The finance world is dominated by a small group of billionaires whose wealth, influence, and investment strategies shape global markets. As of 2025, the top 10 richest people in finance collectively hold over $446 billion, according to Forbes. From legendary investors to modern hedge fund pioneers, these individuals have leveraged skill, strategy, and innovation to amass extraordinary fortunes. Here’s a closer look at who they are, their careers, and their estimated net worths.

1. Warren Buffett – $146.5 Billion

Known as the “Oracle of Omaha,” Warren Buffett is the chairman and CEO of Berkshire Hathaway. Buffett has built his fortune through long-term investments in companies like Apple, Bank of America, and American Express. Renowned for his disciplined value investing approach, Buffett remains one of the most respected figures in global finance.

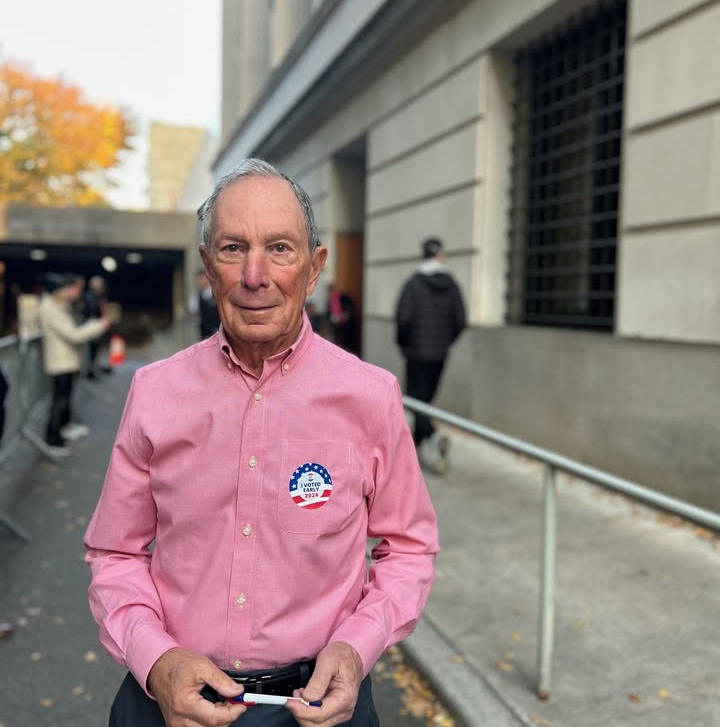

2. Michael Bloomberg – $109.4 Billion

Michael Bloomberg founded Bloomberg LP, the financial data and media powerhouse, transforming how investors access market information. Bloomberg also served as the Mayor of New York City and is a noted philanthropist, using his wealth to fund public health, education, and environmental initiatives.

Michael Rubens Bloomberg

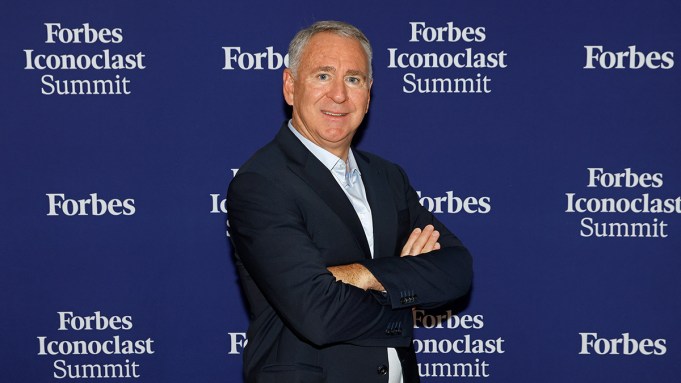

3. Ken Griffin – $49.6 Billion

Ken Griffin is the founder and CEO of Citadel, one of the world’s most successful hedge funds. Known for innovative quantitative trading and market-making strategies, Griffin has built a financial empire that spans equities, fixed income, and global derivatives markets.

Ken Griffin

4. Stephen Schwarzman – $48.1 Billion

Stephen Schwarzman co-founded Blackstone, a leading global investment firm specializing in private equity, real estate, and credit. His leadership has propelled Blackstone to become one of the largest and most influential investment firms in the world.

Stephen Schwarzman

5. Jim Simons – $31.4 Billion

Mathematician and cryptographer Jim Simons founded Renaissance Technologies, a hedge fund famed for its quantitative trading strategies. The Medallion Fund, managed by Simons’ team, has consistently delivered extraordinary returns, making him a legend in finance.

Jim Simons

6. Thomas Peterffy – $28.6 Billion

Thomas Peterffy is the founder and CEO of Interactive Brokers, a brokerage firm recognized for its technology-driven trading platforms. Peterffy pioneered electronic trading, making global financial markets more accessible to individual and institutional investors alike.

Thomas Peterffy

7. Jeff Yass – $28.9 Billion

Co-founder of the trading firm 3G Capital, Jeff Yass has accumulated his fortune through high-frequency and quantitative trading. He is also known for his political involvement and strategic investments across the financial sector.

Jeff Yass

8. Abigail Johnson – $35 Billion

Abigail Johnson is the CEO of Fidelity Investments, one of the world’s largest asset management firms. Under her leadership, Fidelity has expanded its offerings to include retirement planning, brokerage services, and wealth management, solidifying its position as a financial powerhouse.

Abigail Johnson

9. R. Budi Hartono – $25.8 Billion

An Indonesian billionaire, R. Budi Hartono co-owns Djarum, the country’s leading clove cigarette manufacturer. Hartono also holds significant stakes in Bank Central Asia, one of Indonesia’s largest banks, diversifying his wealth across industries.

10. Daniel Gilbert – $24.8 Billion

Daniel Gilbert is the founder of Quicken Loans, the largest online retail mortgage lender in the U.S. His technology-driven approach revolutionized mortgage lending, enabling Gilbert to build a significant financial fortune while reshaping the industry.

Conclusion

The top 10 richest financiers in 2025 showcase the diversity of paths to wealth in the financial sector. From legendary investors like Warren Buffett to innovative tech-driven pioneers like Daniel Gilbert and Thomas Peterffy, these billionaires demonstrate the power of strategy, vision, and innovation. Together, their combined net worth of $446 billion underscores the immense influence finance leaders wield over global markets and economies.