For our May edition, CEO Today had the privilege to connect with Nitin Kumar, Senior Managing Director and Leader of the Technology sector practice at FTI Consulting, who’s spent the majority of his career working on mergers and acquisitions in the Telecom, Media & Technology (TMT) sectors for companies, mostly along Highway 101 and around Silicon Valley.

Nitin has developed M&A strategies, conducted commercial/operational/technical due diligence and assisted with M&A integration and separation. He specialises in creating deal value from revenue synergies and has also led dozens of cost-focused consolidation M&A deals. Over the course of his career, Nitin has added value to hundreds of M&A transactions by engaging at various stages of the transaction continuum. His recent work includes helping CEOs, boards, investors and leaders transform their business models by leveraging disruptive trends in M&A to pivot into new business models leveraging technologies (e.g., SaaS, SDN, blockchain, open source, AI, IoT, AR/VR, drones and voice-enabled devices, etc).

As a Silicon Valley insider for two decades, Nitin finds it “a fascinating challenge to utilise my business knowledge, network of experts, consulting skills and experience in M&A deals to solve problems at the cutting edge of new technologies.” He’s built an expansive network in Silicon Valley with TMT sector clients who rely on him to help them through difficult business changes, serving as both a trusted adviser and personal advocate. Below, Nitin discusses recent trends within the Silicon Valley tech landscape and offers his tips on how to leverage disruptive technologies to your company’s advantage.

What have been any recent trends in the tech landscape in Silicon Valley? What are some of the trends and patterns with disruptive technology that you are seeing?

I believe we are experiencing the equivalent of tectonic shifts in business that is primarily technology-driven and is impacting the fundamental ways we conduct commerce –and this trend extends far beyond Silicon Valley. These shifts can also conflict with each other, making business strategy more difficult to conceptualise and execute today than in years or decades in the past. Some of these shifts are as follows:

- Product to cloud vs. cloud to edge;

- Centralise (SDN/NFV) vs. decentralise (e.g., blockchain);

- Players who monetised voice are now monetising data (e.g., telcos) while those who monetised data are now monetising voice (e.g., Google, Amazon);

- Brick-and-mortarto omnichannel retail economy, or, “bricks-and clicks”

- Closed-sourceto open-source(Android);

- Human to machine (AI);

- Real to virtual (AR/VR);

- Building traditional enterprises vs. monetising ecosystems.

There are very few absolute rules in this new frontier – companies need a data- driven approach to navigate this complexity, uncertainty and ambiguity, which has become profound over the last few years and is not likely to abate.

Traditionally, technology has served to enable or enhance existing business models or to create entirely new ones. More recently, we find ourselves in a place where there is a developed technology but the ecosystems are still evolving, and business models don’t really exist. Take, for instance, blockchain – here we have a viable technology but it will take several years to build scalable business models around it and monetise it. CEOs and corporate think- tanks must devise new ways of adapting in such a landscape.

How can a company leverage disruptive technologies to its advantage?

In the last decade or so, we have seen many incumbent companies experience disruption or displacement by new technologies and their associated business models. These companies viewed new players as benign threats rather than existential ones, not conforming to longstanding industry norms, not what the market demanded or not conducive to the economics of how they made money.

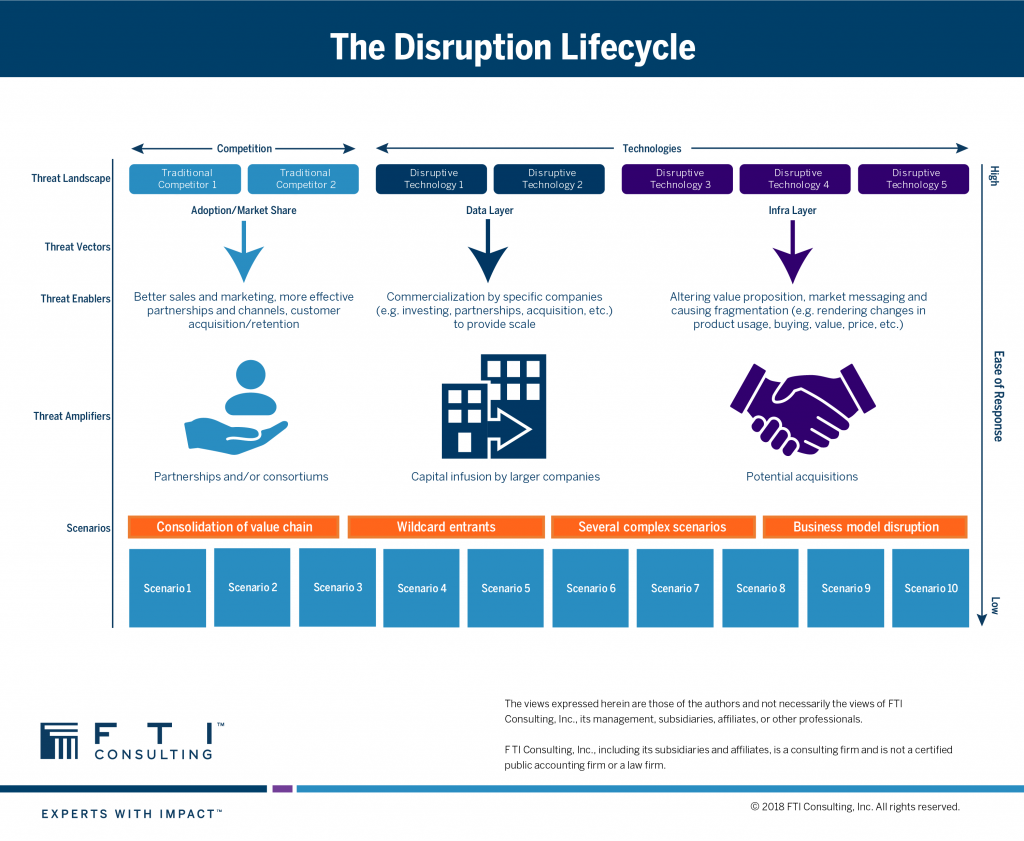

Over time, these so-called benign technologies found the right enablers. Think of how open source technology from Linux came to be – many mainstream operating systems, like Solaris, ignored them, but they would find the right catalyst in backing and investment from IBM. When an enabler catalyses a newcomer, its impact then becomes visible to the market, its customers and its partners. This occurs across companies of all sizes, scale, reach, customers and niche players. Once the technology becomes established, performance improvement, innovation and new business models will follow and further amplify these new capabilities, which have now gone from being benign to threatening for incumbent players who didn’t perceive the magnitude of such change. Amplifiers can also include acquisitions by larger players or strategic partnerships.

Once this diffusion occurs, the new technology has prevailed and displaced many established players. This is attributable to the legacy methods of incumbents who have, so far, mostly countered with traditional responses. As a result of incumbents’ high-cost structures and inability to respond quickly, disruptors continue to benefit and scale.

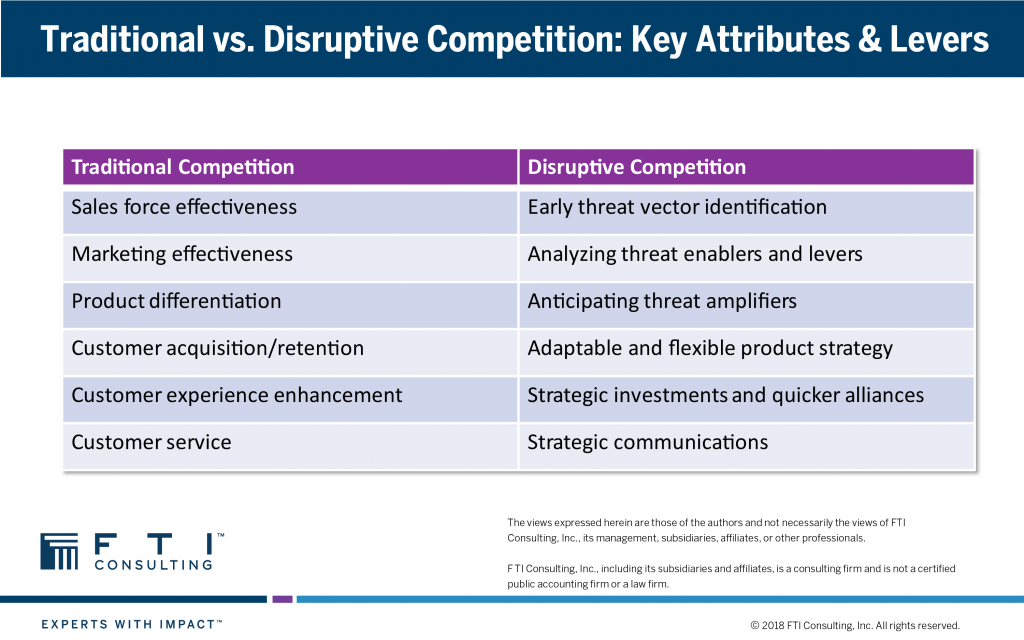

It is crucial for established players to understand the anatomy of the disruption lifecycle and to manage each aspect of it. Speculating around myriad scenarios and trying to manage a nearly infinite number of possibilities or outcomes can quickly become futile. Competitive surveying of relevant technologies, understanding their potential impact at each stage of the lifecycle and developing an ability to respond to unconventional threats is more critical today than ever.

Strategic and tactical responses to disruptive competition are far different from traditional competition. Disruptive technologies may have more than one vector of impact – they could come at legacy players from multiple fronts (for example, the threat of obsolescence to multiple pieces of the technology stack of established players or making an established products or channel structure entirely obsolete).

One does not always have to see a disruptive technology as adversarial. Traditional players at scale today need to continuously stay apprised of emerging technologies and ask themselves a few key questions:

- Is this technology benign or potentially threatening? Is it relevant to our key business processes or our customers?

- Can a so-called benign technology eventually become a business model in itself or reconfigure an established business model?

- Can we be the enabler of that catalyst rather than leave the opportunity to someone else?

- Do we have the institutional capability and culture to implement this technology?

- Should we wait for this technology to become more widely adopted? What are the likely consequences of being a late adapter?

- What happens if this technology is better utilised by our competitors?

What are traditional CEOs’ attitudes towards this? Do they need to change their perception and vision for the future?

CEOs and other corporate leaders are feeling the impact more than ever but they are aware of the need to understand these shifts, develop foresight and execute business model changes to stay relevant to their customers. Most senior executives have now started to think about disruptive technologies as an opportunity rather than a threat, unlike a few years ago. Today it is about playing well and collaborating in the ecosystem versus going at it alone.

CEOs of traditional companies struggle with the ability to be quick and agile, with long decision periods and the legacy culture often getting in the way of executing the strategy as drawn up. Getting ahead of the curve, taking calculated risks to adopt new technologies, making bets with venture investments, executing some well-planned M&A transactions and building out the ecosystem are some of the changes that CEOs need to think about to respond to these threats.

You have quite an amazing M&A background, can you please explain how does M&A play into the new world order?

Below is a list of items that have impacted the thinking behind M&A strategy through integration:

- It is more challenging for companies to approach a new business model because often it is far removed from their traditional ways of doing business. For example, selling licensed software and SaaS have very different economics, KPIs and go-to-market approaches.

- Typically, the older (or new) model tends to cannibalise the new (or older) model, making go-to-market decisions a lot harder.

- There are few conventional synergies to realise from back offices – M&A integration today is mostly about product and revenue synergies.

- Disruptive technologies or capabilities are not just one thing – putting clear definitions on an array of required capabilities and their impact requires heavier alignment between corporate strategy and development.

- Single acquisitions rarely materially transform business models –developing a view of assets in combination to foster a pipeline with an invigorated level of engagement with the target companies is more important than ever

- Defensive versus offensive plays need to be differentiated – the former tends to be more dilutive.

Many of my clients now feel that acquiring disruptive assets is very expensive and harder to justify based on valuation alone. Markets would take better to a cohesive acquisition strategy involving a series of acquisitions, leading to a higher value business model. I have observed several types of value-adding deals that have been well received by markets:

- Catalyst transactions: The first acquisition signaling the acquirers’ intent to change and embark on embracing change and thinking about the future.

- Strengthen the stack: Specific capabilities, like AI, cyber, analytics, and so forth that enhance the posture of the existing value chain and can lay the foundation for subsequent acquisitions.

- Creating competitive advantage: Adding more capabilities across the stack to differentiate from competitors and to become a disruptor.

- Attaining scale: Gain customer and market momentum at scale, displacing competitors and future proofing the acquirer for the near term, while creating the runway for more game - changing acquisitions.

How does one create value from M&A today that is different from the past?

There are four major areas of change I see in the market while advising some of my clients through these changes:

- Function to business model

Acquirers look to create value, not merely protect the asset they bought – most deals need to make an impact on the growth trajectory of the company or transform their business model. M&A integration today tends to drive structural transformation that could impact competitor behavior or industry dynamics. In a survey that I ran with 100 M&A integration leaders, they indicated that functional integration approaches are not scaling to deals focused on new business models. M&A integration has traditionally had two ways of creating value:

- Functional integration: Enhance the organisation’s ability to compete by aligning and integrating functional assets and capabilities into bundles of competitive advantage through lowering costs and increasing efficiency;

- Structural integration: Enhance the organisation’s structural advantage (an offensive play) or shield organisation (a defensive play) from industry structural forces that would kill profits.

- Synergies

Traditionally, companies have thought of synergies as either cost or revenue-driven and approached it that way. Given that there are typically few cost synergies (probably negative synergies due to underinvestment in back office) when acquiring smaller,disruptive companies/technologies/business models, one needs to think about this differently. An approach that I have frequently used is to look at synergies in three ways.

a.Sequential synergies: If the acquirer (or target) does activity A, then the target (or acquirer) is now enabled to do activity B (sequential to A), previously not possible on the value chain;

b.Reciprocal synergies: The acquirer brings X, enabling Y for the target and vice versa (e.g., what can they both add to each other, etc.);

c.With this framework, cost and revenue synergies are a byproduct not a starting point, unlike traditional M&A integrations.

- Configuration of Integration Management Office

The IMO is the centre of gravity during an M&A integration, and the way it is configured depends on how value is captured. In the era where cost synergies were drivers of value creation, a functional approach was adopted for good reason (e.g., costs come from specific functions with a few well-defined drivers like headcount, contracts, etc.) and can be executed quickly - hence it made sense to have functional work streams. Today, it is all about revenue synergies, and a single function is not capable of delivering complete value. The linkage between sales, marketing, service, product, pricing, and customer experience needs to be in unison in order to create value – hence the IMO needs to be configured by value-driver, not by function. Rigid proponents of functional integration do not create value!

- M&A Integration Talent

During the era of classic consolidation mergers, the focus was on eliminating redundant people, assets, processes, and to create synergies by stretching economies of scale. These synergies largely came from the back office or support functions, such as finance, IT, and HR. For the most part, the skills for these functions were portable across industries and sectors, leading the M&A market to spawn a lot of generalists. Today, the focus has shifted to acquiring products and capabilities that enable new business models, which requires a specific, detailed understanding of these industries and sectors. A lot of M&A integration generalists now need to reorient themselves. Many M&A professionals, both in the corporate and consulting worlds, have grown up managing the integration process, for example, the IMO, Day One checklists, tools, templates and reporting with limited focus on true value creation. The process is still important, but the real magic is in creating product-driven value, not managing the integration processes.

As a consultant to CEOs and Boards, how are you and FTI Consulting keeping up with this change?

These market shifts impact the consulting profession as much as anyone else. There are a couple different ways we deal with these market shifts:

- We work in industries where we have deep understanding of the products, ecosystems, trends and business models. We bring our unique perspectives and insights on transformative changes we observe in an industry and ascertain how these changes might impact a client’s specific business trajectory.

- These days, it is difficult for generalist consultants (as opposed to industry specialists) to deliver the value that executives expect. Thus, we try to leverage our network and meet smaller, disruptive companies in specific areas, e.g., autonomous driving, blockchain, AI etc. After meeting a couple dozen companies, it is easier to discern trends, gaps, risks, opportunities, M&A targets, and to form a point of view informed by this perspective. A detached, academic approach to keeping up with these changes is obsolete. Today, it is about gathering timely, relevant insights from the field and developing a point of view that will be more insightful to our clients than a clinical whitepaper.

What makes FTI Consulting stand out in a crowd of competitors?

FTI Consulting has always positioned itself as a specialist consulting firm rather than a generalist firm. There are several unique things about us: we deploy seasoned professionals who have held operating and executive positions in industry, thereby bringing specific knowledge, added credibility, better productivity and enhanced time-to-value. Secondly, we have chosen to engage only in industries and sectors where we have deep expertise and can be impactful. Lastly, we focus on the specific business issues, insights and solutions to our clients’ problems rather than a boilerplate work product – which is something our clients recognise and value.

What is your advice to companies that are struggling to keep up with change and innovation and disruption?

- Get comfortable making frequent or sudden pivots. Never get into a comfort zone or be complacent, even when you are ahead of your competition.

- Find builders and give them responsibility, authority and accountability.

- Develop foresight and skillsets to navigate business complexity and strategic ambiguities.

- Move away from intuition to data-driven decision making wherever possible.

- Build ecosystems and develop skills to monetise them. There is no need to own the value chain but learn to have a specific and influential role in it.

- Continuing with traditional approaches will not change much.

- Become a catalyst or an amplifier.

- Invest in continuous and fast-paced learning.

- When it comes to the organisation, be agile and respond quickly.

About FTI Consulting

FTI Consulting is an independent global business advisory firm dedicated to helping organisations manage change, mitigate risks and resolve disputes in many areas and functions, including financial, legal, operational, political & regulatory, reputational and transactional. Each of FTI Consulting’s practices is a leader in its specific field, staffed with experts recognised for their depth of knowledge and track record of making an impact. Collectively, FTI Consulting offers a comprehensive suite of services designed to assist clients across the business cycle – from proactive risk management to responding rapidly to unexpected events and dynamic environments.