Bayer's Bold Leadership Overhaul: CEO Bill Anderson's Radical Management Model

Bayer CEO Bill Anderson has introduced a transformative management approach called Dynamic Shared Ownership (DSO), aiming to decentralize decision-making and enhance operational efficiency. This strategy involves reducing hierarchical layers and empowering self-managed teams to drive innovation and accountability. The initiative has led to significant organizational changes, including job cuts and restructuring, as Bayer seeks to navigate legal challenges and improve financial performance.

A New Era in Corporate Leadership

In a bold move to reshape Bayer's organizational structure, CEO Bill Anderson has implemented the Dynamic Shared Ownership (DSO) model, challenging traditional corporate hierarchies. This approach decentralizes decision-making, empowering employees at all levels to take ownership of their roles and contribute to the company's success. By dismantling bureaucratic layers, Anderson aims to foster a more agile and innovative corporate culture.

The DSO Model: A Radical Shift in Management

The DSO model is characterized by several key principles:

-

Decentralized Decision-Making: Employees are entrusted with greater autonomy, reducing the need for top-down directives.

-

Self-Managed Teams: Small, cross-functional teams operate independently, taking full responsibility for their projects.

-

Continuous Feedback and Adaptation: Regular evaluations and adjustments ensure that teams remain aligned with organizational goals.

According to a statement from Bayer's supervisory board, "Moving on to Dynamic Shared Ownership, we have made substantial progress in implementing the new operating model. As part of these efforts, we have so far reduced some 10,000 positions worldwide and roughly halved the number of management levels in the Group" Bayer.

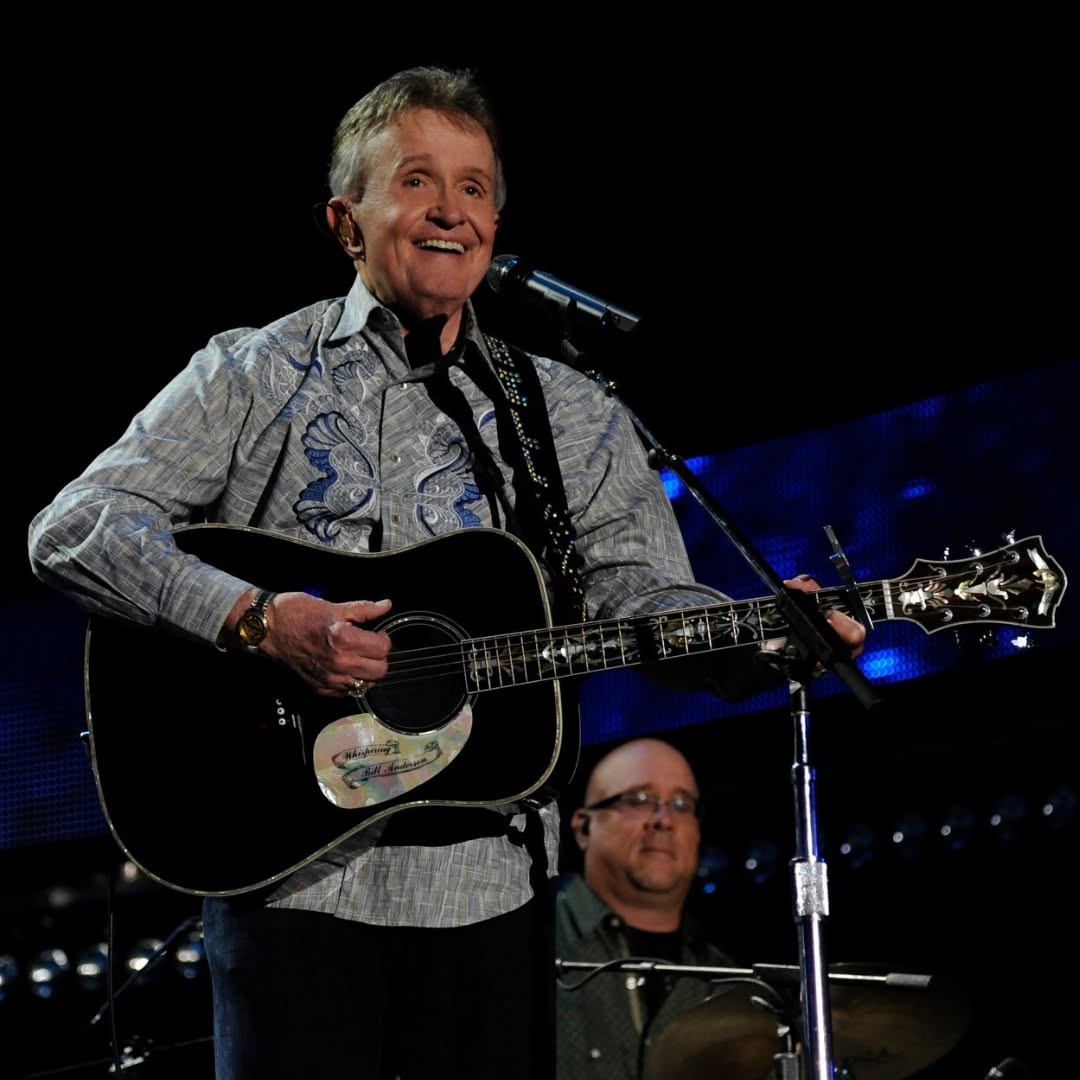

Bill Anderson

Financial Implications: Balancing Innovation with Fiscal Responsibility

The implementation of DSO has significant financial implications for Bayer. The company aims to achieve €2 billion in sustainable organizational savings by the end of 2026. However, these savings must be weighed against ongoing legal challenges, such as the glyphosate litigation, which continue to strain the company's resources AInvest.

Financial analysts are closely monitoring Bayer's ability to balance cost-cutting measures with the need for investment in research and development to drive future growth. The success of the DSO model will be crucial in determining the company's long-term financial stability.

Legal Considerations: Navigating Complex Challenges

Bayer's restructuring efforts under the DSO model occur amidst ongoing legal battles, particularly related to its acquisition of Monsanto and the subsequent glyphosate litigation. These legal issues have resulted in substantial financial provisions and continue to pose risks to the company's reputation and financial health.

The company's approach to DSO may also have legal implications, as changes in organizational structure and employee roles could affect compliance with labor laws and regulations. Bayer must ensure that its restructuring efforts align with legal requirements to mitigate potential legal risks.

Conclusion: A Transformative Journey Ahead

Bayer's adoption of the Dynamic Shared Ownership model represents a significant departure from traditional corporate management practices. While the potential benefits of increased agility and innovation are evident, the company must navigate financial and legal challenges to realize the full potential of this transformative approach. As CEO Bill Anderson leads Bayer through this period of change, the success of the DSO model will be closely watched by industry observers and stakeholders alike.