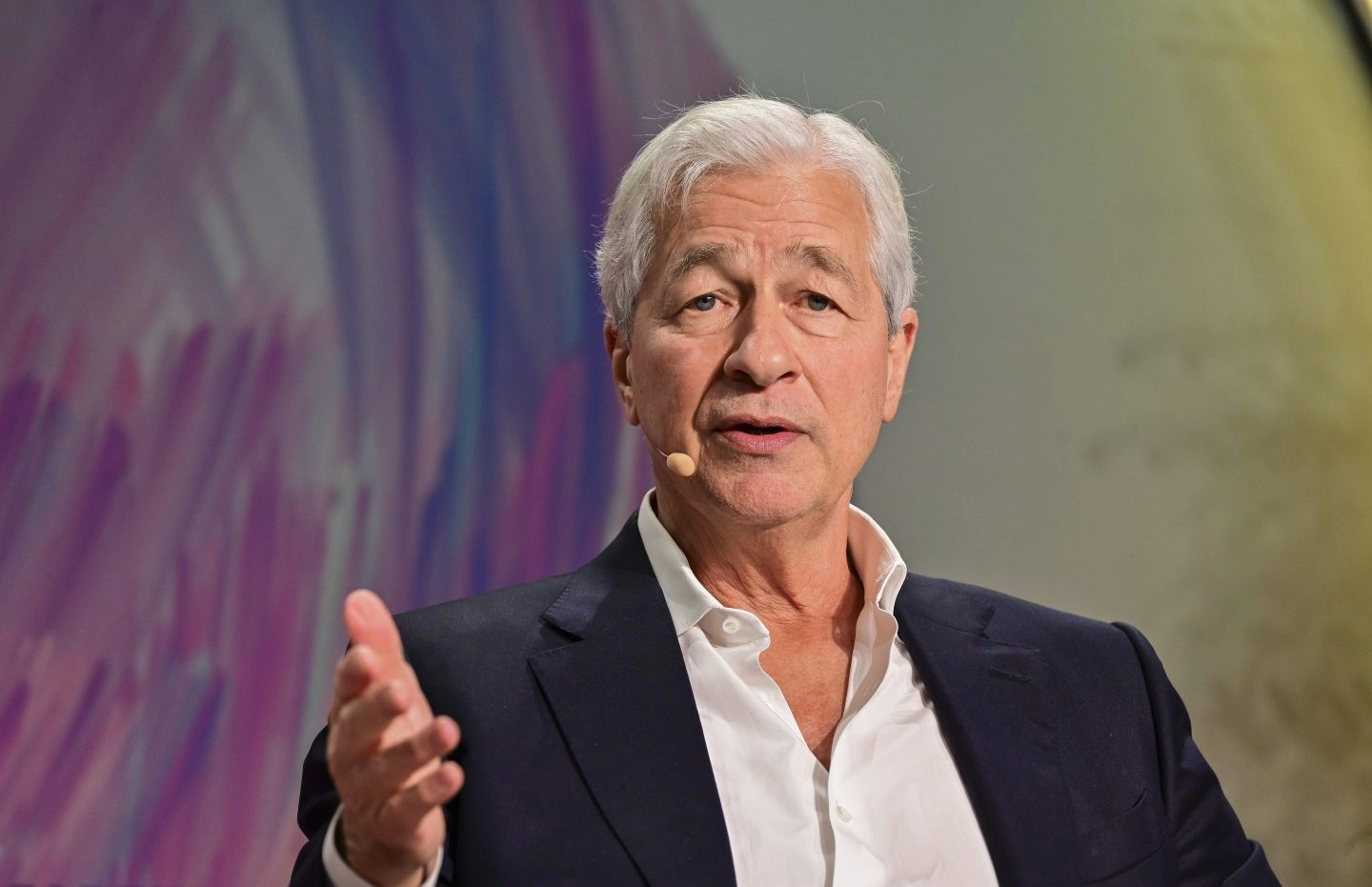

Jamie Dimon’s “Cockroach” Warning: What JPMorgan’s $170M Loss Says About Private Credit Risks

JP Morgan’s Dimon warns more “cockroaches” could surface in private credit after a $170M Tricolor loss, exposing hidden risks in shadow banking.

When Jamie Dimon, CEO of JPMorgan Chase, publicly warned during the October 14, 2025 earnings call that “when you see one cockroach, there are probably more,” he was speaking of more than quirky metaphor — it was a caution about fragile linkages across the private credit/shadow banking sector. His comments came after JPMorgan wrote off $170 million in exposure tied to the collapse of the subprime auto lender Tricolor — and as First Brands, a major auto parts supplier, filed for bankruptcy amid alleged financial mismanagement.

The financial impact may be modest for JPMorgan’s overall balance sheet, but the reputational and systemic implications are clearer: even top-tier institutions can be drawn into emerging risks in sectors that lie outside traditional banking oversight.

What Happened: Tricolor, First Brands, and JPMorgan’s Write-Down

Tricolor, a subprime auto lender, declared bankruptcy amid allegations of fraud, causing a ripple in credit markets. JPMorgan disclosed a $170 million loss in the third quarter tied to that collapse.

Almost simultaneously, First Brands — a U.S. auto parts manufacturer — filed for Chapter 11 protection, carrying more than $10 billion in liabilities and drawing scrutiny over $2.3 billion in missing receivables. The company’s former CEO, Patrick James, resigned amid investigations.

JPMorgan said it had no direct exposure to First Brands. But due to its involvement in lending to or investing in private credit vehicles connected to these firms, it still absorbed exposure from downstream risks.

During the analyst call, Dimon warned:

“When you see one cockroach, there are probably more, and so everyone should be forewarned of this one.”

He added that over the long credit cycle, hidden vulnerabilities are likely to surface:

“If we ever have a downturn, you’re going to see quite a few more credit issues.”

He also said, “We always look at these things and we’re not omnipotent — we make mistakes too.”

These remarks underscore JPMorgan’s awareness that its risk filters are being tested by exposures in sectors it does not fully control.

The Business & Reputational Angle

JPMorgan has long marketed itself as a safe harbor in turbulent times, leaning on rigorous credit discipline. A hit tied to shadow banking — even an indirect one — cracks that narrative slightly.

More importantly, Dimon’s warning is a strategic signal: he’s alerting markets, regulators, and investors that the bank is watching the fringe credit world closely. That gives JPMorgan a reputational advantage — positioning it as vigilant — but also potential exposure if more failures emerge.

For counterparties, clients, and credit markets at large, his metaphor sets expectations: hidden stresses in private credit will be probed and punished, which may trigger risk repricing and tighter lending conditions.

Regulatory and Legal Stake: What’s at Stake

Currently, private credit firms operate under far lighter regulatory constraints than commercial banks — less capital requirement, less disclosure, fewer stress tests. That regulatory gap is precisely what Dimon’s warning targets.

If further failures occur, pressures could mount on U.S. and global regulators to impose transparency requirements, capital buffers, or mandatory disclosures on non-bank lenders. Already, the U.S. Trustee has requested an independent examiner in the First Brands bankruptcy, citing suspicions of fraud or misconduct.

Legal risk is also nontrivial: creditors and trustees may mount litigation targeting investment firms or funds that backed Tricolor or First Brands, especially where evidence of deception or double-pledging of receivables emerges.

Q&A for Clarity

Q: How do problems in private credit affect mainstream banks?

A: Traditional banks may not lend directly to risky firms, but they often provide capital to or share exposure with private credit funds. Defaults or fraud in those funds ripple back through the system. As losses mount, banks may need to write down assets or tighten capital allocation — curbing their ability to lend widely.

What’s Next: Risk Cycle or Systemic Warning?

Dimon described the current environment as a long bull run in credit since 2010. He suggested the recent failures could be early signs of excesses being revealed as the cycle turns.

The real test will be whether future defaults are isolated or clustered. If more private-credit “cockroaches” appear in sectors like consumer finance, real estate, or supply-chain lending, markets could see broader credit tightening.

For now, JPMorgan is signaling that it is better prepared — and warning others to brace themselves.

RELATED: America’s Debt Time Bomb: J.P. Morgan Warns the U.S. Is ‘Going Broke Slowly’

FAQs

1. Why did JPMorgan take a $170 million hit?

Because it had indirect exposure via credit funds tied to Tricolor, which defaulted. JPMorgan wrote off that amount in Q3.

2. What went wrong at First Brands?

First Brands filed for bankruptcy with over $10 billion in debt. Around $2.3 billion of receivables were unaccounted for, sparking fraud investigations and the CEO’s resignation.

3. Could this lead to stronger regulation of private credit?

Yes. If more failures emerge, regulators may push for disclosure rules, capital requirements, or oversight for private lenders — a major shift from the current lightly regulated framework.