could therefore be abandoned. This may seem obvious to some within the organization but the reality is that these systems and processes are missing in many key functions, particularly in operations like HR, Finance and IT. Critically, at CEO and Board level, these data systems seldom integrate, meaning that strategic decisions about cross-functional assets are often based on incoherent information.

China: opportunity and imperative

Look no further than China to see where a lack of knowledge, structure, systems and data are impacting negatively on Western corporate strategy. While nomenclature like ‘emerging’ or ‘developing’ may be appropriate when describing China’s overall market conditions, they are entirely inappropriate terms when applied to China’s innovation landscape. It is true that in relation to IP and the legal systems that protect these rights, China is behind the West and playing catch up. However, when it comes to innovation in the new economy and investment in the intangible assets that support long term growth, China is far more advanced than most Western economies.

If Western business leaders fall into the simplistic trap of seeing China only as an IP laggard then they are likely to be committing their organisation to an overly defensive strategy. A more nuanced and better-informed approach would recognize that China is one of the most advanced innovation economies and at the same time is struggling to bring its IP systems up to Western standards. How businesses manage this complexity is important and requires sophisticated data and information as well as open minds. There is a lot to be learnt from the way that many Chinese companies are innovating and using new forms of intangible value and scale to compete.

In China and across the global economy, smarter and more effective approaches to strategy, structure and systems are required if growth is to be sustained. At the heart of this challenge is a better understanding of the role that intangible assets play in business, particularly emerging forms of intangible value that drive the new economy. CEOs must lead this transformation, focusing on new approaches to knowledge, structure, systems and strategy.

Luke Minford is the Chief Executive of Rouse, an IP services business focused on emerging markets.